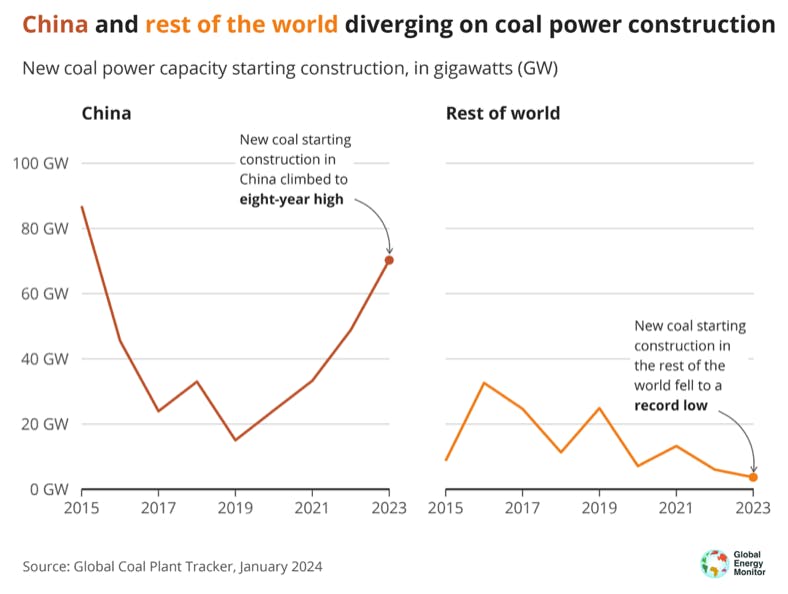

Construction began on 70 gigawatts (GW) of new capacity in China, up four-fold since 2019, says GEM’s annual report on the global coal power industry.

This compares with less than 4GW of new coal power construction starting in the rest of the world – the lowest since 2014.

Outside China, only 32 countries have new coal projects at pre-construction phases of development and just seven have plants under construction.

While global coal power capacity – both overall and outside China – grew in 2023, GEM says this is likely to be a “blip” that will be offset by accelerating coal retirements in the next few years in the US and Europe.

Other key findings of the report include that construction of coal-fired power plants globally – excluding China – declined for the second year in a row. However, coal power plant retirements were also at the lowest level since 2011.

‘Pivotal juncture’ for China

In China, 47.4GW of coal power capacity came online in 2023, GEM says. This increase accounted for two-thirds of the global rise in operating coal power capacity, which climbed 2 per cent to 2,130GW.

China’s 70.2GW of new construction getting underway in 2023 represents 19-times more than the rest of the world’s 3.7GW. As the figure below highlights, the country’s trajectory (red line) is diverging significantly from the rest of the world (orange line).

The level of new construction starting in China is nearly quadruple what it was in 2019, when the country hit a nine-year annual low of entirely new coal power stations starting.

New coal capacity starting construction shown in GW for China (red line) and the rest of the world (orange line). Credit: GEM.

This is the fourth year in a row that the amount of new coal construction starting has increased in China. This is out of line with President Xi Jinping’s 2021 pledge to “strictly control” new coal power capacity, GEM states.

In early 2022, China’s National Energy Administration’s 14th five‐year plan for a “modern energy system” stated that 30GW of coal power would be retired by 2025.

However, when counting larger coal units with capacity of at least 30 megawatts, less than 9GW of power plants have been shut down in the last three years, and few others have plans to retire, GEM notes.

If China is to meet this 30GW retirement target, it “needs to take immediate action”, GEM adds.

“

Coal’s fortunes this year are an anomaly, as all signs point to reversing course from this accelerated expansion. But countries that have coal plants to retire need to do so more quickly, and countries that have plans for new coal plants must make sure these are never built.

Flora Champenois, coal programme director, Global Energy Monitor

In a statement, Qi Qin, China analyst at the Centre for Research on Energy and Clean Air, said:

“The recent surge in coal power development in China starkly contrasts with the global trend, putting China’s 2025 climate targets at risk. At this pivotal juncture, it is crucial for China to impose stricter controls on coal power projects and expedite the transition towards renewable energy to realign with its climate commitments.”

Collectively, China, India, Bangladesh, Zimbabwe, Indonesia, Kazakhstan, Laos, Turkey, Russia, Pakistan and Vietnam account for 95 per cent of global pre-construction capacity, according to the GEM report.

The 5 per cent remaining is distributed among 21 countries, the tracker finds. Of these, 11 have one project and are on the brink of achieving the “no new coal” milestone, it adds.

