Indeed, in the world of project financing, any supposed rebound has been illusory.

The financing of coal power outside of China has now hit its lowest point since 2010, according to our latest figures in the Global Coal Project Finance Tracker (GCPFT).

We found that for every US$1 in coal project lending that reached financial close in 2022, another US$14 earmarked for previously proposed projects was stopped.

But, despite a myriad of economic, political and social headwinds that have slowed funding to the coal sector, project lending continues to display resilience, particularly in southeast Asia.

By the numbers

Global Energy Monitor’s GCPFT, which surveys funds raised in connection with specific coal-power projects, has found that only US$544m earmarked for two coal power stations reached financial close last year.

These were the Hwange power station in Zimbabwe, which underwent a refurbishment of existing units financed by the Export-Import Bank of India, and the Puting Bato power station in the Philippines, which refinanced units built six years ago through the Bank of the Philippine Islands and Rizal Commercial Banking Corporation.

Neither project was a greenfield development.

The coal sector, meanwhile, lost at least US$7.7bn of documented project financing last year, after lending arrangements appeared to halt at 15 coal power plants of 28 units, comprising 27 gigawatts (GW).

The actual monetary figure is almost certainly higher, but reliable public details on financing could not be found for half of these plants.

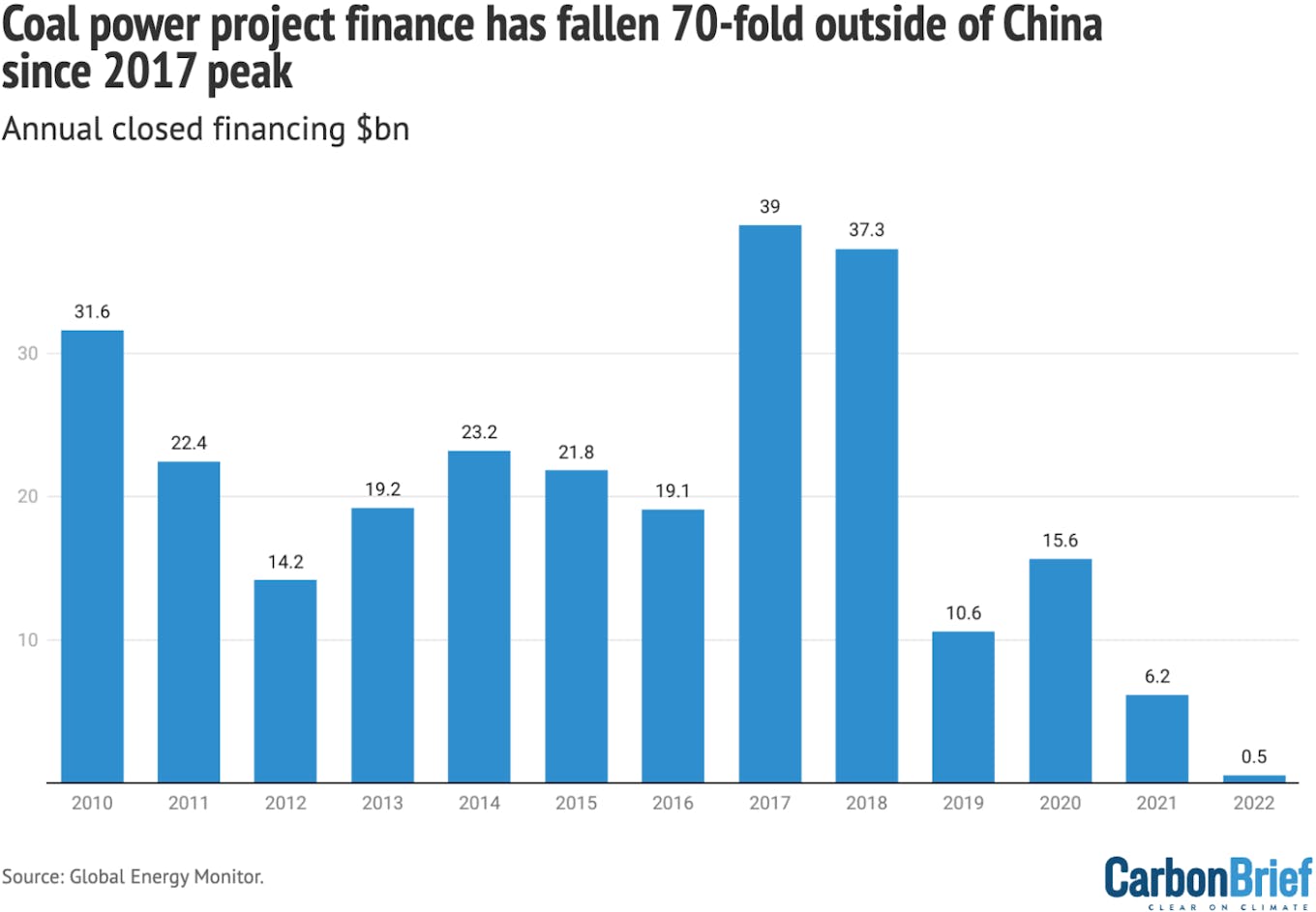

Globally, 2017 was the peak year for coal power project financing since 2010 (the start of the data set analysed), during which the industry closed US$38bn, almost 70 times more than in 2022, as the chart below shows.

Since 2010, coal project finance has fallen by 70-fold outside of China since it peaked at US$38bn in 2017. Source: Global Energy Monitor. Chart by Tom Pearson for Carbon Brief using Datawrapper.

But, in recent years, the industry’s reliance on project finance has lost share to general corporate lending. This trend has been driven by public and private divestment policies, national commitments and general financial uncertainties, which have reduced lenders’ appetites to earmark funds for specific coal projects.

In addition, coal-power developers may have also borrowed less in 2022 due to high coal prices, coupled with high interest rates and general bond market uncertainty.

Altogether, these factors have made project finance an increasingly rare instrument of choice for the industry.

Where did coal-project financing stop last year?

