Voluntary carbon markets (VCMs) have seen rapid growth in the last decade as carbon offsets became an important part of climate strategies across the globe. In 2021, the market value of VCMs grew fourfold to US$2 billion (RM9.3 billion) compared to 2020, and is expected to grow to between US$10 billion (RM46.5 billion) to US$40 billion (RM186 billion) by 2030.

Demand for voluntary carbon credits is being fuelled by commitments made by governments and organisations to reduce their carbon footprint. In line with the 2015 Paris Agreement, where most countries agreed to limit the increase in global temperature to 2°C, many governments have also announced their nationally determined contributions (NDCs) towards cutting global greenhouse gas (GHG) emissions. While the Paris Agreement involves state actors, private actors are increasingly taking part in climate action, either through compliance carbon markets imposed in certain jurisdictions, or through their participation in voluntary carbon markets.

In certain jurisdictions, there are interactions between compliance and voluntary carbon markets, whereby carbon credits from the voluntary markets are permitted to be used as part of the carbon reduction requirements in the compliance market. These markets have helped put a price on carbon and help to channel funds to finance projects that mitigate climate change through the buying and selling of carbon credits.

| Compliance Carbon Markets | Voluntary Carbon Markets |

|---|---|

| Compliance carbon markets are markets created by regulation or policy in specific local, national or regional jurisdictions. These markets typically involve a cap and trade or Emissions Trading System (ETS), where each market participant is given a set quota of emissions which they may trade with other participants who are looking to exceed their quota. | Voluntary carbon markets are used by entities to buy and sell carbon credits without a compliance purpose. These markets are often used by organisations or individuals to offset their carbon emissions voluntarily. |

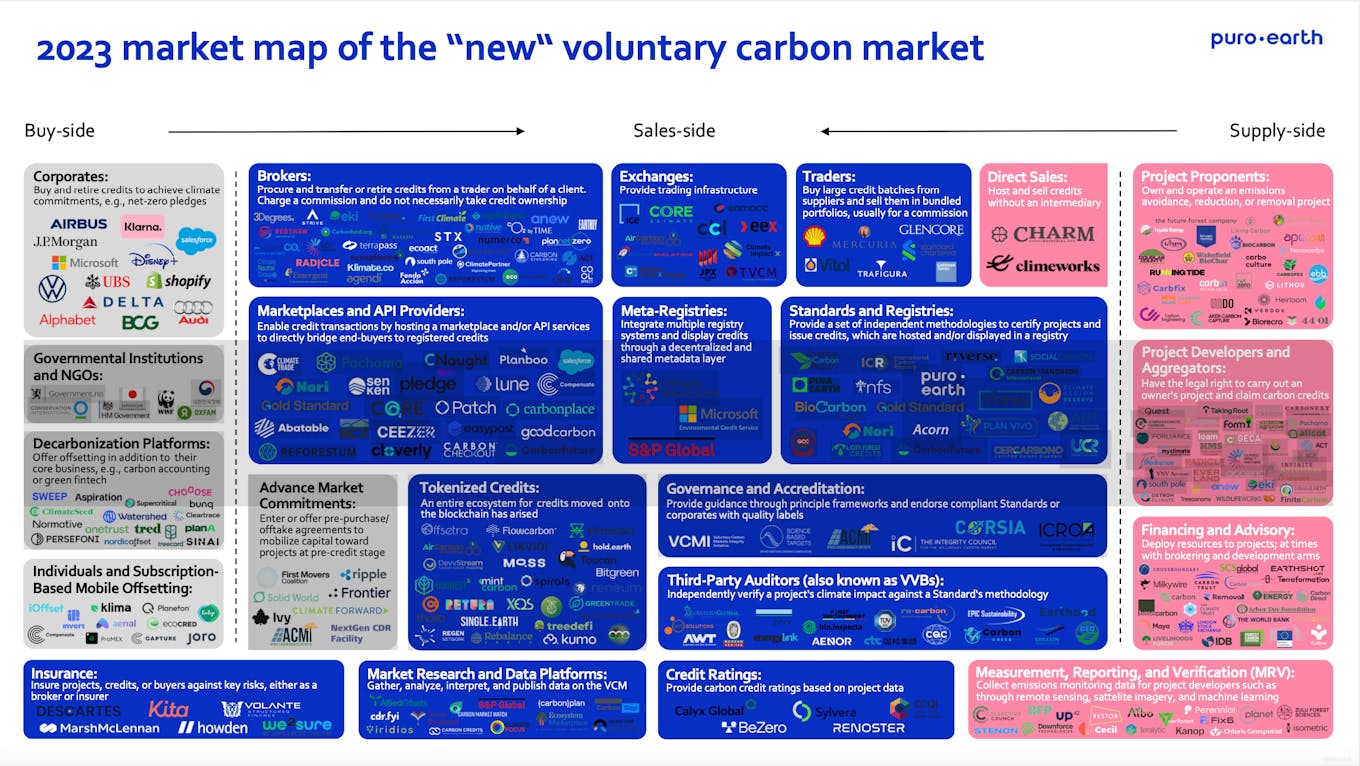

This infographic is a non-exhaustive map illustrating the different global actors involved in the complex landscape of VCMs that is still expanding.