The tracker identifies 20.9GW of entirely new coal power proposals outside of China in 2023. This was led by India, which saw 11.4GW of new coal capacity proposed, more than any year since 2016. This was in part due to the revival of several stalled projects in the country, GEM explains.

Kazakhstan also saw 4.6GW of new proposals and Indonesia saw 2.5GW. Some 4.1GW of previously shelved or cancelled capacity is now considered “proposed” again.

Another handful of countries – Russia, the Philippines, Botswana and Nigeria – also saw revived proposals and construction restarting in 2023.

Retirements slow

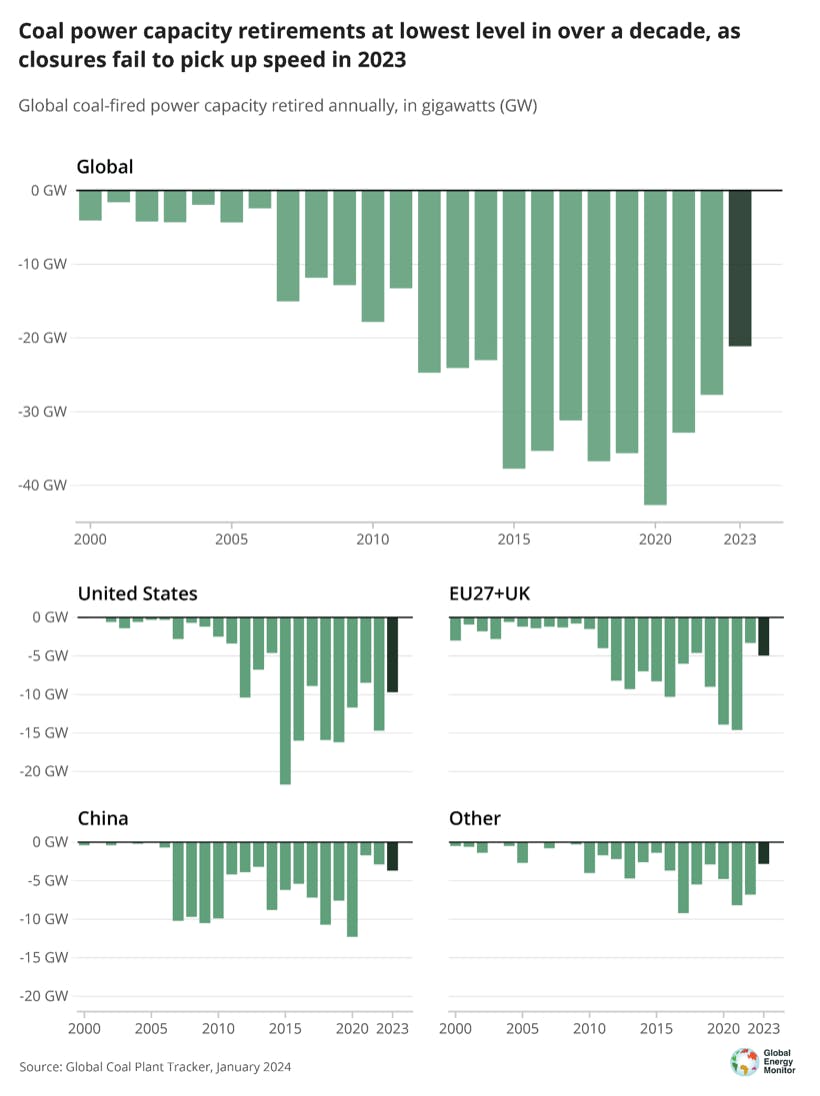

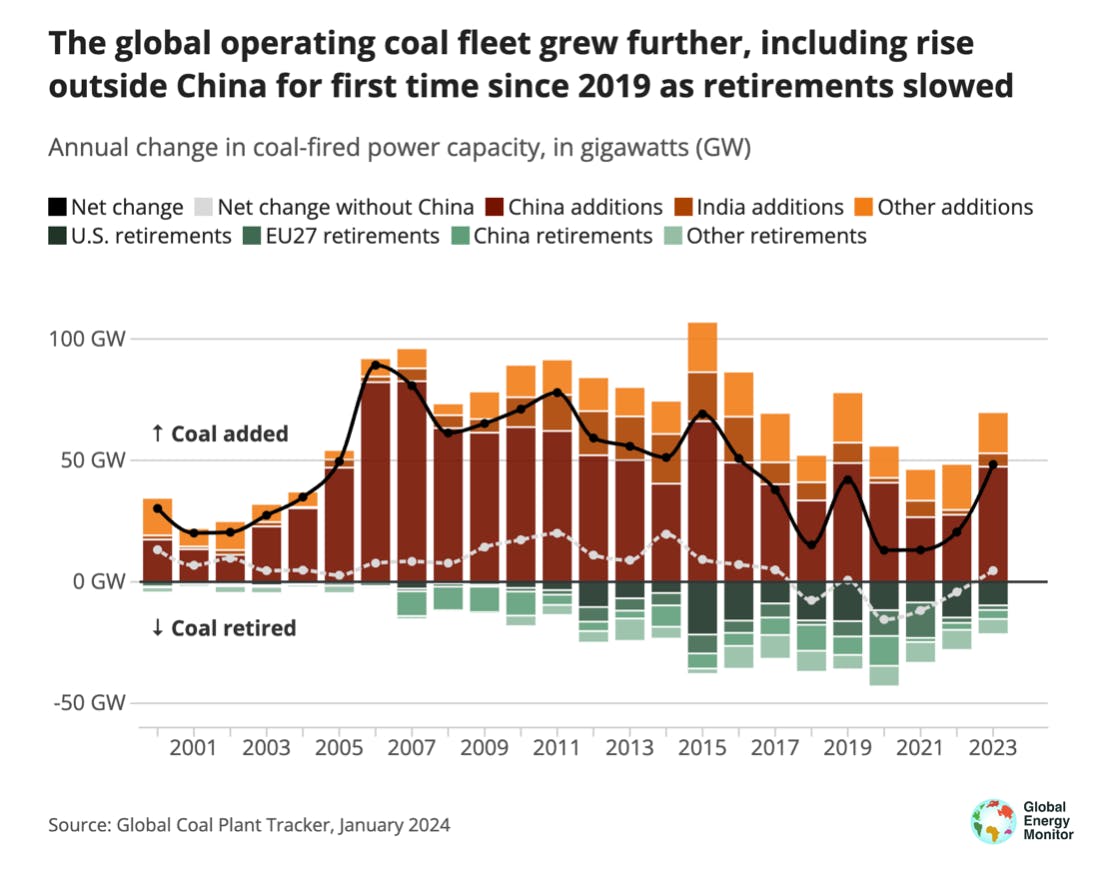

Globally, a total of 69.5GW of coal power came online in 2023, while 21.1GW was retired, GEM finds. This led to the highest net increase in global operating coal capacity since 2016, with a 48.4GW jump.

New capacity also came online in Indonesia (5.9GW), India (5.5GW), Vietnam (2.6GW), Japan (2.5GW), Bangladesh (1.9GW), Pakistan (1.7GW), South Korea (1GW), Greece (0.7GW) and Zimbabwe (0.3GW).

In total during 2023, the tracker found 22.1GW came online and 17.4GW was retired outside of China. This resulted in a 4.7GW net increase in the world’s coal fleet operating outside China. Globally, coal power capacity reached 2,130GW in 2023, up from 2 per cent a year earlier.

The US contributed nearly half of coal power retirements, GEM says, with 9.7GW shuttering in 2023. However, this is a drop in retirements from 14.7GW in 2022, and a peak of 21.7GW in 2015.

Elsewhere, the EU and UK represented nearly a quarter of retirements, with 3.1GW closing in the UK, 0.6GW in Italy and 0.5GW in Poland. There is now just one operating coal-fired power plant in the UK, with the Ratcliffe-on-Soar set to close in September 2024.

Overall, global coal power plant retirements were at their lowest level since 2011, as the figure below shows.

Coal-fired power station capacity annual retirements in GW, shown globally, in the US, the EU27 and UK, China and other. Black bars indicate 2023 data. Credit: GEM.

Outside of China, the number of coal-fired power plants starting construction declined for the second consecutive year, hitting its lowest level since data collection began in 2015, GEM notes.

Less than 4GW of new projects began construction outside of China in 2023, far below the average of 16GW between 2015 and 2022. Just seven countries started construction, with one plant each in India, Laos, Nigeria, Pakistan and Russia, as well as three plants in Indonesia.

Construction has not started on any coal plants in Latin America since 2016, and none has started in Organisation for Economic Co-operation and Development (OECD), European or Middle Eastern countries since 2019, GEM says.

