The amount of capital the world’s biggest banks provided to oil, gas and coal companies has dropped for the first time since 2016, according to an annual study by non-profit groups.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

Some US$673 billion was provided to fossil fuel majors in the form of loans and underwriting for bonds and equities in 2022 from the world’s top 60 banks, down from US$801 billion in 2021, the study titled Banking on Climate Chaos found.

There were significant declines in financing for coal power, with Chinese banks now providing 97 per cent of funding for the world’s top 30 coal companies as banks from other countries back away from the most climate-harming of fossil fuels, according to the study.

One fossil fuel type that received more financing in 2022 was liquified natural gas (LNG), which countries and companies have been trying hard to position as a low-carbon transition fuel.

Last year’s overall decline in dirty energy financing can be explained by record energy major profits in the wake of the Ukraine invasion, rather than banks living up to climate pledges by excluding fossil fuels from their lending portfolios, the report’s authors suggested.

The report also noted that the biggest energy firms do not need to rely on debt markets to raise capital because they generate such large profits.

The fossil fuel industry made US$4 trillion in profits in 2022, up from a yearly average of US$1.5 trillion. Oil majors that saw record profits and did not rely on any financing last year included US-based Exxon Mobil and European firms Shell and Equinor.

“

Even as fossil fuel companies made US$4 trillion in profits in 2022, banks still provided US$673 billion in financing.

Banking on Climate Chaos report

“Since most bank policies do not exclude financing for fossil fuel companies, there is no reason to think that 2022 is anything but a temporary outlier in the trajectory of fossil fuel finance,” the report said.

The study, which was conducted by NGOs including Rainforest Action Network, Indigenous Environmental Network, BankTrack and Urgewald, has been running since 2016, the year after the Paris Agreement was signed to limit planetary heating to 1.5 degrees. That year, banks lent US$738 billion to fossil fuel firms despite a flurry of commitments to rein in financed emissions.

The lending dip in 2022 could be the “calm before the storm” as fossil fuel firms set themselves up for a borrowing spree to fuel expansion, the report suggested. According to analysis by Oil Change International, a non-profit, the oil and gas industry had drilling plans approved in 2022 for the next few years that could exhaust 17 per cent of the global carbon budget for meeting the climate-critical 1.5 degree target.

Climate-wrecking capital

Of the 60 banks in the study, 16 increased fossil fuel lending in 2022, with six of those firms based in Asia Pacific. Among them were Industrial and Commercial Bank of China (ICBC) (24 per cent increase year-on-year), Japan’s Sumitomo Mitsui Banking Corporation Group (SMBC) (4 per cent) and South Korea’s KB Financial Group (12 per cent).

Four of the top 12 fossil fuel lenders globally in 2022 were from Asia Pacific, including Japanese mega-banks Mitsubishi UFJ Financial Group (US$29.5 billion), Mizuho (US$28.8 billion) and SMBC (US$22.5 billion) and China’s ICBC (US$21.6 billion).

Chinese banks dominated coal power, coal mining and Arctic oil and gas lending in 2022, while Japan’s MUFG was the world’s biggest natural gas lender last year.

Twenty-eight per cent of the biggest dirty energy lenders are United States based, down from 33 per cent in 2021.

The world’s biggest fossil fuel financier in 2022 was Toronto-headquartered Royal Bank of Canada (RBC), unseating North American rival JPMorgan Chase as the biggest climate-wrecking bank for the first time since 2019.

