When China’s national carbon market is launched later this year it will be the world’s second-largest carbon market, after the European emissions trading scheme (ETS), which it will eventually overtake.

In sharp contrast, the absence of an explicit carbon price in Australia and persistent turbulence and confusion around domestic energy policy are hindering investment in renewable energy, leaving Australia lagging behind global trends in cutting emissions.

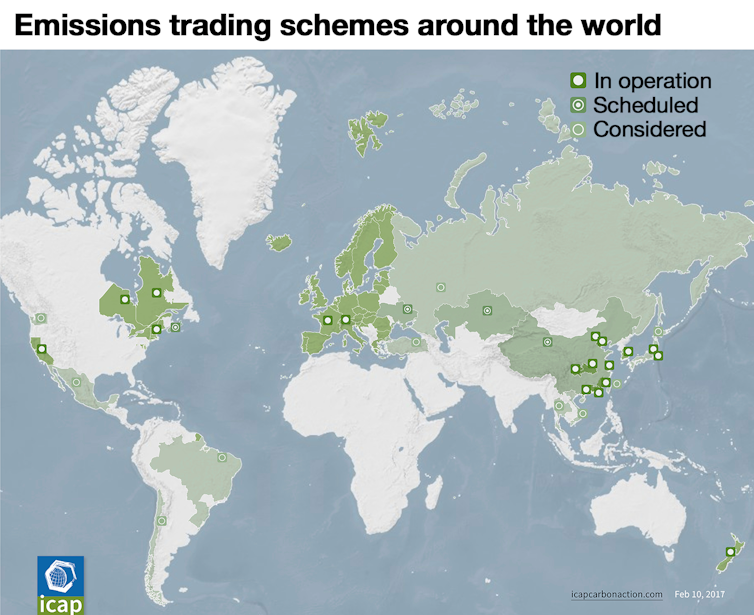

China will add to the cluster of national and sub-national emissions trading schemes that now exist in the European Union, Canada, the United States, Japan, South Korea and New Zealand.

As the World Bank Group’s 2016 report on the state and trends in carbon pricing indicated, up to a quarter of global emissions will then be covered by carbon pricing initiatives across some 40 national jurisdictions and 20 cities, states and regions. The evolution of regional carbon markets fostered by the Paris Agreement, in North Asia and elsewhere, will economically advantage those able to participate.

For a brief time Australia flirted with being a global leader in carbon pricing and emissions trading. The Howard Government debated—and rejected—a national carbon price in 1994. In 2009 Labor proposed laws to establish a national emissions trading scheme, the Carbon Pollution Reduction Scheme, which then failed in the Senate.

Instead, Australia became the first country in the world to dismantle a national carbon price, when Tony Abbott axed Gillard Labor’s carbon tax. Now Australia is in danger of becoming an outlier globally—and this will have significant economic costs as well as environmental implications.

China’s climate leadership

When China became the world’s largest national greenhouse gas emitter in 2006, its involvement in any effective global emissions reduction agreement became an unavoidable responsibility.

China first acknowledged this internationally in 2009 when, at the climate negotiations in Copenhagen, it announced voluntary measures to improve national energy efficiency, pledging to cut its carbon dioxide emissions per unit of GDP by 40 to 45 per cent below 2005 levels by 2020.

In 2014, China and the United States jointly announced their national targets and goals as a means of providing momentum for the following year’s Paris summit. China committed to an energy intensity target for 2030, lowering carbon dioxide emissions per unit of GDP by 60 to 65 per cent below 2005 levels, and also to peak its emissions before 2030.

Indeed it appears already to have achieved this goal as a result of industrial modernisation and slowing economic growth, along with a push to reduce its reliance on coal and its global leadership in building renewable energy capacity (specifically, solar and wind).

Then, a decade after the launch of the European ETS, during a second joint announcement with the United States in September 2015, President Xi Jinping declared that China would establish a national carbon market by 2017.

China’s national ETS

Seven pilot emissions trading schemes have operated in China since 2013. These subnational projects—in five cities and two provinces, including Beijing, Chonqing, Guandong, Hubei, Shanghai, Shenzen and Tianjin—together already cover some 26.7 per cent of China’s GDP in 2014.

