The Singapore Exchange (SGX) on Monday announced its first ever set of equity indices focused on sustainability, underscoring the growing importance of environment, social and governance (ESG) issues in a region that has been lagging behind its global counterparts.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

The SGX Sustainability Indices, composed of SGX-listed stocks, identify listed companies that meet sustainability reporting requirements and are considered sustainability leaders with established and leading ESG practices.

Sustainability performance, broadly measured by ESG indicators, has in recent years become a mainstream business issue as consumers worldwide demand increased transparency from businesses and issues such as climate change pose a growing risk to operations.

SGX chief executive officer Loh Boon Chye observed in a statement that investors across the globe are placing increasing importance on ESG, “resulting in significant growth of AUM (assets under management) allocated to ESG strategies and growing demand for transparent benchmarking tools”.

“SGX Sustainability Indices provide a transparent avenue through which investors can assess the sustainability practices of SGX-listed companies and identify ESG leaders in Singapore. They will also help to further profile SGX-listed companies with strong relevant credentials among a growing pool of ESG-aware international investors,” he said.

In Asia, stock exchanges in countries such as China, Indonesia, Malaysia, India and Japan already have sustainability-related indices in place.

Junice Yeo, director for Southeast Asia at London-headquartered sustainability consultancy Corporate Citizenship said that the launch of the index “is timely” and will “enable institutional investors to get a clearer picture of the Singapore companies managing their ESG risks”.

The indices, screened with transparent ESG criteria by consultancy Sustainalytics, consist of a broad market indicator and a narrow Leaders index basket.

All constituent weights are capped at 15 per cent, ensuring greater portfolio diversification, said SGX.

The suite is made up of four new indices including the flagship SGX Sustainability Leaders Index, which is comprised of SGX-listed companies that are considered to be clear frontrunners in ESG standards when compared to their peers.

In addition to meeting the necessary ESG requirements, companies must also meet minimum liquidity requirement in order to qualify for inclusion.

Michael Jantzi, CEO of Sustainalytics, said: “We hope as a result of their new family of Indices, increasing numbers of SGX-listed companies will enhance their disclosure around ESG issues, enabling investors to make more informed decisions.”

The launch of SGX newest indices follows recent moves by SGX to raise standards on sustainability reporting. Starting financial year 2017, more than 800 listed companies in Singapore will be required to publish sustainability reports on a ‘comply or explain’ basis.

David Smith, head of corporate governance at Aberdeen Asset Management commended the move, saying that “Aberdeen fully supports the integration of ESG into the investment process. As long-term investors we firmly believe in the need to consider and fully understand all risks, rather than narrowly defined financial risks, that relate to a company’s long term success.”

The SGX Sustainability Indices suite includes the flagship SGX Sustainability Leaders Index of which property developer City Developments Limited and Cambridge Industrial Trust (CIT) are among the 24 component companies listed.

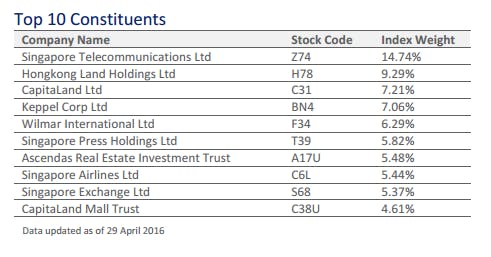

The Top 10 constitutents in SGX’s Sustainability Leaders Index. Image: SGX

CDL chief Grant Kelley noted that “sustainability is becoming mainstream in today’s global business environment and investors increasingly assess companies on their corporate stewardship and ESG performance”.

”This Index is timely and will elevate the importance of ESG performance for Singapore-listed companies, and enhance Singapore’s standing among the global investment community,” he said.

Philip Levinson, chief executive officer of CIT’s manager, said: “This is a strong testament to the progress made by the Trust… there is still a lot of work ahead of us and the team remains committed to our goal of becoming one of Asia’s greenest industrial REITs.”