That’s according to the first World Energy Investment report, published by the International Energy Agency (IEA). While fossil fuels still dominate energy supplies, the IEA says changing investment flows point towards a “reorientation of the energy system”.

Carbon Brief has seven charts showing why the IEA thinks an energy shift is underway.

Energy investment

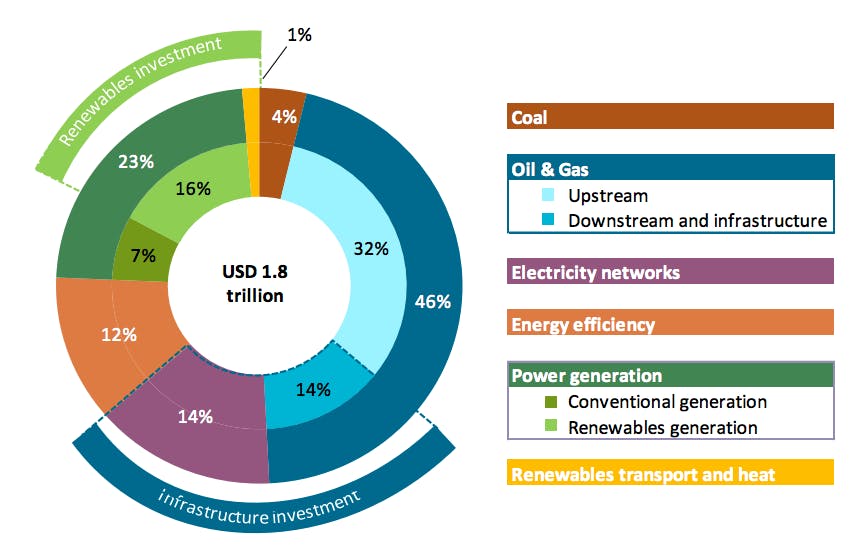

World energy investment amounted to $1.8tn in 2015, the IEA says, equivalent to 2.4 per cent of global GDP. Around half went towards fossil fuel extraction and distribution, mainly for oil and gas.

Renewables accounted for 17 per cent of the total, around $300bn. The vast majority of this was in the electricity sector, where nearly 70 per cent of investment in power stations went towards renewables.

Global energy investment in 2015, by sector. Source: World Energy Investment 2016, IEA.

