There is a “moderate risk” of severe haze affecting Indonesia and its closest neighbours – Malaysia and Singapore – for the rest of 2025, said a regional think tank which releases yearly haze assessments.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

Singapore Institute of International Affairs (SIIA), in its latest haze outlook, attributed the decision to raise its risk rating from green to amber – which reflects a shift from low to moderate risk, according to its “traffic light” system – to significant policy changes it is observing in Indonesia, and evolving global and regional market conditions.

These include a lack of certainty over the continuity of forestry policies fronted by Indonesia president Prabowo Subianto’s administration, as well as consistently high palm oil prices which could create pressures that put sustainable production at risk.

A cross-border haze that has drifted from Sumatra and affected parts of Malaysia since last week has also prompted the think tank to review its assessment and raise its alert rating from last year’s.

Speaking at a media briefing held at the institute’s office on Monday, Simon Tay, who chairs SIIA, said the heightened alert should be “concerning” and called for governments to take action, to both contain the escalation of hotspots and address worries about rising deforestation and volatile commodity markets potentially driving plantation expansion.

He said: “It has become clear that regional fire and haze risks are rising…If this had been assessed a month ago, we might have issued a green rating. But the fires and market conditions warrant caution.”

“The reason we put in our prediction quite early in the dry season is to try to stimulate or nudge action by governments, by Asean, and by the companies we engage…So we had to make a judgment call and I hope it’s not seen as a kneejerk reaction.”

Last week, the Asean Specialised Meteorological Centre (ASMC) also activated a Level 2 transboundary haze alert – its second-highest alert – for the southern Asean region. Based on satellite surveillance, it said smoke haze was observed to emanate from clusters of hotspots detected in parts of Sumatra.

Counts by Indonesian authorities showed South Sumatra with 1,137 hot spots on 24 July, and more than 2,500 hotspots recorded in the same area since the beginning of the year.

Parts of Peninsular Malaysia, including capital Kuala Lumpur, saw air quality ratings hovering in the moderate range, with occasional spikes into the “unhealthy” territory, over the past week. In Singapore, the National Environment Agency (NEA) said the city-state has not been impacted by the transboundary haze due to favourable wind conditions.

The ongoing dry season in Asean usually lasts until October. However, SIIA’s report projected that 2025 will see a milder and shorter dry season that could peak in August, hence haze events would not be prolonged.

Indonesia coordinating minister of politics and security Budi Gunawan said the government will put in its best efforts to put out the forest and land fires in Riau on 23 July 2025, highlighting how transboundary haze can dent the credibility of Indonesia. Image: Kemenko Polkam RI / Facebook

At the briefing, Tay also stressed that the Indonesian government has signalled that it is accelerating efforts to curb the haze situation. Last Wednesday, coordinating minister for political and security affairs Budi Gunawan shared that Malaysia and Singapore have expressed their concerns through diplomatic channels; he has asked Indonesian agencies to immediately deploy all personnel and equipment to bring the fires under control.

Food versus fuel

In its report, SIIA researchers made reference to Indonesia’s plan to raise its palm oil-based biodiesel blend to 50 per cent, or what is known as its B50 biofuel mandate, that has been in the spotlight recently. The report stated that the Prabowo administration’s intensified push to use more biofuels, alongside other economic policy shifts targeted at boosting the nation’s gross domestic product (GDP) growth, could see a conflict arising from using palm oil for both food and energy become more prominent.

It cited media and non-governmental organisation reports that have warned that Indonesia’s food and energy projects could result in more clearing of forests and peatlands. “Care is needed to ensure that efforts to create new plantations are sustainable, and to increase the efficiency of existing plantations,” it said.

Earlier this year, Indonesia, the world’s largest producer and exporter of palm oil, pushed ahead with the rollout of its B40 programme, which saw the requirement of biofuels with a mix of 40 per cent palm oil with 60 per cent diesel, up from 30 per cent palm oil previously. As supplies tighten, market analysts have said that this will keep palm oil prices elevated, with some projecting a decline of Indonesian palm oil exports by about 7 per cent for the year.

Tay noted that the Prabowo administration has signalled continuity of his predecessor Joko Widodo’s sustainable forestry policies, yet at the same time, the think tank observes that the need to achieve an 8 per cent economic growth target has pushed the President to make some key policy shifts, and these need to be closely monitored.

“The changes are not entirely negative, but we are in a very watchful mode…Unlike the Jokowi administration, we can’t say now that we have seen enough reasons to give accolades [to the Prabowo government] and feel safer,” said Tay. On the biofuel mandate, he said the related policies might seem green, but could drive plantation expansion.

“There is every need in the world to increase agricultural productivity and output to meet food security and energy needs. A lot of the commodities, especially palm oil, have great potential to serve as biofuels, but the aim must be to expand the yield in a more productive, sustainable way, and to avoid fire consequences,” he said.

In December last year, international palm oil prices soared to their highest level in 30 months due to climate-related pressures and forecasted volatility; prices have remained elevated. Indonesian palm oil has also been trading at a higher price than soybean oil from Latin America for nine consecutive months, which is an unusual phenomenon, given how palm oil is usually the cheapest vegetable oil by a fair margin.

