Against the backdrop of the global energy transition to renewables, China’s energy system is undergoing profound changes. Last year, Xi Jinping’s report to the 20th Party Congress included a proposal to “speed up the planning and development of a system for new energy sources”. The proposed system stands in contrast to today’s one based on fossil fuels.

“New” means a new energy mix – with the share of energy from non-fossil sources continuing to growing – and also new institutional mechanisms, established to ensure energy security by supporting the supply of energy and dispatching of reserves.

Establishing the new energy system is dependent on a new power system. At the end of March this year, the proportion of China’s installed generating capacity from non-fossil energy sources reached 50.9 per cent, exceeding for the first time the installed capacity for fossil-fuel power. The need for a new power system is increasingly pressing, with the proportion of electricity from wind power, solar PV and other new energy sources steadily increasing. Particularly critical, in the power system, are the allocation and transmission of electricity among regions. These are matters that the power market reforms urgently need to address.

This is the second of a two-part series of articles. Part one, “The current state of China’s electricity market”, discussed electricity trading in China today and offered suggestions for establishing a unified electricity market. This final part will discuss the importance of spot markets in establishing such a unified market, and how to realise that goal.

Price discovery function

The pathway for developing electricity markets in China differs somewhat from elsewhere. In the power markets of other countries, spot markets (for day-ahead and real-time transactions) usually come first, followed by the establishment of a medium to long-term (futures) market, primarily as a hedge against spot risk.

In China, however, the development of the electricity market began with medium- to long-term (MLT) electricity trading. These markets, which dominate at present, theoretically have the advantage of stabilising electricity prices and averting risk. However, without spot prices and day-ahead prices as a reference, and with trading framed by contract, there is lack of flexibility for adjustments.

As an example, with coal prices soaring, MLT trading has lagged far behind electricity prices since the second half of 2021, failing to reflect supply-and-demand conditions and regulate the rocketing cost of coal power. Coal power producers have incurred large losses as a result. The China Electricity Council (CEC) estimates that rising coal prices in 2021 resulted in about 600 billion yuan (US$83 billion) of additional coal-procurement costs for coal power firms in China. All such firms made a loss between August and November, while 80 per cent of them did over the course of the whole year.

MLT trading aside, spot trading of electricity helps discover electricity’s real-time prices, better reflects supply-and-demand and market costs in real time, and can bring surplus capacity, not subject to MLT contracts, into the real-time market, to compete on the grid. Coal power companies continued losing money in 2022, but the debt situation eased. Further penetration of spot markets on the power-generation side was an important factor, in addition to state measures such as interval-based regulation of coal prices and upwards adjustment in the floating range of feed-in tariffs for long-term agreements.

Promoting consumption of new energy

In fact, the positive effect of electricity spot markets in accelerating new energy consumption can already be seen. During the past four years of inter-regional and inter-provincial spot trading in surplus renewable energy, there has been a reduction of more than 23 terawatt-hours (TWh) in curtailment (wastage) of electricity from renewables.

Take as an example the spot market based on the power grid of West Inner Mongolia, which covers more than half of installed generating capacity in the Inner Mongolia Autonomous Region. It was launched in June 2022 as part of the first batch of regional pilots for spot trading – the first time such spot markets had been set up in China without differentiating between participation of coal-fired units and new energy sources. Data since the start of the trial run show striking results in terms of encouraging the consumption of new energy. As of 20 July 2022, compared with pre-trial-run operation, new energy consumption had cumulatively increased by about 64 gigawatt-hours (GWh).

Compared with the MLT market, spot trading in electricity is more frequent and shorter in cycle, thus better suited to the volatility and unpredictability of new energy sources. And under equal market competition, the marginal cost of power generation from new energy is lower. With the global energy crisis driving up primary energy prices and the marginal cost of thermal power being relatively high, under equal market competition the marginal cost of power from new energy sources is lower, making it more likely to be prioritised for dispatch.

In addition, spot trading gives rise to a peak-valley price spread. This opens profitable opportunities for new entrants to the market, such as those providing energy storage and other services, and encourages flexible adjustment of resources to match consumption of new energy.

