Six years after a video of a turtle with a straw in its nose drew global attention to the horrors of plastic pollution, fossil fuel companies are ramping up polymer production while recycling remains a “marginal activity”, a new report finds.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

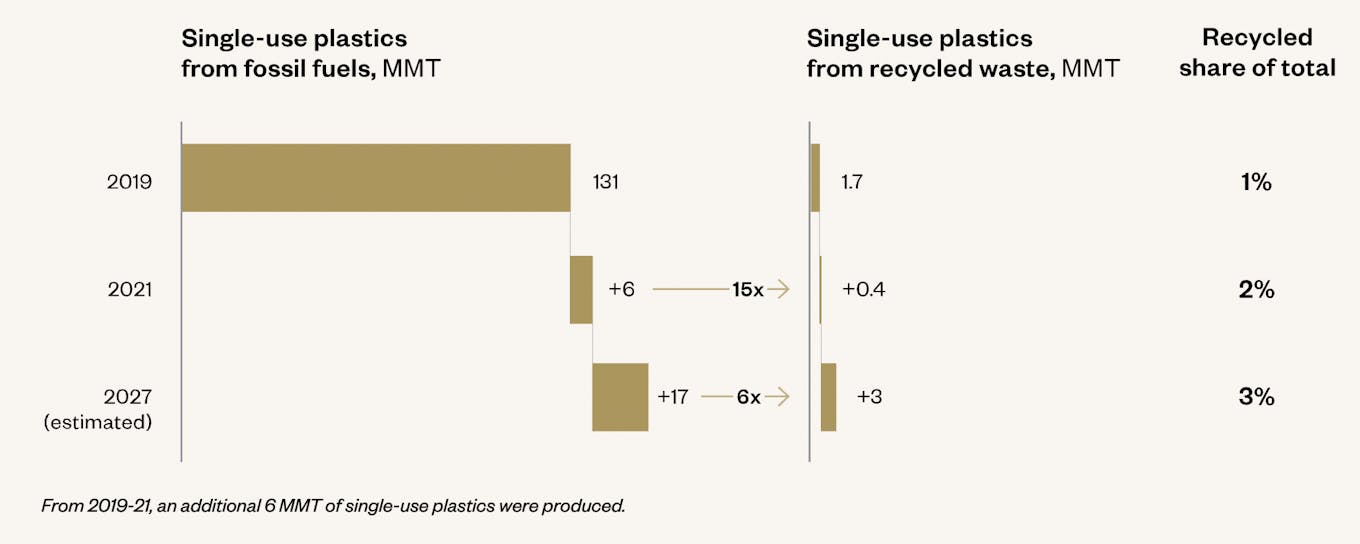

Between 2019 and 2021, the worldwide production of single-use plastics outstripped recycled plastic production by 15 times, according to Plastic Waste Makers Index, a report by Minderoo Foundation.

In that time frame, 6 million tonnes of single-use plastics was produced, and a further 15 million tonnes is expected to be in circulation by 2027 as fossil fuels companies pivot from oil to petrochemicals to protect revenue growth. Plastics are almost entirely made from fossil fuels.

Only 9 per cent of all plastic produced globally is recycled, and an estimated 10 million tonnes of plastic waste enters the ocean every year, causing environmental and health problems, particularly in the Global South where recycling infrastructure is lacking.

“The root cause of the problem is that it is cheaper to produce virgin plastic than sort, clean and recycle used plastic,” said Dominic Charles, Minderoo Foundation’s director of finance and transparency at The Economist Impact’s Sustainability Week Asia event on Monday 6 February.

“Until we can intervene to correct that economic imbalance, we will see no change in capital flows into the infrastructure we need to deal with waste better,” he said.

Between 2019 and 2021, an additional 6 million tonnes of single-use plastics were produced, 15 times the amount of single-use plastic recycled. Source: Plastic Waste Makers Index

Petrochemical companies are only scaling up recycling capabilities in developed countries where there is strong demand for recycled plastics and economic conditions are favourable. Investments in recycling infrastructure in developing countries, which suffer the brunt of plastic pollution, are much rarer, Minderoo noted.

A lack of investment in recycling is the reason behind why only 3 million tonnes of single-use plastic will be recycled by 2027 compared to 17 million tonnes of virgin plastic produced, according to Minderoo’s calculation.

“The reality is, the plastics industry has scaled up tremendously over the past few 30 to 40 years. But the recycling industry is only just starting to catch up,” said Rob Kaplan, chief executive of Circulate Capital, a firm that invests in recycling plants in developing countries. “There’s a massive disparity there.”

An 80 per cent reduction in plastic pollution could be achieved over the next few decades if more investment was channelled into the recycling sector, said Kaplan, whose firm has invested in recycling firms in South and Southeast Asia, backed by corporates including Coca-Cola, Unilever and Dow.

The problem is that investors don’t think they’ll see good returns from recycling, Kaplan said. “Investors will only start investing in recycling if they believe that they will make lots of money doing it. Right now, they don’t think that’s the case.”

Mervyn Tang, who leads the Asia Pacific sustainability team for investment firm Schroders, said that recycling is not a risk investors like to take, because recycling businesses are hard to scale. “We’ve been seeing some investment [in recycling], but building that up will take time,” he said.

Recent investigations into plastic recycling entities have also raised questions over the credibility of the sector among investors. Reuters and Bloomberg are among news outlets to highlight the failings of industry-backed non-profit Alliance to End Plastic Waste (AEPW) to scale clean-up solutions while its members ramp up polymer production.