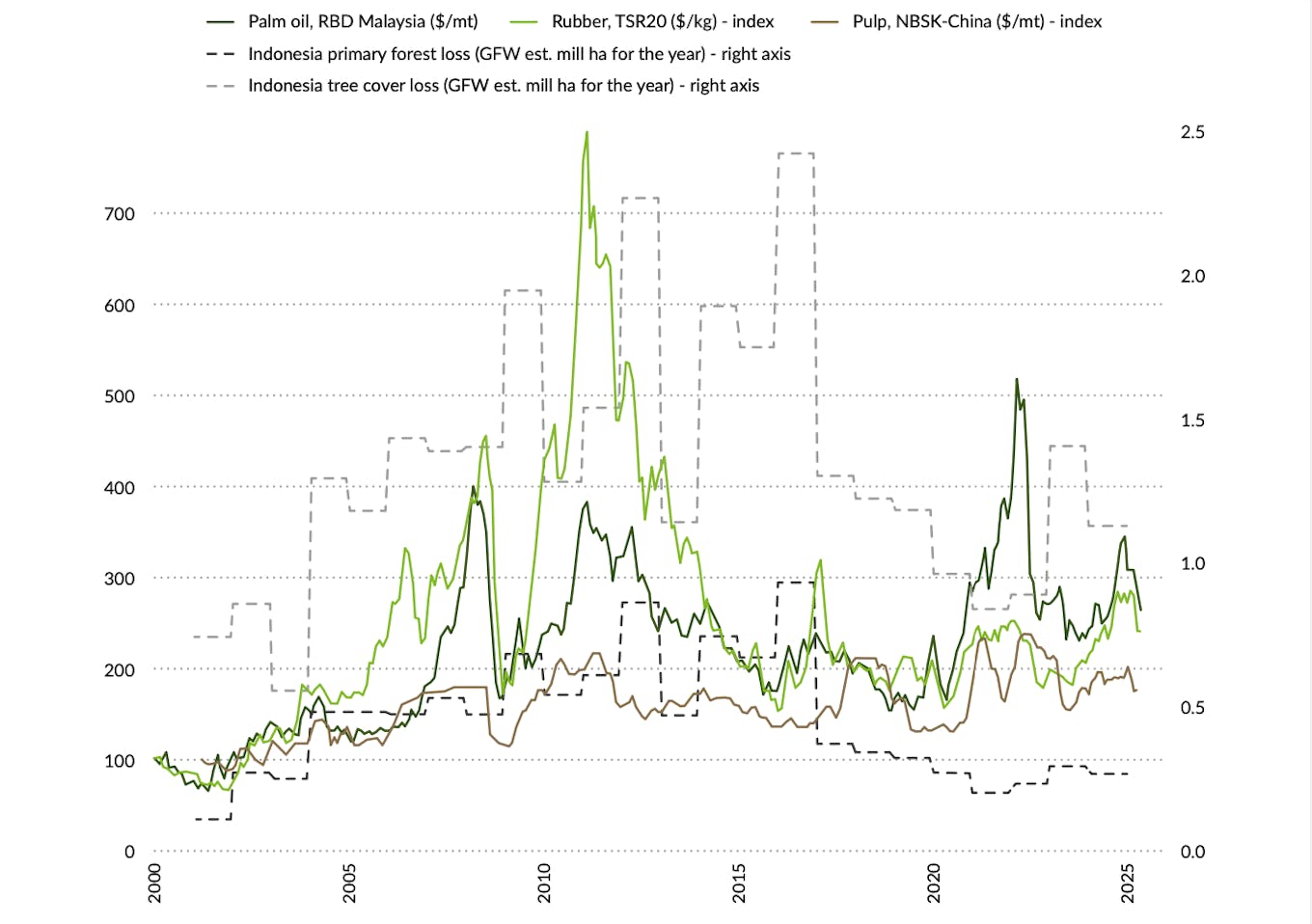

According to SIIA’s analysis, increases in the price of palm oil had traditionally been closely linked to higher deforestation rates in Indonesia, especially before 2020, but the trend has been less clear in recent years, after the Covid-19 pandemic. Deforestation by slash-and-burn techniques has caused serious forest fires, which result in persistent air pollution that impacts countries across the region.

SIIA mapped out deforestation in Indonesia compared to commodity prices, which shows a weaker correlation between the two factors in recent years. Deforestation figures also do not necessarily translate directly to the expansion of plantations, said the think tank. Image: Haze Outlook 2025

Khor Yu Leng, associate director of sustainability at SIIA, said: “If I reflect on my chats with people in the industry, they are saying that the price [of palm oil] is signalling for more supply, but in the region, I think the containment of plantation expansion has been successful…The prices could still inspire people on the ground to take things into their own hands, but it remains a question mark, if the relationship between market prices and haze risk still holds true.”

In its report, the think tank also called for regional cooperation to be enhanced at the Asean level, including by monitoring the implementation of a second roadmap on regional cooperation towards transboundary haze pollution control launched in August 2023. Tay noted that the establishment of an Asean coordinating centre mandated under an existing agreement should be prioritised.