Bursa Carbon Exchange (BCX), Malaysia’s first voluntary carbon marketplace, is gearing up to offer its first local, nature-based carbon credits within the first half of this year.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

The credits will be based on the Kuamut Rainforest Conservation Project in the state of Sabah, which has been registered with certification scheme Verra. The project is pending validation of its triple gold rating based on Verra’s Climate, Community and Biodiversity standards, which it was awarded last year.

“As soon as the carbon credits are issued, we will be able to auction them as the very first Malaysia-based carbon credits,” said Muhammad Rizal Azmi, assistant vice president of business development and sales at BCX.

The Kuamut project, which protects 83,381 hectares of tropical rainforests in Sabah, has already been given the highest possible ranking for Improved Forest Management projects by carbon project ratings firm BeZero, said Rizal during a BCX webinar last month. It is expected to reduce emissions by 543,049 tonnes of carbon dioxide equivalent per year over its 30-year lifespan.

The project is managed via a public-private partnership between the Sabah Forestry Department, Rakyat Berjaya, a subsidiary of state-backed foundation Yayasan Sabah, and carbon project financier Permian Malaysia, a local branch of UK-based Permian Global which recently appointed Ivy Wong as its Malaysia CEO. The Kuamut project is also supported by indigenous community organisation PACOS Trust and the South East Asia Rainforest Research Partnership (SEARRP).

While BCX currently only accepts Verra-certified carbon credits, it will be adopting the Gold Standard, another certification standard for carbon credits, by the end of this year, said Rizal. BCX signed a memorandum of understanding with Gold Standard two months ago at COP28 with the aim of enhancing its offerings and improving the knowledge of local ecosystem players. Gold Standard had agreed to support capacity building for Malaysian carbon project developers and encourage the development of validation and verification bodies.

Nature-based credits are expected to fetch a premium due to their potential co-benefits, as well as higher operational costs for measurement, reporting and verification (MRV) activities, said Rizal. However, to encourage the listing of more local carbon projects on BCX, the government announced in its 2024 budget that carbon projects listed on the exchange are eligible for tax deductions of up to RM300,000 for costs incurred in their development, as well as MRV activities.

BCX also plans to begin facilitating the trade of renewable energy certificates (RECs) by the first half of this year via an auction, with continuous trading to begin in the third quarter, the exchange told Eco-Business.

BCX announced on 17 January that it would collaborate with the Malaysian Photovoltaic Industry Association to jointly promote solar RECs, in which BCX would offer the association’s members the opportunity to trade RECs while exploring the potential supply of solar RECs from members.

It is also exploring the potential supply of RECs from East Malaysian state utilities company Sarawak Energy and facilitating cross-border RECs trading via the I-REC platform following an agreement signed with Sarawak Energy, the I-REC Standard Foundation and the Hydropower Sustainability Alliance at the COP28 climate talks last year.