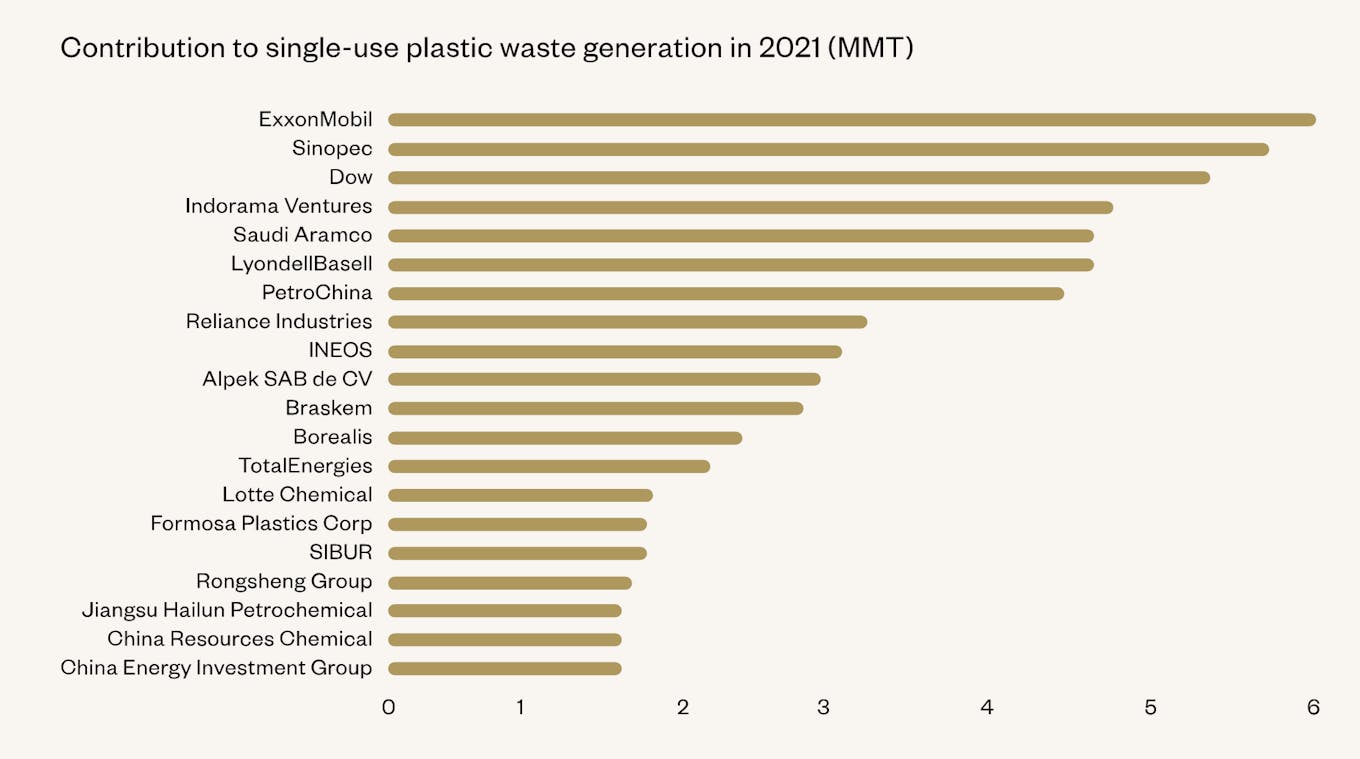

Among AEPW’s founding and most active members is ExxonMobil, which tops Minderoo’s ranking of the world’s biggest sources of single-use plastic waste for the second year running.

The top 20 petrochemical companies producing virgin polymers bound for single-use plastic. Source: Plastic Waste Makers Index

As more countries develop producer responsibility laws that hold producers accountable for the environmental cost of plastic, petrochemical companies are being asked to foot more of the bill for pollution, which costs the blue economy up to US$2.5 trillion a year.

Minderoo’s report identified only two companies – Thailand-headquartered Indorama Ventures and Taiwanese firm Far Eastern New Century (FENC) – out of the 20 in the study that are producing recycled polymers at scale. A further eight firms have made commitments to recycle more plastic, but this will amount to greenwashing if words are not backed up by action and investment, the report said.

Carbon copy of the climate crisis

The environmental cost of single-use plastic is not limited to oceans clogged with litter. Single-use plastic production generated the equivalent annual greenhouse gas emissions of the United Kingdom in 2021, according to Minderoo’s estimates.

The non-profit suggested that plastic producers include Scope 1, 2 and 3 emissions from plastic polymers in net-zero climate strategies, and introduce targets to produce a minimum 20 per cent target for recycled feedstock in polymer production by 2030 to align their businesses with global climate goals.

Mechanical recycling reduces cradle-to-grave emissions by 30 to 40 per cent compared to producing polymers from fossil fuels, Minderoo noted.

It also called for a levy on fossil-fuel polymer production to generate funds for scaling plastics collection, sorting and recycling infrastructure.

“We need a fundamentally different approach that turns the tap off on new plastic production. We need a ‘polymer premium’ on every kilogram of plastic polymer made from fossil fuel,” said Dr Andrew Forrest, chairman of Minderoo Foundation.

A report by Minderoo in October predicted that the petrochemical industry could face a new wave of litigation for plastic pollution as evidence of the harm ingesting and breathing in plastic does to human health emerges.