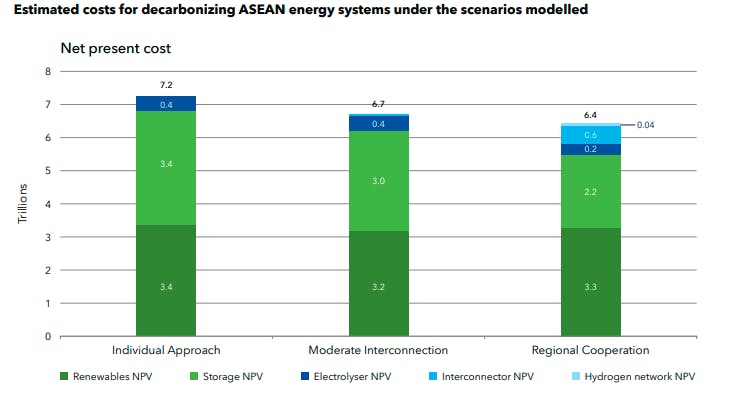

Countries in Southeast Asia could save up to US$800 billion from their collective decarbonisation costs if they fully collaborate on building a regional power grid, including hydrogen pipelines, according to new research by energy expert and assurance provider DNV.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

The report, published on Tuesday, found that “unconstrained sharing of resources” between Asean countries through power grid interconnectors and hydrogen networks would lower the cost of decarbonisation by approximately 11 per cent compared to a scenario in which countries tried to fully decarbonise using only their own resources.

A fully interconnected grid would require an additional 3.75 million kilometres of additional electrical infrastructure, but reduce the need for up to 600 gigawatts (GW) of installed solar capacity and 1.2 terawatt-hours (TWh) of electrical storage, said DNV. It would also lead to a 13 per cent reduction in the spatial footprint needed for Asean’s energy transition, their research found.

However, the decades-old plan by Asean members to establish an Asean power grid “has not been progressing as intended, said DNV. Although 30 GW of regional interconnection capacity was identified in 2010, less than 8 GW of interconnections have been developed among Cambodia, Laos, Malaysia, Singapore, Thailand and Vietnam, the report said.

“This regional grid could be used to support decarbonisation efforts by transporting clean energy from countries with excess renewable power to countries with shortages. However, most decarbonisation efforts to date remain confined to individual nations,” said the report. DNV identified uncoordinated and lengthy regulatory processes between different countries as among the barriers that have impeded collaboration so far.

So far, interconnectors in the region have been limited to bilateral power agreements in which energy often only flows in one direction, said the report. “Full multilateral, multidirectional power trade … could allow a better distribution of renewable resources across countries: increase access to, and the diversity of, renewable electricity; and reduce electricity prices across the region, but implementation has remained limited.”

Asean can reduce its decarbonisaton costs by full regional cooperation on energy systems versus an individual-country approach, a new study by independent energy expert and assurance provider showed. Image: Asean Interconnector Study/ DNV

The report highlighted that progress towards full integration has largely been made via the Laos-Thailand-Malaysia-Singapore Power Interconnection Project (LTMS-PIP), which involves the export of hydropower from Laos to Singapore by via transmission lines to existing cross-border interconnectors in Thailand and Malaysia. While limited to 100 MW for now with plans to expand capacity to 300 MW, the initiative provides an “encouraging sign” for the development of multilateral energy trade in Asean, said DNV.

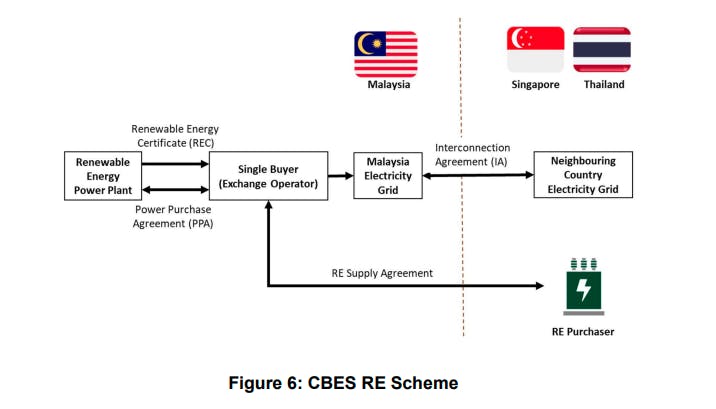

In a parallel development, Malaysia on Monday announced the launch of a cross-border energy exchange platform which will facilitate the export of renewable energy from the country. This comes a year after the country lifted its ban on renewable energy exports.

Dubbed the Energy Exchange Malaysia (Enegem), the platform will rely on its existing interconnections with neighbouring Singapore and Thailand, according to the Malaysian Energy Commission’s (EC) updated guide on cross-border electricity sales. Green electricity sold through the exchange will involve the physical delivery of electricity and the associated Renewable Energy Certificates (RECs), which verify the purchase of renewables.

Enegem’s inaugural auction will facilitate the sale of 100 megawatts (MW) of renewable energy to Singapore, said Malaysia’s Ministry of Energy Transition and Water Transformation (Petra). The platform will then utilise up to 300 MW of the existing interconnection between Peninsular Malaysia and Singapore, while the sale of renewable energy to Thailand is “subject to availability”, the EC said.

The platform will be operated by Malaysia’s Single Buyer, currently an independent, “ring-fenced department” within national utilities company Tenaga Nasional. Single Buyer will buy renewable energy from solar, hydropower and other clean energy producers in Malaysia via power purchase agreements, then enter supply agreements with power purchasers in neighbouring countries. The Single Buyer “will also serve as the verifier of green attributes and the issuer of RECs associated with cross-border electricity trading,” the EC said.

Malaysia’s cross-border energy exchange will be operated by the country’s Single Buyer, which will enter into power purchase agreements with Malaysian renewable energy producers and sell the energy to buyers in neighbouring countries via supply agreements. Image: Guide for Cross-Border Electricity Sales/ Energy Commmission

“Renewable energy export is potentially a new revenue source and capacity growth driver for Malaysia’s renewable energy industry, currently reliant on domestic large scale solar (LSS) and corporate green power programme (CGPP) schemes,” said Maybank analyst Nur Farah Syifaa in a research note to clients on Tuesday.

Both the LSS and CGPP schemes are bidding programmes for renewable energy production and purchase, based on quotas allocated by the EC. The fifth phase of the LSS scheme was announced earlier this month for a quota of 2 GW, while the CGPP, which enables companies to enter power purchase agreements with solar power producers, has an allocation quota of 800 MW.

Nur Farah pointed out that the existing Plentong-Woodlands Interconnector between Malaysia and Singapore can currently facilitate 1 GW of electricity flow. Singapore aims to import 4 GW of low-carbon electricity by 2035, or 30 per cent of its electricity supply.

To expedite the integration of Asean’s cross-border power grids, DNV recommended that member countries work to establish regional institutions with clear responsibilities. “Although regional institutions and working groups have already been established, such as the Asean Energy Centre and Heads of Asean Power Utilities/Authorities organisation, there is still a lack of clear functionalities and responsibilities,” the report said. The establishment of a taskforce to speed up regional coordination “should begin immediately”, it added.