Fewer than 100 firms across five Southeast Asian countries have tapped into sustainable financing over the past five years, according to a new report by the World Bank, with small and medium-sized enterprises almost completely left out of sustainable debt markets.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

Only 83 companies from more than 10,000 firms across Indonesia, Malaysia, Philippines, Thailand and Vietnam (Asean-5) have obtained financing via sustainable financial instruments since 2017, said Dr Tatiana Didier, senior economist at the World Bank and co-author of the report Unleashing Sustainable Finance in Southeast Asia.

Most of these were financial institutions or public-listed companies with investment grades.

“There is a huge financing gap for small and medium enterprises, both the bigger medium-sized companies and those at the smaller end of the spectrum,” said Didier at the report’s launch in Kuala Lumpur on Tuesday.

The report also revealed that only a very small, select set of firms in these countries have raised funds via debt markets, whether through green bonds or syndicated loans. Of a total 51 firms which have issued sustainable bonds and syndicated loans in the Asean-5, only 31 were non-financial institutions.

Comparatively, sustainable private equity markets have financed smaller and younger firms, but their total value remains small at US$265 million over the past five years. This is less than 5 per cent of the amount raised in sustainable debt markets.

The three critical gaps that prevented sustainable financing from flowing to more companies were a lack of high quality and widely available climate-related data, limited expertise in assessing sustainable investments, and limited investment opportunities in sustainable projects and activities, Didier said.

On top of that, the World Bank found that firms and investors often prioritised financial performance over sustainability. “Rather than being seen a potential direct revenue stream, climate mitigation and adaptation measures are viewed as avoiding potential disasters or as corporate social responsibility efforts,” said Didier.

A key barrier to the growth of sustainable finance is a lack of incentives in order to enable the takeoff of bankable projects, said Dr Ma Jun, president of the Beijing Institute of Finance and Sustainability, which co-authored the report with the World Bank. In China, incentives have taken the form of lower borrowing rates for sustainable projects announced by the People’s Bank of China in 2021, as well as “demonstration projects” that are focused on encouraging sector-specific decarbonisation.

“For example, I am currently in Fuzhou [the capital of southeastern China’s Fujian province] where the local government is organising demonstration projects for transition in the petrochemical, textiles and cement sectors,” Ma said, while joining in virtually for a panel discussion at the report launch. He added that such projects, if successful, can substantially reduce the perceived risk for other companies in a particular sector.

For each sector, a company usually takes the lead in developing and getting financing for a transition plan, he added.

Incentives in the Asean-5 countries must also come from the top echelon of financial institutions and company boards, said Didier. These should also be factored into the long-term strategies of the firms.

Among the recommendations listed by the report are that policymakers work to mitigate the high risk often associated with sustainability investments, offer an enabling environment for financial market development, and close data gaps by enhancing information systems.

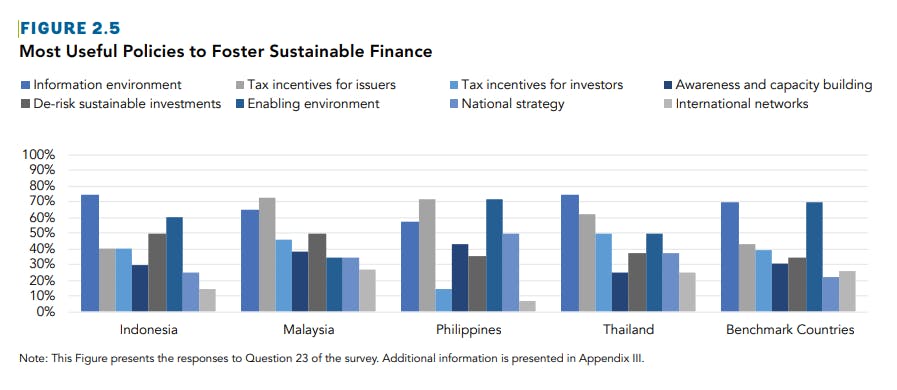

Indonesia, Malaysia, Philippines, Vietnam and Thailand will benefit most from a different mix of policies to foster sustainable finance, according to the World Bank. Image: Unleashing Sustainable Finance in Southeast Asia report/World Bank

What is immediately important for governments and financial institutions to address is, however the implementation of sustainable financing policies, which will look different depending on the country, Didier told Eco-Business on the sidelines of the event.

“A lot of the building blocks are in place in the countries in the region, but implementation is just starting. It might not be easy, but if that can be sped up, that would be a low-hanging fruit to some extent,” she said.