What does the future hold with the global economy’s centre of gravity progressively shifting from the northern hemisphere to the south, particularly to Asia?

At the moment, the environmental prospects don’t look too good, but as the realities of Beijing’s toxic smogs and thousands of dead pigs in Shanghai’s water supply press in, even China seems to be accepting the need for greater transparency and legal enforcement.

The worry is that much of Asia continues to scale economic and business models that are substantially less sustainable than those now operated in the North, with corrupt political and business practices significantly blunting the capacity to change in good order and good time.

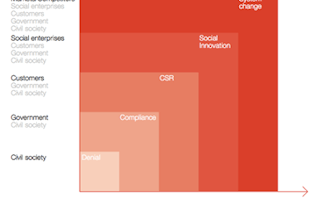

As our team worked on our new report, titled Breakthrough: Business Leaders, Market Revolutions, we evolved a simple map tracking some of the ways in which the Global C-Suite (our term for the top 1,100 companies that collectively control around 50 per cent of global market capitalization) has been impacted. We reproduce it below—and now offer a short, guided tour.

The Breakthrough Map

The vertical axis shows some key forces and drivers that have fuelled the agenda and propelled a growing number of companies and sectors to tackle environmental, social and governance challenges.

Wind the clock back far enough in relation to any issue and you find that the original pressure for change came from activists, NGOs and other organs of civil society.

Over time, however, the torch tends to be picked up by governments and then by different parts of the worlds of business and finance.

Leading companies have worked out how to partner with each of the new influences on the vertical axis. Today, for example, we see growing mainstream business interest in the potential lessons to be learned from the growing range of social and environmental enterprises.

In parallel, we also now see growing business involvement in what is called pre-competitive coalitions, designed to bring the resources of many different companies to bear—helping shape the rules of the game before competitors start to compete. These range from the Zero Discharge of Hazardous Chemicals coalition in the sportswear sector through to The B Team, led by Sir Richard Branson and former PUMA CEO Jochen Zeitz.

Focusing back on the diagram, a diagonal trajectory runs from bottom left to top right, taking us from an early state of denial (where business lobbyists either dispute the existence of a problem or, where they accept there is a problem, energetically deny any link to the activities of a particular industry) through to the point of ‘breakthrough’—where the system jumps to a different, more sustainable, state.

Over time, a growing number of corporate pioneers shift the needle, moving beyond compliance to new forms of citizenship and corporate social responsibility.

The next step beyond that, in the CSR space, is the evolution of new forms of social innovation, social entrepreneurship and new forms of impact investment. Ultimately, however, such approaches may be found wanting—because they fail to measure up to the nature and scale of the relevant challenges.

Among the reasons are that current market incentives—indeed the entire discipline of economics—too often fail to reward those who pioneer new ways of creating social and environmental value. But that will change over time.

The diagram’s horizontal axis plots the growing number of C-Suite roles that have become embroiled in all of this as the agenda becomes more complex, more urgent and, for a growing number of sectors, increasingly strategic—in the sense that they create new risks and opportunities.

The CSR and social innovation phases have seen the appointment of a growing number of Chief Sustainability Officers (CSOs). But for true system change, CSOs can only hope to play a catalytic role.

Ultimately, every C-Suite role has to be involved, including the Chief Financial Officer (CFO), with the CSO’s early agenda properly embedded in all key functions.

The leading edge of change in most companies and most sectors is currently found in the social innovation and impact investment space. One question we have often been asked since our first Breakthrough Capitalism Forum in London last year, is what criteria define a breakthrough innovation, technology, business model or policy?

Based on our research to date, and with examples provided in the report, we believe that such initiatives need to be future-ready, ambitious, fair and disruptive. We will showcase some of the more successful experiments in our next round of Breakthrough Forums, with major events planned both in Toronto and Berlin.

There are already a few examples of initiatives that fit a number of these criteria emerging in countries like South Korea (with its emphasis on the green growth economy) and Singapore (with its growing focus on social innovation and entrepreneurship). But it remains to be seen whether these can these be scaled, adapted and replicated across Asia. Our conclusion is that they can, but only if the political, governance, economic and cultural conditions are in place.