The climate finance architecture—the system of specialized, public funds that help countries implement climate mitigation and adaptation projects and programs—is crucial if the world is to overcome the climate change challenge. These funds play a valuable role in everything from deploying renewable energy to helping smallholder farmers cope with drought to restoring degraded forests, and often mobilize even larger volumes of funding from the private sector and other sources.

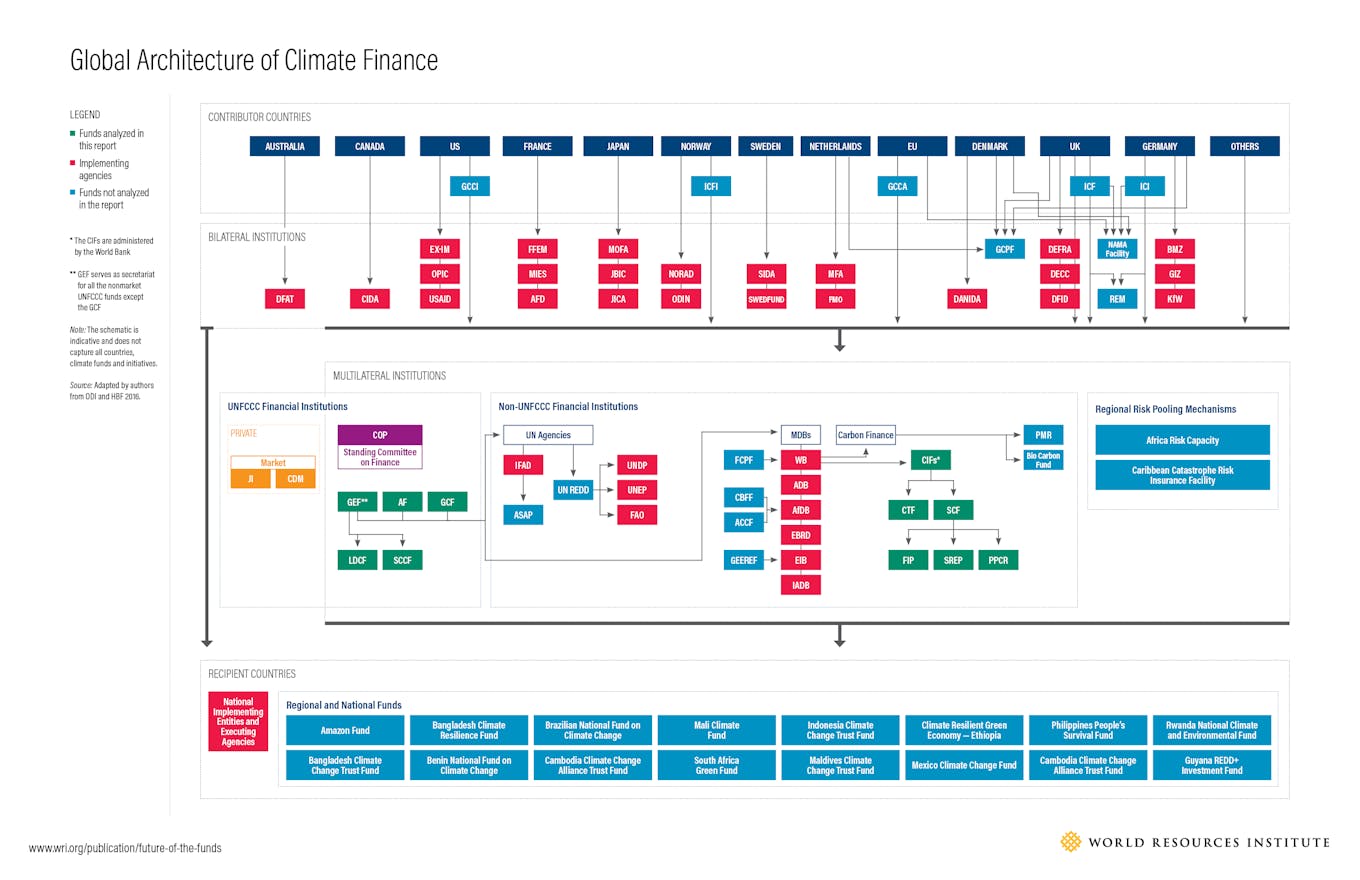

Yet, the climate finance architecture has become too complex. Over the past 25 years, dozens of national, regional and international climate funds have been created. Each new fund responded to needs and gaps that existed at the time, but this has led to a rather complicated system:

