Ceasing financing for new coal-fired power plants has become mainstream among the Singaporean banking giants, ever since OCBC became the first Southeast Asian bank to do so in 2019. Rivals DBS and UOB followed suit within a month.

Now it seems like Singapore’s central bank is steering financial institutions in a slightly different direction: towards financing the managed phase-out of coal in Asia.

In a region where coal accounts for almost 60 per cent of electricity generation and most of the coal-fired power plants are “very young”, just saying “no new coal” will not be enough for Asia’s net-zero transition, said Gillian Tan, who was appointed the Monetary Authority of Singapore (MAS)’s new chief sustainability officer last October after the exit of its first CSO Darian McBain.

Accelerating the retirement of coal-fired power plants in a manner that is just and economically feasible has become a focal point globally, as seen from financing mechanisms that have sprung up in the last few years, such as the G7-led Just Energy Transition Partnership (JETP), Asian Development Bank’s Energy Transition Mechanism (ETM), and the Energy Transition Accelerator, a joint initiative by the United States Department of State, Bezos Earth Fund, and The Rockefeller Foundation.

Gillian Tan’s appointment as chief sustainability officer is in addition to her role as assistant managing director (Development & International) at MAS. Image: MAS

In a media interview on Tuesday (May 30), Tan acknowledged the apparent tension between all three local banks’ strong stances on phasing out exposure to coal in their portfolios and the central bank’s push for managing an early coal phase-out. “We very much support banks or other financial institutions taking reference from global best practices, standard-setters and science-based experts on this,” she said.

For instance, financial institutions should refer to guidance from the International Energy Authority (IEA)’s “Net Zero by 2050” roadmap, which has made it “very clear” that unabated coal generation should be phased out by 2040.

Tan adds that without a concerted effort for the early retirement of coal plants, the world will not achieve net zero within the next two decades, which is what IEA has said it needs to do.

Last year, MAS announced in its 2022 sustainability report that it will exclude from its portfolio the equities and corporate bonds of companies that derive more than 10 per cent of their revenues from thermal coal mining and oil sands activities.

MAS has been supporting regional policy guidance on this front, noted Tan, who also chairs the Asean Taxonomy Board work group developing the Asean Taxonomy Plus Standards. The revised Asean Taxonomy became the world’s first taxonomy to provide clarity on how transition financing can be catalysed for a coal phase-out in the region.

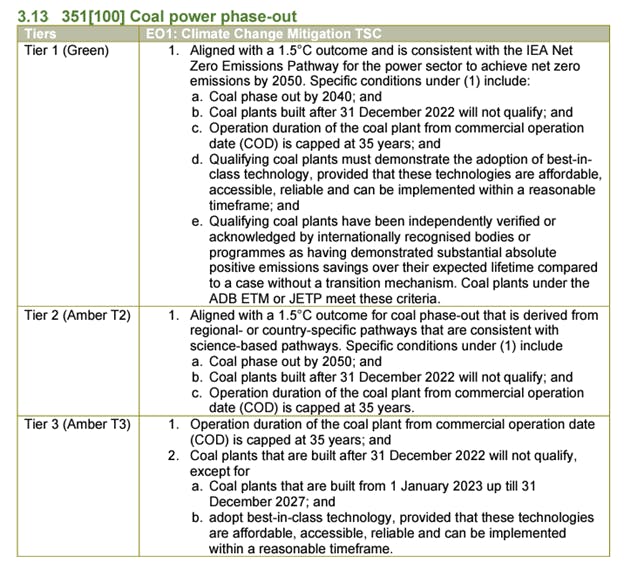

The technical screening criteria for the assessment and classification of coal phase-out in the second version of the Asean Taxonomy. [Click to enlarge] Image: Asean Taxonomy

Under the “traffic light” model, coal plants built between 2023 and 2027 that “adopt best-in-class technology” – provided that the technologies are affordable, reliable, and can be implemented within a reasonable time frame – can qualify for the lowest tier in the taxonomy, classified as “Amber Tier 3”.

For the top and middle tiers, labelled “Green” and “Amber Tier 2” respectively, only coal plants built before 2023, and that are aligned with a global warming scenario of 1.5 degrees Celsius above pre-industrial levels, can qualify.

Taxonomies, as classification systems, help to provide criteria, at different levels of granularity, that activities, assets and products must meet to qualify as sustainable. The region-wide taxonomy for Asean that launched in November 2021 is targeted at aligning development in Southeast Asia. The Philippines, Singapore, Thailand and Vietnam are also working on their first national versions.

‘Huge industry interest’ in upcoming national taxonomy

Tan revealed that MAS will be launching a public consultation within the next few weeks on its proposal to include additional criteria for the managed phase-out of coal in the Singapore-Asia Taxonomy.