In 2022, financing stopped at several high-profile projects in Asia and Africa, according to our data, with three projects demonstrating the multiyear lending struggles.

Jamshoro, Pakistan

Back in 2019, the proposed Jamshoro power station in the Sindh province of Pakistan appeared to reach financial close on a US$303m for the 660 megawatt (MW) Unit 6, but planning challenges led to the cancellation of the loans last year. Although a second attempt at financing soon surfaced, the embargo on coal financing by Western and Chinese lenders put the onus on the Saudi Fund for Development and the Kuwait Fund for Arab Economic Development for potential funding despite steep legal, technical, economic, and regulatory obstacles.

Samcheok, South Korea

Civil society groups have heavily resisted the 2,100MW Samcheok power station in the Gangwon province of South Korea, since its beginning, citing a range of health and environmental concerns. When the national government signalled target=”_blank” a desire to wean the country off coal, the future investment in the US$3.8bn plant remained uncertain. Ever since, the plant has endured a fitful construction process and financing constraints. Last year, a cohort of securities companies were supposedly placing bonds to support the plant, but the status of that bond issuance is questionable since five of the six securities companies have declared a phase out of coal finance.

Binga, Zimbabwe

The local developer informally claimed that US$950m in financing at the 2,100MW Binga power station in the Matabeleland North province of Zimbabwe closed through the Bank of China in 2018, but no official announcement was subsequently made public. After several years of uncertainty, China then moved to stop all overseas coal financing in 2021. The first unit, in our latest update, is presumed shelved after no news in at least two years and additional phases are presumed cancelled after no news for four or more years.

Where is coal-project financing ongoing?

Nevertheless, the world’s major private and public financial institutions still have US$17.8bn earmarked for specific coal-power projects.

This finance is supporting 56.7GW of proposed coal capacity, notably in Vietnam (US$6.4bn), India (US$4.2bn), Cambodia (US$1.3bn) and Bangladesh (US$1bn).

This amount is split between US$14bn in proposed designated debt funding and US$3.8bn in equity funding, involving construction and finance schemes, such as Build-Own-Transfer and Build-Own-Operate-Transfer.

Chinese institutions have designated US$8bn of the US$14bn in debt financing (57 per cent). This news comes as some legacy projects prior to China’s 2021 commitment to stop the financing of foreign coal plants may still go ahead.