They have employed slightly different market designs, varying the range of greenhouse gases and industry sectors covered, slightly different approaches to permit allocation, verification and compliance, and produced seven different carbon prices, at times ranging from some A$2.50 to up to A$22 per tonne.

The new national market represents a further step in the process of policy learning and systematic development, based on these experimental steps as well as the experience of the European ETS, which has evolved in several phases since 2005.

During its trial phase, from 2017 to 2019, policymakers will work to help new participants become familiar with the new national market and to improve its design. The market initially will be restricted in scope and size. It first will only include carbon dioxide and, like its pilots, its initial carbon price likely will be modest.

Guidelines from the National Development and Reform Commission indicate it will cover eight major industry sectors, such as power generation, petrochemicals, construction materials, pulp and paper, aviation, and iron, steel and aluminium production.

Nevertheless it is expected to cover some 40 to 50 per cent of total Chinese emissions and eventually become a significant contributor to the suite of measures now being used to tackle Chinese emissions. Full implementation is expected to occur from 2020 onwards—with greater industry coverage, an increased percentage of allowances allocated by auction, and improved benchmarking.

A new measure among many

The new national carbon market is an additional response to the pressures that have driven Chinese climate and energy policy reforms over the past decade.

Domestically, a complex basket of tools are already in use to increase energy efficiency and reduce emissions. Coal-fired power generation has faced increasingly stringent regulation and new investment to counter dangerously high levels of air pollution in major cities, growing health problems and associated social unrest.

China’s heavy industries—economically sluggish, energy-inefficient and emissions-intensive—are under intensifying regulatory and now market pressure to modernise rapidly. While the carbon prices under the sub-national pilots have remained modest, they have added to this pressure for technological and economic reform.

National energy security is a strategic concern given China’s economic reliance on energy imports. The threats from global warming to China’s food and water security are recognised as concerns at the highest levels of government, including through the 13th Five-Year Plan.

China’s climate and energy policies also offer China an opportunity to demonstrate global leadership in climate policy, with the election of US President Donald Trump creating new diplomatic possibilities, a point emphasised in President Xi Jinping’s opening speech to the 19th Communist Party Congress, where he noted that China had taken a “driving seat in international cooperation to respond to climate change”.

Implications for Australia

A successful Chinese national emissions scheme has a range of impacts for Australia.

About a quarter of Australia’s coal exports (by volume) currently go to China, which in 2016 was Australia’s second biggest market for thermal coal and third biggest market for metallurgical coal.

“

The turbulent unpredictability of Australia’s climate politics and policies stands in contrast to China’s steady institutional commitment to accelerating decarbonisation.

If a national carbon market accelerates improvements in energy efficiency in China’s metals and power generation sectors, its demand for Australian coal exports—already beginning to contract—is likely to fall faster.

Second, for a quarter of a century, a succession of conservative Australian Prime Ministers justified the absence of a meaningful Australian climate policy by claiming there was no point in reducing emissions here because China wasn’t doing enough to tackle the problem.

Based on misrepresentations of what was happening in China, the Howard government delayed and then the Abbott government destroyed an Australian carbon pricing mechanism. Both leaders consistently stalled Australian climate policy, and continued to spruik the mirage of a national energy future based on exporting coal to ever larger overseas markets, including in China.

![]() In all, the turbulent unpredictability of Australia’s climate politics and policies stands in contrast to China’s steady institutional commitment to accelerating decarbonisation. Given its present weak climate policy settings and institutions, and without a clear target for renewables, Australia will struggle to meet its current emission reduction commitments and will face increased future costs for failing to act sooner.

In all, the turbulent unpredictability of Australia’s climate politics and policies stands in contrast to China’s steady institutional commitment to accelerating decarbonisation. Given its present weak climate policy settings and institutions, and without a clear target for renewables, Australia will struggle to meet its current emission reduction commitments and will face increased future costs for failing to act sooner.

Peter Christoff is Associate Professor, School of Geography at the University of Melbourne. This article was originally published on The Conversation.