Singapore’s listed and large non-listed companies (NLCos) may soon be required to report their climate-related disclosures in line with new standards launched by the International Sustainability Standards Board (ISSB) last week.

A committee formed by two of Singapore’s top regulatory agencies – the Accounting and Corporate Regulatory Authority (ACRA) and Singapore Exchange Regulation (SGX RegCo) – is now seeking feedback on its recommendations. The public consultation will conclude by the end of September, before the recommendations are finalised by 2024.

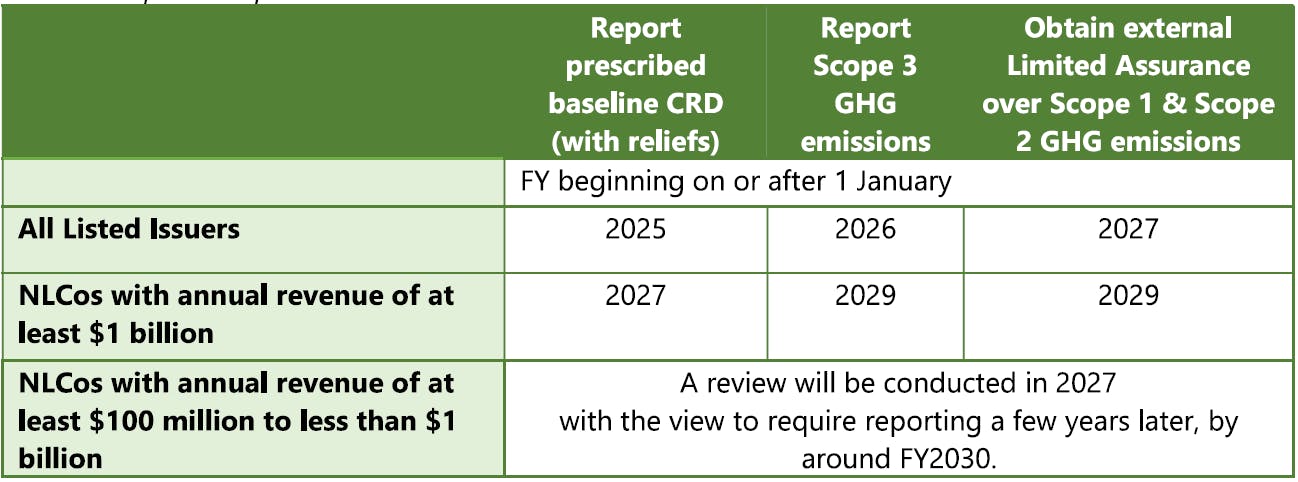

Key recommendations include making climate reporting mandatory for listed companies by financial year 2025 (FY2025) and large NLCos with SG$1 billion (US$0.74 billion) revenue from FY2027. This would affect approximately 1,000 companies – 300 of which would be non-listed entities – after considering exemptions.

This could make Singapore the first jurisdiction in Asia to mandate ISSB-aligned climate reporting for NLCos.

Elsewhere in the region, Hong Kong launched a public consultation in April this year on mandating ISSB and TCFD-aligned reporting for listed companies from 2024, which would apply to sustainability reports published in 2025.

Japan also plans to issue its draft sustainability disclosure standards based on ISSB’s framework by 31 March 2024, and finalise its standards by 31 March 2025.

SRAC intends to expand this requirement to private companies with SG$100 million (US$74 million) revenue by around FY2030 upon conducting a review in 2027, which would include about another 2,200 companies.

Proposed phased and tiered implementation timeline for mandatory climate reporting in Singapore. Source: Sustainability Reporting Advisory Committee (SRAC)

From 2028, Singapore-based companies with significant operations in the European Union will also be required to report according to its Corporate Sustainability Reporting Directive (CSRD), which uses a “double materiality” approach.

In contrast to ISSB’s standards – which are focused on “single materiality”, or the impact of sustainability-related factors on the financial position of a firm – the EU’s standards consider an entity’s impact on the environment and society as well.

