A consortium of financial institutions including British insurer Prudential, lenders Citi and HSBC and BlackRock Real Assets are working on plans to speed the closure of Asia’s coal-fired power plants in a bid to slash the biggest source of carbon emissions.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

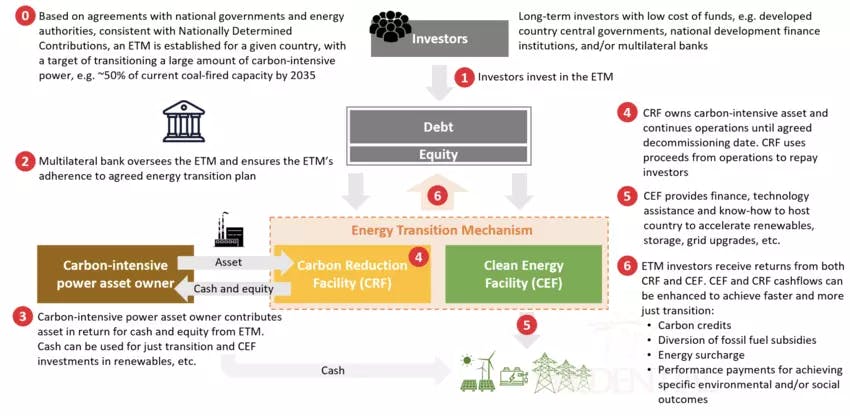

The energy transition mechanism (ETM) will see the creation of large public-private partnerships to buy out plants. The scheme will be financed through a blend of equity, debt and concessional finance.

With low-cost funding, a large percentage of existing coal-fired electricity could be replaced with cleaner sources of energy in 10-15 years on an economically affordable basis without waiting for technological breakthroughs, according to Don Kanak, chairman of Prudential Insurance Growth Markets who masterminded the proposal.

“The ETM would provide financial and technical support to developing countries to allow them to replace coal-fired electricity quicker than would otherwise be possible without the assistance,” Kanak said.

Schematic of an energy transition mechanism [click to enlarge]. Image: Donald P. Kanak, chairman of Prudential Insurance Growth Markets, originally published by World Economic Forum.

Pre-feasibility studies are being driven by the ADB in three markets in Southeast Asia, namely Indonesia, the Philippines and Vietnam to estimate the costs of early closure, which assets could be acquired and to engage with relevant stakeholders. A pilot is expected to see the acquisition of several coal-fired plants.

There are a number of existing sponsors of coal-fired power plants who are interested in exiting ownership of these plants, according to David Elzinga, senior energy specialist, climate change, at the Southeast Asia department, ADB.

“If they are sold to other owners who intend to operate them till the end of their financial and technical lives, such divestment provides no benefit to mitigating climate change,” Elzinga told Eco-Business.

“The ETM will provide a market-based approach for existing sponsors to divest of their plants in a manner where the plants will be decommissioned and permanently removed from the power system,” he said.

Plants will be retired over several years to ensure that activities can be carried out to support the people and communities whose livelihoods are tied to the coal-fired power plants. “And for the power system to develop and be ready to integrate increased shares of renewables,” Elzinga said.

Urgent shift to renewables

A landmark report on climate change from the United Nation’s Intergovernmental Panel on Climate Change (IPCC) warned that wthout “immediate, rapid and large-scale reductions” in emissions, curbing global warming to either 1.5°C or even 2°C above pre-industrial levels by 2100 would be “beyond reach”.

The report “is a code red for humanity,” UN Secretary-General António Guterres declared.

According to a June report by think tank Carbon Tracker, China, India, Vietnam, Indonesia and Japan “are responsible for 80 per cent of the world’s planned new coal plants and 75 per cent of existing coal capacity.”

“Addressing reliance on coal, particularly in Asia, is an urgent priority in the transition to net zero,” according to an HSBC official in comments sent to Eco-Business.

“There is a clear need for public and private sector collaboration and investment in initiatives that can accelerate a just and orderly shift to renewables.”

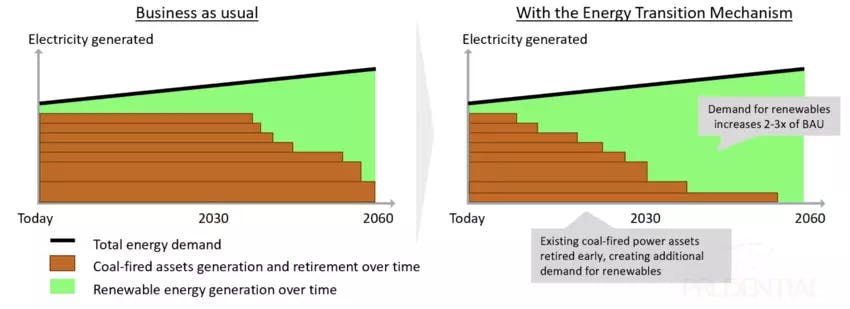

The transition mechanism could accelerate demand for renewables by two to three times, according to Kanak, adding that climate targets cannot be met unless coal is replaced with renewable energy.

“This is particularly true in Asia where existing coal-fired power stations are young and numerous, and are set to operate for decades without action,” Kanak said.

How ETM dramatically accelerates demand for renewables. Image: Donald P. Kanak, chairman of Prudential Insurance Growth Markets, originally published by World Economic Forum.

Incentives are needed to replace coal power plants with renewable energy, said Julien Vincent, Australia executive director of Market Forces, a non-profit which campaigns for financial institutions to protect the environment.

“It’s also important that profits from exercises like these are reinvested in the local community to protect the social and economic circumstances of the region that will be currently attached to coal power,” he told Eco-Business.

Campaigners have been quick to highlight that HSBC is one of the largest financiers of fossil fuels in the world.

The Banking on Climate Chaos 2021 report that analyses fossil fuel financing from the world’s 60 largest commercial and investment banks revealed that HSBC has ploughed US$110.7 billion towards fossil fuels since the Paris climate agreement was signed in 2015.

A May 2021 Market Forces study shows that HSBC has ownership stakes in companies planning 73 new coal plants, emitting 15 billion tonnes of CO₂ over their lifetimes.

“This initiative will only have meaning if HSBC commits to no longer finance the expansion of the fossil fuel industry and phases out its fossil fuel financing in line with the goals of the Paris Agreement,” Andrew McGibbon UK Campaign Lead at Market Forces said.

“Otherwise, this is just HSBC trying to make money from both ends of the climate catastrophe.”