Standard Chartered will be announcing new oil and gas emissions reduction targets at its upcoming annual general meeting, said the British bank’s first chief sustainability officer (CSO) Marisa Drew, who was appointed to the role in July 2022.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

Drew, who was in Singapore to attend a roundtable session organised by the bank’s venture capital arm SC Ventures on Tuesday (7 Mar), revealed its latest plans to address scrutiny over its fossil fuel decarbonisation targets when she spoke to Eco-Business on the sidelines of the event.

The group’s AGM is usually held in May.

According to StanChart’s latest annual report, the oil and gas sector accounted for 17 per cent of the lender’s total absolute financed emissions, making it the single largest contributor. Nearly half of the sector’s global emissions came from Asia, Africa, and the Middle East.

In 2022, the bank moved from using a revenue-based intensity metric to absolute financed emissions to measure its oil and gas sector emissions – a change environmental and shareholder groups have called for in recent years.

“The industry convention was a revenue metric when we first started the journey, and what the industry realised was that a revenue model can be very misleading,” said Drew.

A media roundtable by SC Ventures held on 7 March 2023, where StanChart’s chief sustainability officer Marisa Drew was one of the panellists (third from left). Image: SC Ventures

The revenue-based carbon intensity model measures the amount of greenhouse gas emitted from the loans and investments provided by a financial institution to its clients as a proportion of their revenue. This means that when client revenues increase, the bank’s revenue-based emissions intensity will decrease.

The bank last announced a targeted 30 per cent reduction in revenue-based carbon intensity for its oil and gas portfolio by 2030 in its net zero white paper, published in 2021. Against this existing intensity metric, StanChart recorded an 8 per cent reduction year-on-year in financed oil and gas emissions last year.

“This year in particular, if we’re all very honest with ourselves, we had a spike in commodity prices and the revenue-based intensity model is flattered by the fact that the revenues go up. So it wasn’t really that [absolute emissions reduced] – there was a reduction, I don’t mean to overstate – but it was clearly flattered by the fact that commodity prices rose and revenues rose. So as a percentage, it looked like emissions were reducing faster than they were. So this is an attempt to address that,” Drew explained.

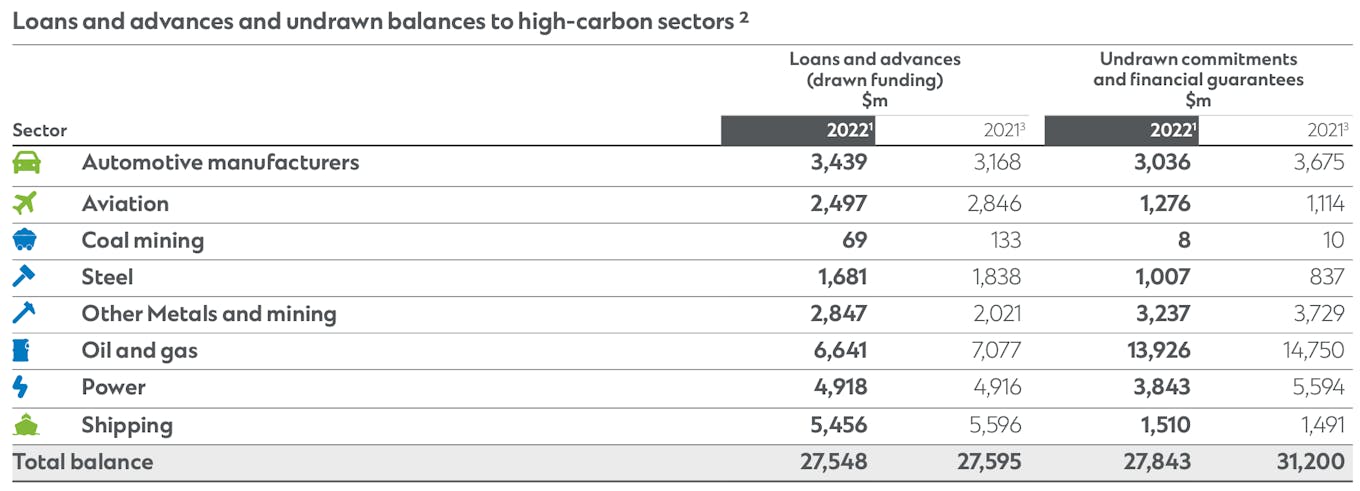

Standard Chartered’s exposure to high-carbon sectors via loans and advances as well as undrawn commitments and financial guarantees. Source: Standard Chartered’s Full Year Annual Report 2022

The bank also reported a 30.3 per cent decline in absolute emissions for its coal mining portfolio in the past year. The exposure to coal mining in its loan book has been brought down from US$133 million in 2021, to US$69 million in 2022, with no new coal mining loans made.