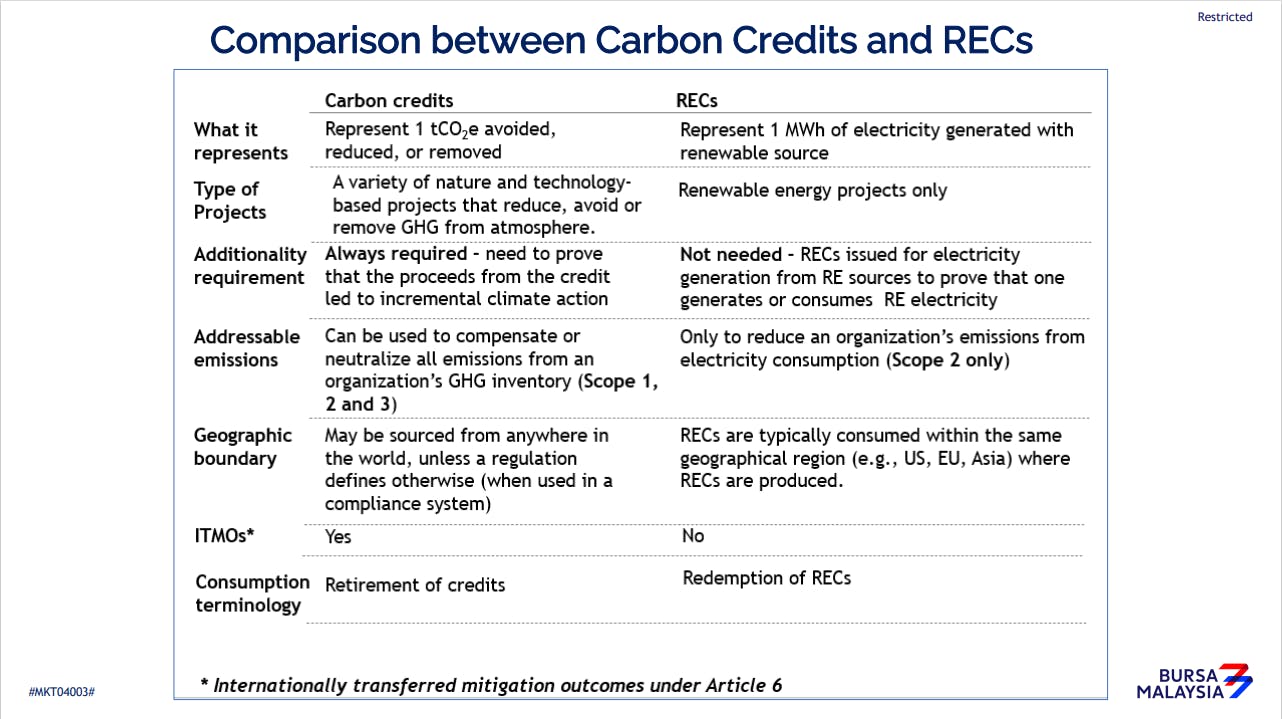

While carbon credits can be used to offset a company’s Scope 1, 2 and 3 emissions, renewable energy certificates can only be used to offset its Scope 2 emissions, which come from electricity consumption. Image: Bursa Carbon Exchange

Dr Chen Wei Nee, who leads BCX, said that the carbon exchange’s decision to expand its product offerings is in line with the ambitions of its parent company, stock exchange operator Bursa Malaysia, which recently repositioned itself as a multi-asset exchange. “Similarly, we would like (BCX) to be seen as a supermarket that offers a suite of shariah-compliant environmental (offerings),” said Chen.

Although the exchange enabled continuous trading of carbon credits in September last year, it has experienced weak participation. A check by Eco-Business of BCX’s market activity via its website this week indicated that no carbon credits were traded during market hours.

However, the exchange has learnt through conversations with industry participants and companies that Malaysian businesses are more familiar with and therefore more eager to trade RECs, said Chen. While RECs can also be bought and traded via international agents, BCX aims to meet the market’s demand for price discovery and transparency via its public exchange, she said.

Marketplaces for Malaysian RECs already exist, the most prominent of which is the Malaysia Green Attribute Tracking System (mGATS), a marketplace for Malaysia Renewable Energy Certificates (mRECs) operated by national utilities firm Tenaga Nasional Berhad. Among the list of renewable energy plants registered under mGATS are several solar farms and hydroelectric power plants.

“While TNB has been doing a very good job in terms of supply RECs, if (demand) is not met by TNB, the shortfall is only able to be met through (private) brokers, through which there is a lack of price transparency and price discovery,” explained Chen. “Therefore, as an exchange, we have been requested to extend our products…to provide and promote price discovery and transparency.”

Chen also addressed concerns that trading carbon credits and RECs on BCX with the intention of retiring them as offsets would be interpreted as greenwashing instead of encouraging businesses to reduce their emissions. She cited a recent study by Ecosystem Marketplace which found that companies engaged in voluntary carbon markets reported lower emissions year-on-year compared to companies that did not participate in carbon markets.

In addition to it being important for firms to disclose their mitigating measures when it comes to abating emissions, Chen added that businesses should ensure their mitigation measures do not only rely on offsets but a broader portfolio of decarbonisation measures.

“There should always be a combination of actual abatement plus the use of environmental attributes,” she said, “(but) over time, you should use fewer environmental attributes and your real abatement measures should increase.”