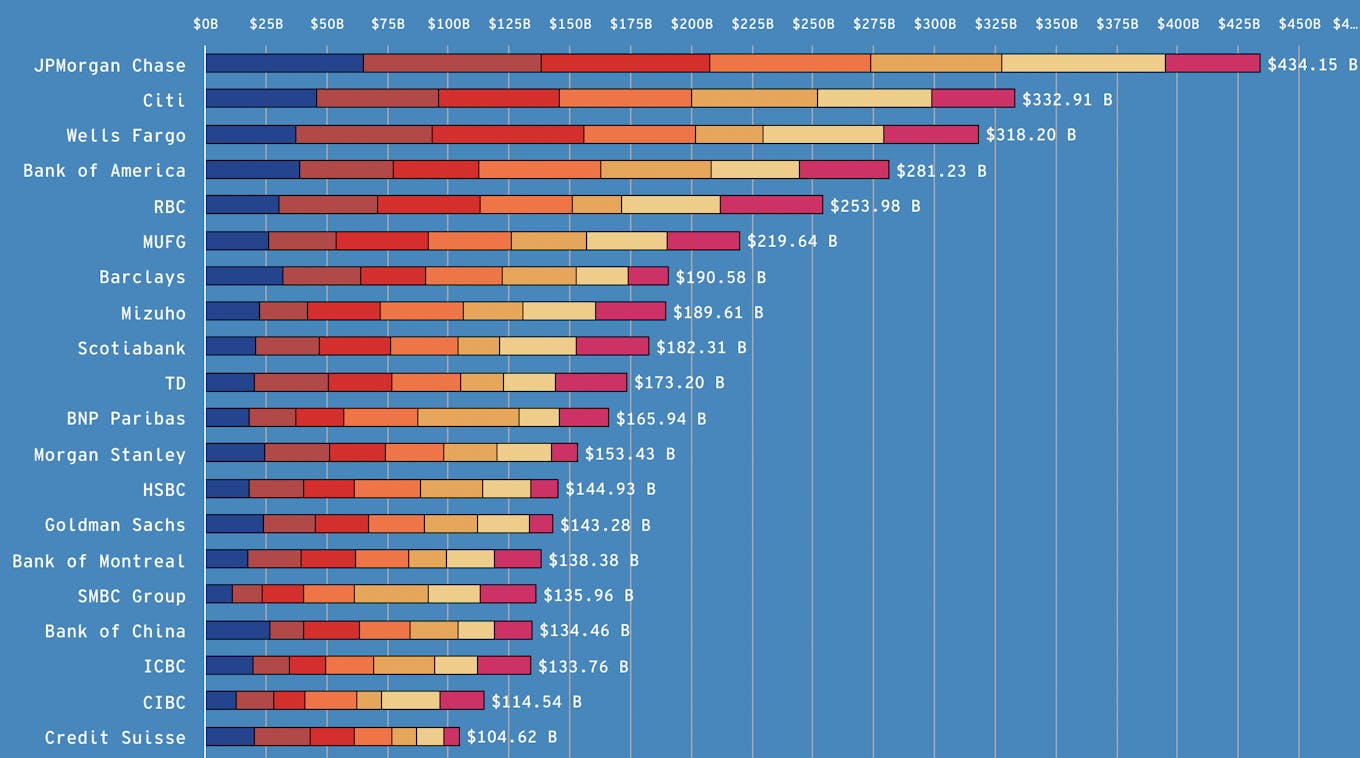

JPMorgan, which a few years ago set a target for achieving net-zero emissions by 2050, is the largest financier of fossil fuels since the Paris Agreement, pumping US$434 billion – more than the annual GDP of Singapore – into dirty energy development over the past six years.

The top 20 lenders to fossil fuel companies since 2016, the year after the Paris Agreement was signed. Asia’s top fossil fuel lender is Japanese bank MUFG, which has a net zero target for financed emissions of 2050. Source: Banking on Climate Chaos

Loopholed exclusion policies

Exclusion policies are crucial for de-funding fossil fuel expansion, a trend that has percolated through the finance sector since the signing of the Paris Agreement.

However, the report revealed that despite 49 of the 60 banks profiled having made net-zero commitments, most of these targets are undermined by weak or loopholed policies for excluding finance for fossil fuel expansion.

Despite having net-zero targets, these 49 banks provided 81 per cent of the financing for the top 100 fossil fuel expanders in 2022, which include Calgary-headquartered TC Energy, French oil major TotalEnergies, Texas-based crude producer ConocoPhillips and Middle Eastern giant Saudi Aramco.

In March, ConocoPhillips was greenlit to drill in the Alaskan Arctic with financial support from banks that had fossil fuel exclusion policies in place, including Bank of America, Citi, Credit Suisse, HSBC, JPMorgan Chase, Mizuho and MUFG.

ConocoPhillips was able to secure financing by declaring that it was for general corporate purposes rather than for a specific project.

Banks from Asia Pacific have the weakest policies for excluding fossil fuels clients. While 40 of the 60 banks studied have some restrictions on oil and gas lending, none are in Asia.

Thirteen of the banks studied with no credible fossil fuel exclusion policy are Asia-based – 12 are Chinese, including China CITIC Bank, China Construction Bank and China Everbright Bank, and one Indian, the State Bank of India.

In 2021, the International Energy Agency warned that if the planet was to avoid the worst consequences of climate change and cap global warming to 1.5 degrees by reaching net-zero by 2050, there could be no further expansion of the fossil fuels industry.