“We’re dead serious about our work to reduce to net zero,” said Drew, highlighting the bank’s work to set baselines and science-based target trajectories for high-emitting sectors to reach their interim targets by 2030 and ultimately net zero by 2050.

“The unique challenge that we’ve got in our markets – and this is unlike others whose portfolio mix is different – is that we have 59 footprint markets at StanChart. 33 of those countries either don’t have a net-zero commitment or have a net-zero commitment after 2050. So we have got to face the reality that we’re dealing with a unique footprint, that it’s difficult to move much faster than your clients move. But our only [other] choice then is to say I won’t act for you at all, and we do think we can provide a lot of influence,” Drew contended.

While StanChart no longer provides financial services to clients who derive all their revenue from thermal coal, it has only exited from 14 of the 37 client entities it has identified as 100 per cent dependent on coal as of 2022. One such entity the bank has cut ties with is Indonesia’s second largest coal producer Adaro.

Up to 2024, the bank will continue financing clients that generate less than 80 per cent of their revenue from coal and this threshold for coal as a percentage of a client’s revenue will become more stringent over time.

“The percentage that we would tolerate of a company’s revenues coming from coal will keep reducing. So it doesn’t mean that we can’t or won’t do something in the near future. But the amount from any company’s portfolio mix will get reduced to virtually nothing by 2030, and that’s the way we’re driving that down,” said Drew.

Frankfurt-based Deutsche Bank – also a Glasgow Financial Alliance for Net Zero (Gfanz) member – has recently tightened its thermal coal policy. The European bank has brought down the revenue dependency threshold from 50 per cent to 30 per cent, and is giving existing clients until 2025 to provide a “credible diversification plan”.

After that date, the bank’s CEO Christian Sewing maintained that it will “not shy away from exiting a relationship” if it sees no willingness on the part of a client to embark on a credible transition, though this will “only ever be a last resort”. The bank now plans to update its oil and gas policy, having amended its thermal coal policy.

“No one big bang” to get to net zero

Last year, StanChart drew flak for its involvement – alongside other Gfanz members HSBC, Deutsche Bank, Citi, and MUFG – in a planned US$10 billion loan refinancing for Saudi Aramco, the world’s largest oil producer. The new revolving loan facility is not sustainability-linked and will allow Aramco to withdraw money on an ongoing basis while repaying the balance regularly.

This form of lending activity typically falls under the bank’s undrawn commitments, but the Net-Zero Banking Alliance guidelines do not presently require members to set targets for these so-called “facilitated emissions”.

Drew clarified that the bank’s net zero commitment “doesn’t mean that there won’t ever be another oil and gas financing”. Rather, it means that the high-carbon emitting industries in its portfolio “have to have a credible transition plan” so that the carbon emissions from the bank’s financing reduce over time.

On StanChart’s continued partnership with the oil giant, Drew responded: “Saudi Aramco, I will tell you, is one of the most committed to the green transition.”

“[Aramco is] taking what has historically been one of the most efficient [industries] in the world – production of oil and gas – and applying the engineering mindset and technological know-how to invest in green [projects]. These are the kinds of organisations that you actually want in this discussion,” said Drew.

She also spoke highly of Abu Dhabi National Oil Company (Adnoc) CEO Sultan al-Jaber and chair of this year’s COP28 climate conference: “He will tell you chapter and verse on what they’re doing to transform that company.”

“

We need [oil and gas companies like Saudi Aramco] to participate, obviously for the global emissions reduction, but equally because they’ve historically been really good at what they do.

Marisa Drew, CSO, Standard Chartered Bank

“We’re doing little and big things [with these companies]. Big things about huge investments in green projects, but also little things. For instance, they [referring to Adnoc] have a gas refinery getting LNG to the mainland and we’re doing what I call process improvements, where you’re putting solar there and you’re ensuring that the rig is powered with renewable energy… And that’s how we’re going to get there. There’s no one big bang.”