Market map infographic republished with permission from Puro.Earth. [Click to enlarge]

Buy-side – buyers financing climate action

Carbon credit purchasers come from an array of backgrounds. In VCMs, the buyers are most often organisations with climate strategies in place, aiming to offset GHG emissions from their operations or seeking to improve their climate impact. If organisations chose to use carbon credits to offset their GHG emissions, those carbon credits must be retired to avoid double counting.

Sales-side – the enablers of the carbon market

VCMs are facilitated by actors in the sales-side of carbon markets. Crucial to the growth of VCMs are the actors who maintain the integrity and ensure transparency of markets and the credits being traded on the exchanges. This includes standards, registries, and auditors, whose roles are to ensure the legitimacy of the carbon credits produced. Standards are responsible for developing methodologies and maintaining the carbon credit registry, and also providing accreditation to auditors and validators who assess and verify the performance of carbon projects.

The buying and selling of carbon credits can be facilitated by marketplaces which provide a platform that bridges buyers directly to registered credits. In these marketplaces, buyers are given access to information that supports their decision-making when it comes to making investment decisions in carbon credits.

In addition, there are also carbon market exchanges which provide the infrastructure for carbon trading, such as spot trading or auctions. Exchanges also provide additional services that further support trading activities. For example, Bursa Carbon Exchange (BCX) integrates Islamic finance in carbon trading, being the world’s first Shariah-compliant carbon exchange in addition to offering Shariah-compliant carbon credits. Additionally, BCX also conducts due diligence on carbon credits and participants before being onboarded on the exchange, requiring applicants to pass know-your-customer (KYC), anti-money laundering, anti-bribery and anti-corruption requirements. BCX reduces counterparty risks through the application of these measures and the use of an omnibus account which requires carbon credits (from suppliers) and funds (from buyers) to be deposited with the Operator’s unit and cash custodian accounts respectively.

Third-party research platforms, credit rating agencies and insurers also have a role to play as enablers of the carbon market ecosystem. Research platforms keep buyers and sellers informed by providing expert insights and analysis on the latest market trends and development, which help facilitate informed decision-making among participants. Credit rating agencies perform a complementary role by rating carbon projects based on their types, such as carbon sequestered or removed, permanence of the projects and alignment with the United Nations’ Sustainable Development Goals to help buyers better assess the quality of carbon credits. Meanwhile, carbon credit insurers offer buyers protection against potential underperformance or invalidation of credits.

Supply-side – how are carbon credits created?

Carbon credits are generated through different types of projects. These can be broadly grouped into two categories, namely nature-based solutions and technology-based solutions. On top of that, there are two different types of carbon projects, namely emissions avoidance projects, which prevent emissions from entering the atmosphere compared to a business-as-usual scenario; and emissions removal projects, which remove existing carbon dioxide or its equivalent from the environment.

The project proponents are sometimes supported by external project developers and aggregators, who may be given the legal right to execute the project and claim the carbon credits generated. A key component for credit generation is measurement, reporting, and verification (MRV), whereby data on GHG emissions avoidance or removal is collected and used to support the verifiability of the generated carbon credits.

| Project Category | Description | Examples |

|---|---|---|

| Emissions Avoidance | Projects which prevent or reduce greenhouse gas emissions from entering the atmosphere |

|

| Emissions Removal | Projects which remove greenhouse gases from the atmosphere |

|

The VCM landscape is quickly evolving, with increasing volumes being traded across global carbon exchanges. For instance, the total value of carbon credits traded increased by nearly 60 per cent in the first eight months of 2021 compared to the year before, and more carbon credits were issued in the first half of 2022 than in the full years up to 2018.

Asia is a critical region for the growth of VCMs, where the volume of carbon credits traded doubled between 2019 and 2021. In Southeast Asia, VCMs are estimated to contribute as much as US$10 billion in economic value by 2030, especially from nature-based carbon credits.

This article was first published on Bursa Sustain, Bursa Malaysia’s one-stop knowledge hub that promotes and supports development in sustainability, corporate governance and responsible investment among public-listed companies. It has been edited for brevity.