Within China, final investment decisions on coal plants across all financing types continue at a blistering pace. According to the IEA’s World Energy Investment 2023, nearly all of the 40GW of coal-fired capacity that was approved globally in 2022 is located in China.

But the future of emerging projects remains anything but certain. As Global Energy Monitor data shows, over the past nine years, proposed coal capacity has shrunk by 72 per cent – and the trend is expected to continue.

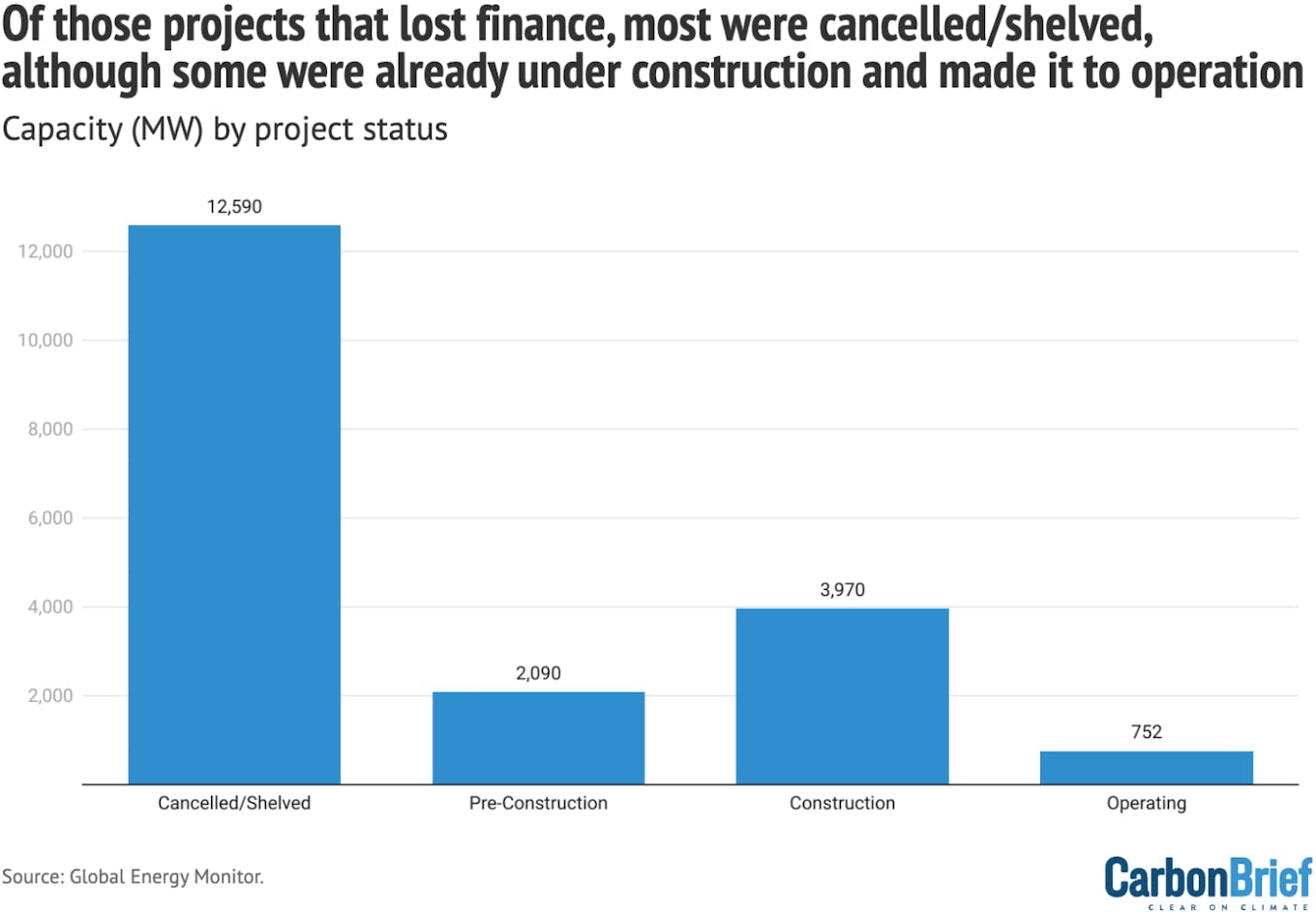

Where financing stopped between 2010 and 2023, 65 per cent of coal-fired capacity was either shelved or cancelled. The remaining 35 per cent of capacity was actively under development or in operation at the time financing stopped. These statuses were sourced from GEM’s Global Coal Plant Tracker.