At a practical level, however, fluctuating spot prices – as new energy sources come onto the spot market – will affect renewable power generators’ appetite for joining the market. Such generators usually produce electricity at the same time of day within a region; that is, the middle of the day for solar and the middle of the night for onshore wind. Good weather could easily lead to an overwhelming power surplus, however, when difficult to match with peak demand, which would lead to zero or negative spot prices over the period. In Shandong, there were 176 days of negative spot prices on the provincial grid during 2022 – meaning a 48 per cent probability of negative spot prices. This reflects a certain amount of overcapacity and wastage, at times of peak output, in Shandong’s new energy installations.

If in future we can expand the inter-provincial spot trading of new energy from a market perspective and make good use of load-curve differences among regions across time zones, then we will be able to smooth out new-energy power-generation curves on a broader geographical and temporal scale, helping to tackle surpluses and shortages across regions.

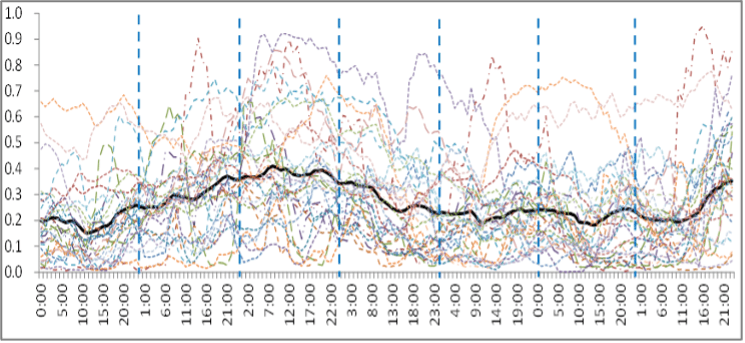

As shown in the figure below, the wind power output of individual provinces (coloured lines) fluctuates greatly during the course of a day. But the line levels out when outputs are coupled across a broader geographical range – in this case the northern, central and eastern zones of the country – enabling new energy sources to be better consumed.

Source: China Renewable Energy Engineering Institute • Note: The solid line combines the northern, central and eastern zones of China.

Reducing installations of new coal power

A unified national electricity market also better enables the existing stock of coal power units to meet peak consumption, instead of relying on new installations – which results in wasted resources or further losses for coal power firms.

The average electricity price will be pushed down as new energy sources enter the market. And for provinces with spot markets, the market price drops or even turns negative whenever a lot of power is being generated from new energy. This leads to a lowering of output from thermal power both in and beyond the province concerned, which squeezes profit margins for coal power. In future, there will be an urgent need to shift the role of coal power to ‘peak output’. Coal power units will need to make reasonable returns operating as back ups for when renewable units cannot produce sufficient electricity. This may be done through participation in ancillary services, capacity compensation mechanisms, or markets.

At present, coal power’s performance is lacklustre when it comes to exercising peak shaving or supporting as reserve capacity. It remains difficult to cover coal power costs when the price of coal increases more than the price of coal power, despite the floating range for long-term feed-in tariffs being elevated to 20 per cent.

At the same time, however, it is difficult for coal power to exercise its capacity for peak regulation in the absence of modifications for flexibility. During Sichuan’s 2022 power shortages, the province’s stock of coal power units did not fully exercise their peak-supply role and it was necessary to incentivise them with market price signals.

At present, localised surpluses and shortages of coal power exist alongside one another. Statistics from the Institute of Energy, Peking University show that new coal power projects, to the tune of 65.24 GW of installed capacity, were approved from January to November 2022 in China, more than three times the amount approved in 2021.

Electricity supply and consumption have been growing fast in China for a long time now. In most of the country, what is in short supply is available power capacity (kilowatts) during peak load hours, rather than electricity produced during a period of time (kilowatt-hours). There are huge seasonal variations in consumption over the course of a year, and the peak loading time when additional power capacity is needed only accounts for 5 per cent of a year.

During summer and winter peaks in electricity consumption, price does not exercise its full function in guiding supply and demand. On the supply side, the price cap limits the yield available to peak power units, while a big gap opens up on the demand side due to lack of a demand-side response mechanism, residential consumption included. In future, with coal power crowding in for only a few dozen hours of “hard gap” time, average hours for coal power utilisation will fall.