Previously called the Green Finance Industry Taskforce (GFIT) taxonomy, it was expected to be published next month, after the third and then-final public consultation wrapped up in March this year. Tan says the national taxonomy has garnered “huge industry interest” and “extensive feedback”, which MAS wants to take time to review so they can be reflected in the final taxonomy. She did not give a specific date for its publication.

The Singapore-Asia Taxonomy has also adopted a traffic light classification system to differentiate an activity’s contribution to climate change mitigation, where activities classified as “green” can qualify for green or sustainable financing, while those classified as “amber” can access transition financing.

Those in the “red” tier deemed to cause “significant harm” would not be eligible for financing.

The “green” tiers of both the Singapore-Asia Taxonomy and Asean Taxonomy are “generally aligned” as they have a similar goal of a 1.5-degree outcome, which facilitates interoperability in the region, said Tan. A key difference, Tan notes, is that the Asean Taxonomy attempts to be more “inclusive” so as to take into account the development stages and heterogeneity of the regional bloc. It provides separate assessment approaches to choose from – either the “Foundation Framework”, which is principles-based and qualitative in nature, or the “Plus Standard”, which uses more detailed criteria and thresholds. Under the Singapore-Asia Taxonomy, activities will be only assessed using the latter approach.

MAS is working to ensure that the Singapore-Asia taxonomy is mapped and interoperable with the European Union and China taxonomies through the Common Ground Taxonomy, a comparative study of the green taxonomies of both countries by the International Platform on Sustainable Financing (IPSF), said Tan. The IPSF was launched in October 2019 to promote dialogue between policymakers in order to mobilise more private capital towards sustainable investments. Its founding members include the relevant authorities of the EU, Argentina, Canada, Chile, China, India, Kenya, and Morocco, and it now has a total of 19 members.

MAS has also been working together with the Glasgow Financial Alliance for Net Zero Asia Pacific (GFANZ APAC) Network to develop a guidance for financial institutions to facilitate the managed phase-out of coal power generation in the region. This initiative was first announced in October 2022 at the “Transition Finance towards Net Zero Conference” held by MAS and the framework is expected to be released by this year.

In a speech at the conference, the central bank’s chief Ravi Menon then said that the GFANZ initiative will help to address the challenges involved in decommissioning these plants, including the fiduciary and reputation risks that financial institutions may face from the initial spike in financed emissions as a result of investing in such early phase-out projects.

After its launch in April 2021, GFANZ – which comprises over 550 financial institutions from 50 countries – opened its first regional office in Singapore in June 2022 to help accelerate the region’s net-zero transition, for which it estimates US$13.6 trillion in investments is required this decade.

Singapore is well-placed to support the managed phase-out of coal in this region, said Tan. “Many [financial institutions] are already plugged into ADB’s work with ETM. They are helping as consultants and giving advice… So we have very strong building blocks in our financial ecosystem.”

Tan reiterates that it is realistic for Asia to phase out coal, when pressed by the media on how feasible it is to phase out coal in the region without more affordable alternative energy sources. “We have looked at the numbers and the models to see if there is a viable case for the early phase-out of plants.”

The operational life of these plants can be brought down by “quite a few years” and replaced with renewables, like solar and wind, that are increasingly profitable in Asia, she added.

Thus far, many of the early phase-out models are “very much premised on being able to bring the costs of borrowing down such that you can buy up the incumbents and bring the lifespan down,” noted Tan. “But the question is, can you scale that and replicate that transaction after transaction?”

“

It’s rare to see a central bank worried about coal. But we realised that it was something needle-moving for Asia’s transition… Someone needed to pull the different pieces together, get the different relevant organisations and parties in the same room and crack it bit by bit.”

Gillian Tan, assistant managing director, group head (Development & International) and chief sustainability officer, Monetary Authority of Singapore

Tan suggests one way of improving the economic viability of an early coal phase-out is through more innovative mechanisms, such as using carbon credits to unlock further financing to bring down the cost of capital. Another way is to offer a more standardised approach, by potentially grouping together a set of power plants with similar risk characteristics if they come from the same jurisdictions and have the same shareholders and owners.

On resolving the issues around the guidance and credibility for financing a managed coal phase-out, Tan is “very optimistic” and believes the region is “getting there” compared to a year ago, especially with the upcoming guidance by GFANZ APAC.

However, with regard to economic viability, “much more needs to be done,” she said. “Perhaps people haven’t thought about it as much because that first set of issues [around credibility] was not resolved. So I think this can change quite quickly.”

Correction note (1 Jun 2023): In a previous version of the article, Tan was quoted as saying that renewables, like solar and wind, are already priced more competitively than coal in Asia. This has been edited for accuracy. Tan meant that solar and wind are increasingly profitable in Asia.