Vietnam’s new US$15.5bn “just energy transition partnership” (JETP) agreement, for instance, will support the country’s climate targets in the coming years – and the country’s latest Power Development Plan inches closer to commissioning its last new coal power station.

Meanwhile, India has paused plans to add new coal plants for at least five years under the country’s latest National Electricity Plan.

Capacity of coal-power projects that have lost financing 2011-2023, by plant status, megawatts (MW). Source: Global Energy Monitor. Chart by Tom Pearson for Carbon Brief using Datawrapper.

Still, recent developments in Southeast Asia suggest how erratic ongoing project and financing arrangements remain – and the potential for those projects to persevere even in the most tenuous political and economic situations.

Long Phu Power Centre (Long Phu-1), Vietnam

The development of the 1,200MW Long Phu Power Centre in the Sóc Trăng province of Vietnam was reportedly disrupted by the 2018 US Treasury embargo placed on Power Machine, a Russian engineering, procurement and construction (EPC) company. While the embargo caused construction delays and a financing freeze of US$650m, the consulting firm was concurrently accused by the US Environmental Protection Agency’s Air Enforcement Division of doctoring greenhouse gas emissions estimates for the plant to help meet most official government Export Credit Agency (ECA) standards. A funding arrangement eventually started to take shape, but in 2020 the Italian Export Credit Agency Servizi Assicurativi del Commercio Estero (SACE) and banking giant HSBC pulled out of the project. Russian Vnesheconombank and the International Investment Bank have reportedly stepped in to fill financing gaps.

Payra, Bangladesh

The Bangladesh-China Power Company (BCPCL) risked defaulting on its US$1.9bn loan for the 1,320MW Payra power station in Patuakhali, Bangladesh after missing a payment of US$114m, according to reporting in December 2022. The managing director of BCPCL stated that the missed payment was caused by the Standard Chartered Bank ending its role in the project, which forced the company to establish an account with Bangladesh’s state-owned Sonali Bank. However, Sonali Bank did not have the necessary reserves to pay the balance. The Bangladesh Ministry of Finance stepped in to issue a sovereign guarantee to secure the loan repayment.

Cirebon 1, Indonesia

In 2019, Hyundai Engineering and Construction admitted that it had bribed a local regent to appease residents who were opposed to the 660MW Cirebon coal power project in West Java, Indonesia. In March 2023, Friends of the Earth Japan and three other NGOs called on Japan’s Ministry of Finance and the Japan Bank for International Cooperation to suspend financial disbursements for the US$850m project, until a verdict was determined on the bribery charges.

What about corporate financing?

The Global Coal Project Finance Tracker monitors the financial transactions to specific coal-fired power stations and proposed projects, which has accounted for an estimated 36 per cent of coal power finance outside of China in the past decade.

The lenders for these projects typically include bonds and loans, export credit agency support, governmental loans and EPC company financing.

But the rest of the coal-power sector remains reliant on general corporate financing, which comes from corporate monies that may derive from the company’s own retained earnings, or by external fundraising through equity issues, corporate loans, revolving lines of credit or general bonds.

Corporate financing of coal power is not captured in this dataset.

The project financing data released in this tracker was found in government, media and business sources and then verified with particular on-the-ground groups and researchers, whenever possible.

However, slow or unusual these project-finance trends might be, support for coal can arrive through a variety of financial pipes. Global market disruptions can and will push actors to fall back on legacy fossil energy systems such as coal.

For the era of coal to come to an end, all financial taps must be shut off – and alternative energy systems must be ready to meet demand in coal’s place.

This story was published with permission from Carbon Brief.