Global sustainable bond issuance reached a new quarterly record of US$231 billion in the first quarter of 2021, more than three times higher than the first quarter of last year and 19 per cent higher than the US$195 billion issued during the final quarter of 2020, according to a note by Moody’s Investors Service on Monday (10 May).

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

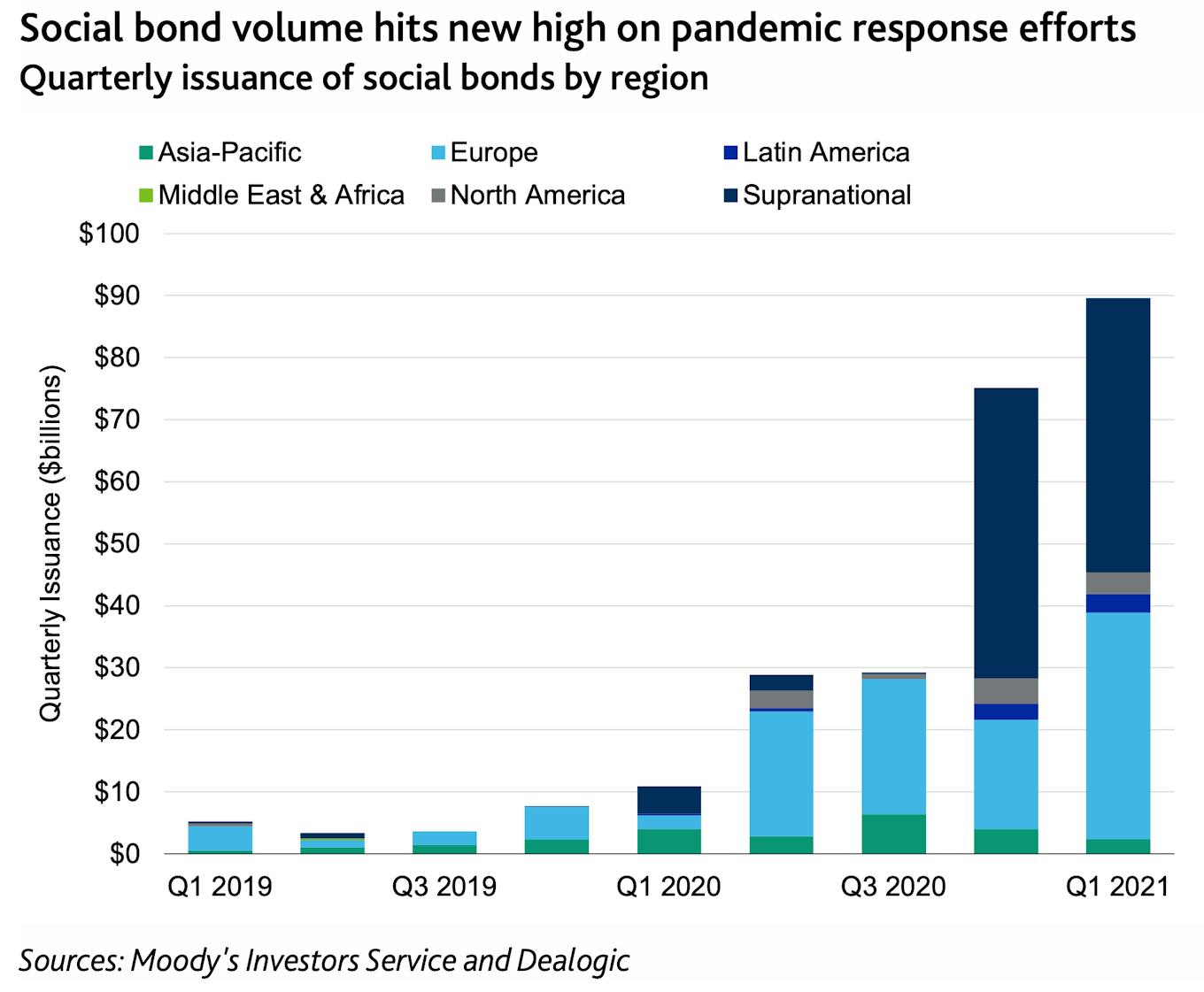

The bumper quarter total comprised of US$99 billion of green bonds, US$90 billion of social bonds and US$42 billion of sustainability bonds.