Since the start of this year, climate disclosures aligned with the Task Force on Climate-related Financial Disclosure (TCFD)’s recommendations are mandatory for listed companies in the financial, agriculture, food and forest products, and energy industries. From 2024, mandatory TCFD-aligned reporting will apply to the materials and buildings, and transportation industries.

Taking reference from ISSB’s relief measures, companies in the first year of reporting would not be required to disclose their Scope 3 greenhouse gas emissions. Scope 3 emissions include the financed and supply chain emissions of a company, which often represent the bulk of an entity’s carbon footprint.

Two years after the mandated reporting takes effect, limited assurance – accurancy checks by a third-party – on Scope 1 and 2 emissions will be needed, according to locally-endorsed standards modelled on International Standard on Sustainability Assurance (ISSA) 5000 or International Organisation for Standardisation (ISO) 14064-3. ACRA-registered audit firms and Singapore Accreditation Council-accredited testing, inspection and certification firms can apply to be registered climate auditors.

Limited assurance is the baseline level of assurance needed for an independent auditor to conclude that no evidence has been found to suggest that the claims made are wrong. This requires less evidence than a “reasonable” assurance, where an auditor needs to prove that there are no material misstatements.

Concurrent use of other standards like the Global Reporting Initiative (GRI) will also be allowed in the same report. While majority of listed companies in Singapore currently use GRI standards, the committee said they were not privy to the data on the proportion of NLCos who are already using GRI or any other reporting frameworks.

Costs of mandatory reporting for non-listed companies

There is currently no readily available data for the cost of reporting and assurance for companies in Singapore. But SRAC estimated that the costs would represent less than 0.1 per cent of the SG$1 billion in revenue for NLCos subject to mandatory reporting, if the same costs as EU or the United Kingdom apply.

In the media briefing on Tuesday (4 July), SRAC said the proportion of this cost will vary according to the size of the company, and there will be flexibility for companies with varying resources for different disclosure requirements so that climate reporting can be done without undue cost or effort.

Under the Green Skills Committee set up by the city-state’s trade and industry ministry, in partnership with the government agency SkillsFuture Singapore, nation-wide capacity building will kick start in 2024.

Enterprise Singapore, a statutory board under the ministry, has set aside SG$180 million (US$133.2 million) to support local companies, especially small- and medium-sized enterprises (SMEs), to build capabilities in areas such as sustainability reporting and managing their carbon emissions.

The SGX RegCo intends to work with partners like ACRA, Singapore Institute of Directors, and GRI to conduct training for directors and working-level preparers of sustainability reports. The Institute of Singapore Chartered Accountants (ISCA) is also developing professional qualification programmes for sustainability assurance, to equip professionals with the requisite skillsets.

Under the government agency Workforce Singapore’s Capability Transfer Programme, companies that require transfer of niche and emerging skills through a foreign specialist to its local workforce can receive support.

“What gets measured gets managed. There is a strong business case for climate reporting as it has helped many businesses to improve performance and create stronger competitive advantage by capturing growth opportunities,” said Esther An, chairperson of the SRAC and chief sustainability officer (CSO) of City Developments Limited.

CSO of DBS Bank Helge Muenkel, who also sits as a representative of the Green Finance Industry Taskforce in the SRAC, noted that the goal of making reporting mandatory for economically significant non-listed companies is to improve the quality of environmental, social and governance (ESG) data across the value chain, especially in relation to Scope 3 emissions.

In a separate statement, the Monetary Authority of Singapore (MAS) expressed support for the committee’s proposal for a climate disclosure roadmap, calling it “an important step” in the journey towards domestic adoption of the ISSB standards.

The country’s central bank is currently studying the formulation of mandatory climate-related disclosures for financial institutions, and is working with SGX RegCo to align listed company requirements with ISSB standards. MAS said it will factor in feedback from the SRAC’s consultation into its proposal for additional financial sector-specific disclosure requirements in due course.