Complexity creates two problems. First, contributor countries have a harder time deciding where to put their money for maximum impact, because some funds do similar things. Meanwhile, prospective recipients in developing countries must spend scarce time and effort learning how to navigate this system to access financing. Overlapping roles and inefficiencies among funds mean the current climate finance architecture isn’t fully meeting countries’ needs.

“

This architecture could be strengthened to remove redundancies, streamline processes and get finance flowing to the right projects faster.

The Paris Agreement on climate change, signed by 193 countries last year, calls for a major realignment of all financial flows towards low-emission and climate-resilient investments. Now is the time to strengthen the public financing architecture to deliver this outcome.

How to restructure the climate finance landscape?

Our new report, The Future of the Funds, examines seven of the key multilateral climate funds:

Between them, these funds have approved $11.7 billion for 967 projects over the last 15 years, and mobilized more than $70 billion in additional financing from the private sector and other sources.

Our analysis shows that funds have strengths in different areas, and that no single fund is currently able to meet the broad variety of climate finance needs that exist.

The CIFs, for example, channel larger sums of money to projects in a few countries, while the GEF provides more modest amounts to nearly every developing country. The AF and GCF channel funds directly to institutions in developing counties, while other funds work primarily through multilateral development banks and UN bodies.

The GEF has lower administrative costs, but takes longer to approve projects, while the AF has relatively higher costs but is faster at project approval. Some funds specialize in supporting either adaptation or mitigation, while others do both. The LDCF and GCF place special emphasis on supporting less developed and more vulnerable countries.

Strengthening the architecture

This architecture could be strengthened to remove redundancies, streamline processes and get finance flowing to the right projects faster. That will require reforms in the short-term, together with a long-term vision for the system:

-

Improve coordination by having fund secretariats and governing bodies engage with each other more closely to minimize duplications and inefficiencies. For example, the LDCF might focus on supporting least developed countries in adaptation planning, and the AF or GCF then supports implementation of the adaptation projects and programs that result from those plans. Funds could also coordinate better with developing country recipients; one option is for governments to designate a single ministry or body to serve as the focal point for all climate funds.

-

Harmonize fund requirements to have a common set of processes, which would help address the challenges recipients faced in having to master a variety of different application procedures and standards. This should be an upward harmonization, to maintain high fiduciary and safeguard standards.

-

Fund programs, rather than one-off projects to catalyze more systemic change at national, regional and ideally, global levels. Programmatic funding involves bundling activities that contribute to a common outcome, such as rolling out renewable energy in several Pacific Island nations as opposed to just one. This can increase efficiency and promote country ownership by enabling entities to program larger sums under one proposal, then devolve decision-making to national or local levels. The GCF and CIFs are particularly well-placed to support more programmatic approaches.

-

Clarify specialization of funds in areas that are firmly in their comparative advantage. A clearer division of labor between the funds could help address both gaps and overlaps in how the funds support different thematic areas, project sizes and take on risk. In the longer term, depending on how the architecture evolves and performs, some funds could even merge or close entirely once they have served their purpose.

Multilateral climate funds had some notable successes, but we are at a critical juncture. The investment decisions in the next five years will determine whether the world will transition to clean and resilient infrastructure that protects communities from the worst impacts of climate change, or lock-in a costly and inefficient high-emissions trajectory.

The climate funds and those who oversee them need to face this challenge head-on. They need to coordinate, harmonize and specialize if they are to maximize their impact.

Joe Thwaites is an Associate in the Sustainable Finance Center, World Resources Institute, and Niranjali is a Climate Finance Associate in the Sustainable Finance Center, World Resources Institute. This post is republished from the WRI blog.