The issuance of sustainability-linked bonds, that incentivise issuers achievement on sustainability objectives through key performance targets, hit a record US$8.6 billion in the first quarter—a 57 per cent increase compared to the same period last year.

Moody’s expects that these will see “significant growth” throughout the remainder of the year as issuers look for investors that are placing greater emphasis on sustainability. There is also greater willingness from borrowers to change how they do business, putting environmental, social and governance (ESG) considerations at the core of their business.

There are few signs of the boom for sustainable finance abating. With the proliferation of net-zero emissions goals from governments and financial institutions, sustainable bond sales are poised to increase. This will be the year of “green stimulus as major economies attempt to integrate their economic recovery and job creation initiatives with their longer-term efforts to reduce carbon emissions,” Moody’s wrote in a recent report.

Greater policy focus on climate change and sustainable development in some of the world’s largest economies is supporting further growth and development of sustainable finance markets globally.

China, for example, has set a goal of carbon neutrality by 2060 and aims to have carbon emissions peak by 2030 under its draft 14th Five-Year Plan (2021-25). The plan also highlights a number of energy and environmental targets.

The European Union (EU) remains at the forefront of sustainable finance policy developments with the bloc’s Green Deal while the United States has seemingly reengaged with climate and sustainable development on the international stage since the appointment of President Joe Biden.

Policy developments in world’s largest economies supporting development of sustainable finance markets. Source: Moody’s Investors Service

Social and gender-related issuance on the up

The volume of social bonds remains steady with issuers using them to help finance their response to the coronavirus pandemic. While this is expected to slow later in year, social bonds will “remain a fixture of the sustainable finance space over the long terms as governments and companies increasingly focus on a broader array of social issues,” according to Moody’s analysis.

Social bonds will remain a fixture of the sustainable finance space over the long term as governments and companies increasingly focus on a broader array of social issues, according to Moody’s Investors Service, 10 May 2021.

Global bond and loan issuance linked to the economic development of women or addressing female underepresentation in board rooms and corporate suites, exceeds US$9 billion and continues to grow.

At least 23 sustainable bonds linked specifically to female economic representation and gender equality targets have been issued since 2017. While they target a range of initiatives, gender bonds are mostly focused on increasing the level of female economic participation and equitable pay in the workforce, both aspects where Covid-19 has dealt a major blow.

Guarding against greenwashing

Some investors have raised concerns about how the proceeds from some sustainable bonds are being spent. Efforts to guard against greenwashing vary considerably across markets although efforts are being made to iron-out patchy information regulating sustainable financing.

The EU, at the forefront of sustainable finance policy, has been working on improving regulatory oversight over green finance through the development of a taxonomy regulation to help clarify what should be considered “green”. The bloc’s taxonomy regulations came into force in July 2020, taking effect in phases from January 2022. In March, the Sustainable Finance Disclosure Requirement (SFDR) went into effect, putting a squeeze on asset managers operating in the EU to disclose how sustainable financial products really are.

China too is developing a taxonomy in collaboration with the EU to reduce fragmentation in sustainable finance practices across the two regions.

Southeast Asia is establishing a green finance rulebook to bring greater accountability to sustainable investments with a progress report expected later this year. But progress to bring better transparency to sustainable finance in ASEAN is too slow, experts said during the CNA Leadership summit in April.

Efforts are being spearheaded by Singapore but it will be challenging to produce a framework that can accommodate regional disparities in economic growth and for countries in different phases of transitioning away from fossil-fuels. However, without attempts to align standards with the world’s economic heavyweights and form a common language, the development of sustainable finance is likely to lag.