In order to avoid such problems, China needs to urgently establish robust market mechanisms for spot trading and capacity compensation, and be wary of the wasted resources or further losses incurred as a result of new coal power units springing up for peak hours.

Path to a unified electricity market

A report released in April this year by the International Energy Agency (IEA), with support from the Energy Foundation, analyses the road towards establishing a unified national electricity market in China. The report recommends a “secondary market model”, where an inter-provincial market exists in parallel with the existing intra-provincial market, to be in place in China before 2030.

The model is one in which local markets exist in tandem with the national market (a “unified market, operating on two levels”). This model can spur inter-provincial trading, with operational and economic gains, on the basis of maintaining the thrust of current policies (preserving provincial autonomy over market design and dispatch decisions).

Specifically, the secondary market model provides for inter-provincial trading of surpluses, similar to the “surplus market” model currently being piloted in the State Grid area, along with a regional centralised clearing model, similar to the “volume-coupling” model currently being piloted in the Southern Grid area.

In the surplus market model, which is simpler to set up, local regions acting on their own initiative offer up surplus electricity for trading on a unified national market. Provinces can then link into other markets while keeping the rules of their own power market, maintaining local market autonomy while increasing overall usage rates. This is exemplified internationally by the SIEPAC power system in Central America, and the SAPP power pool in Southern Africa.

In the longer term, China will gradually set up this kind of volume-coupled market, creating market synergies at a higher level.

Under this model, the national day-ahead market (in which prices are determined one day in advance) operates in parallel with local markets, giving priority to clearing on the national market and achieving optimal allocation of resources, while affecting trading by utilising the corresponding transmission channels. In this way, inter-provincial barriers resulting from different market models can to a degree be avoided.

Taking 2035 as a target year, and assuming that market-based dispatch remains at current levels (premised on today’s concurrent operation of planned dispatch and market dispatch), the data suggest that setting up a secondary market to enhance regional coordination of electricity markets could cut operating costs on the national market by 6–12 per cent, lower CO2 emissions by 2–10 per cent, and reduce curtailments by about 10 per cent.

Regional synergies in the electricity market, coupled with the promotion of fully economic dispatch – whereby the most cheaply generated power is prioritised for dispatch – could reduce operating costs by 25 per cent on the national electricity market, reduce CO2 emissions by about 35 per cent, and reduce curtailment by more than 20 per cent. This would bring combined benefits that are two to three times greater than in the previous scenario.

We believe that promoting inter-provincial and inter-regional trading mechanisms and market-oriented dispatch, and increasing the share of spot trading in electricity, will help to bring down overall operating costs in the power system, broaden the geographical and temporal extent of new-energy consumption, and realise environmental benefits. Doing so would improve inter-provincial trading efficiency.

Future focus

In terms of setting up a unified national spot market for electricity, security of energy sources is crucial. The national strategy for west-to-east power transmission, and the provincial electricity markets, are based respectively on the need to optimise allocation of resources at different levels and to ensure a secure power supply. Gradually instituting a national electricity spot market on the back of today’s inter-provincial spot markets, grounded in the principle of provincial autonomy in market design and dispatch decisions, is a practical way forward that takes into account security and dependability, viability and overall benefit.

At the same time, improving the inter-provincial and intra-provincial spot markets will help alleviate future pressures for peak power supply. In phases of tight supply and demand, it is necessary to make space for price signals on the spot market, such that the market can exercise its function of ensuring supply by guiding the inter-provincial and inter-regional allocation of resources. This promotes levelling out of peak surpluses and shortages, while also damping down the volatility of new energies across a greater range.

Price signals in the power market, be they positive, negative, high or low, can guide the development of new energy sources and the transformation of coal power. This can steer changes in the composition of power supply in different provinces, head off a collective rush into new energy and coal power, maximise the marginal utility of new installed capacity on the basis of guaranteed and appropriate reserves, and promote orderly development of different varieties of electricity supply.

Addressing the underlying interests that account for inter-provincial barriers necessitates breaking down local protections and market segmentation. Drawing on experience from the southern China electricity market, pathways for building regional markets can be explored so as to drive the timely establishment of a national electricity trading centre – where nationwide transactions can be managed.