Nigeria’s Ugboba power station, located at the mine-mouth of the Idowu Falola Coal Mines in the Aniocha North local government area of Delta state, is the first known construction of a coal power plant in Africa since 2019, the report says.

The G7 – which accounts for 15 per cent (310GW) of the world’s operating coal capacity, down from 32 per cent (443GW) in 2015 – has no new coal capacity under construction. However, there is still one proposed coal power plant in Japan and two in the US.

Both of the proposed sites in the US, the 0.4GW CONSOL Project in Pennsylvania and the newly announced 0.4GW Susitna power station in Alaska, are expected to use carbon capture and storage technologies (CCS).

GEM says that these technologies are “effectively uncertain and expensive distractions from the urgent need to phase out coal”.

The G20 is home to 92 per cent of the world’s operating coal capacity (1,968GW) and 88 per cent of pre-construction coal capacity (336GW). Brazil, the current G20 chair, saw its pipeline of pre-construction capacity fall in 2023, but still has two prospective projects remaining – the last pre-construction coal power plants in Latin America.

No new coal nations

Overall, coal capacity reached an all time high in 2023, GEM’s tracker says.

Operating coal capacity outside China grew for the first time since 2019, as less coal capacity retired than in any other single year in more than a decade, as the figure below shows.

Annual operating coal capacity globally in GW, showing coal added (brown/orange bars) and retired (green bars). The lines indicate net change (black) and the net change excluding China (grey). Credit: GEM.

The world’s operating coal power capacity is up 11 per cent since 2015, when governments agreed to keep the global average temperature to well below 2C above pre-industrial levels and aim to limit warming to 1.5°C under the Paris Agreement.

Outside of China, there are still 113GW of coal power projects under construction. While this is only slightly up from the previous year’s level of 110GW, it still highlights that the coal sector is not in line with the International Energy Agency’s (IEA) 1.5°C scenario, GEM says.

Across all IEA scenarios that meet international climate goals there is a rapid decline in global coal emissions.

Globally, pre-construction capacity rose 6 per cent in 2023, “crystallising the importance of calls to stop proposing and breaking ground on new coal plants”, GEM’s report says.

Only 15 per cent (317GW) of currently operating coal power capacity has a commitment to retire in line with Paris Agreement goals, it adds.

Phasing out unabated coal generation by 2040 – in line with the IEA’s 1.5°C pathway – would require an average of 126GW of retirements every year for the next 17 years, GEM notes. This is the equivalent of two coal power plants per week.

Even steeper cuts would be needed to account for the 578GW of coal power plants also under construction and in pre-construction phases of development, GEM says.

There were 12 new countries that committed to developing no new coal generation in 2023, by joining the Powering Past Coal Alliance. This brings the total number of countries up to 101 that have either formally declared they will have no new coal or have abandoned any coal plans they have had over the last decade, GEM notes.

Since 2015, there has been a 68 per cent reduction in global pre-construction capacity, GEM found. New construction starts are now at their lowest level outside of China, since data collection began.

GEM’s report suggests that coal power projects that utilise CCS and those used to power industrial activities may be “a last frontier” for new coal proposals.

For example, Zimbabwe’s 1.9GW of new coal capacity proposed in 2023 is made up of two projects, the Prestige power station and the Gweru power station, designed to power smelters for extracting chromium from ore.

Zimbabwe is one of one six countries, beyond China and India, to have increased its total planned capacity over the past year, along with Kazakhstan, Kyrgyzstan, Russia, Zimbabwe, the US and the Philippines.

At COP28, 130 countries signalled their intent to phase out unabated coal power and stop investing in new unabated coal-fired power plants within this decade, by signing the Global Renewables and Energy Efficiency Pledge.

In addition, the final global stocktake agreement at COP28 reiterated the pledge from COP26 to phase down unabated coal power, but still does not define what “unabated” means. Additionally, wording from earlier drafts on ending permitting of new coal power was omitted in the final text.

“Coal power is at the edge of a precipice, facing political and civil opposition and increasingly uncompetitive economics,” GEM’s report states.

In a statement, Flora Champenois, coal programme director for GEM said:

“Coal’s fortunes this year are an anomaly, as all signs point to reversing course from this accelerated expansion. But countries that have coal plants to retire need to do so more quickly, and countries that have plans for new coal plants must make sure these are never built. Otherwise we can forget about meeting our goals in the Paris Agreement and reaping the benefits that a swift transition to clean energy will bring.”

This story was published with permission from Carbon Brief.