Oil slide

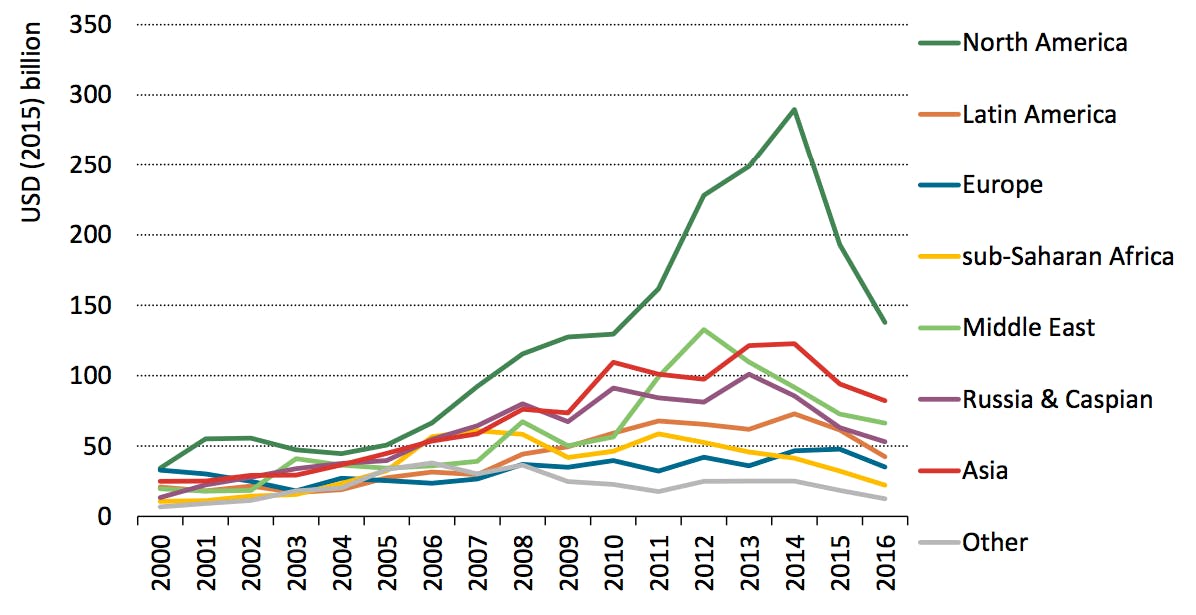

Investment in energy was down 8 per cent year-on-year in 2015 (around $150bn), largely because of falling investment in oil and gas. Soft demand and Saudi Arabia’s determination to squeeze competitors has created a prolonged period of cheap oil that has decimated incomes.

Reductions have been particularly steep in North America, the IEA says, with investment halving in the past two years. The smaller companies that dominate the US shale industry have been particularly hard-hit by the falling oil price, with scores of firms filing for bankruptcy.

Upstream oil and gas investment in 2015, by region. Source: World Energy Investment 2016, IEA.

Falling costs

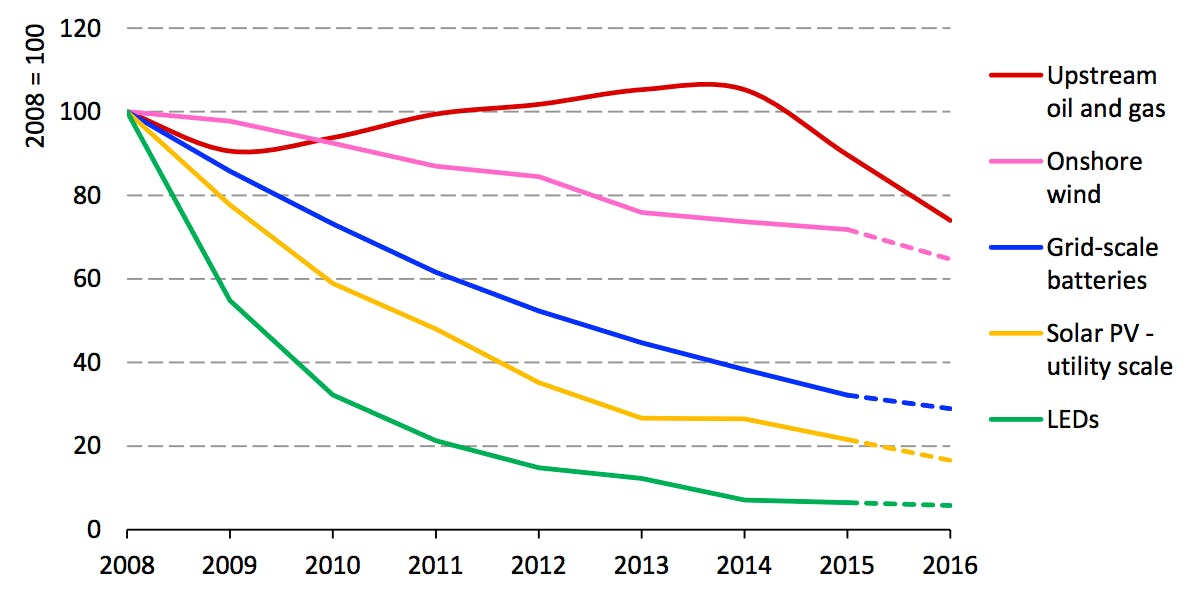

The Saudi strategy has only been partially successful. Some two-thirds of the fall in oil and gas investment has been absorbed by cost reductions, particularly in the shale sector. Upstream oil and gas costs fell 15 per cent in 2015, the IEA says.

These recent oil and gas cost reductions have been easily outpaced by those for new energy technologies. Costs for onshore wind are down by nearly 40 per cent since 2008, solar by more than 80 per cent, LEDs more than 90 per cent and grid-scale batteries by 70 per cent.

The IEA says renewable costs will continue to fall, while the reverse will be true for oil and gas: IEA medium-term analyses foresee lower costs in renewables, lighting and electricity storage and eventually modest cost increases in upstream oil and gas.”

Energy cost developments 2008-2015, by technology. Source: World Energy Investment 2016, IEA.

Power shift

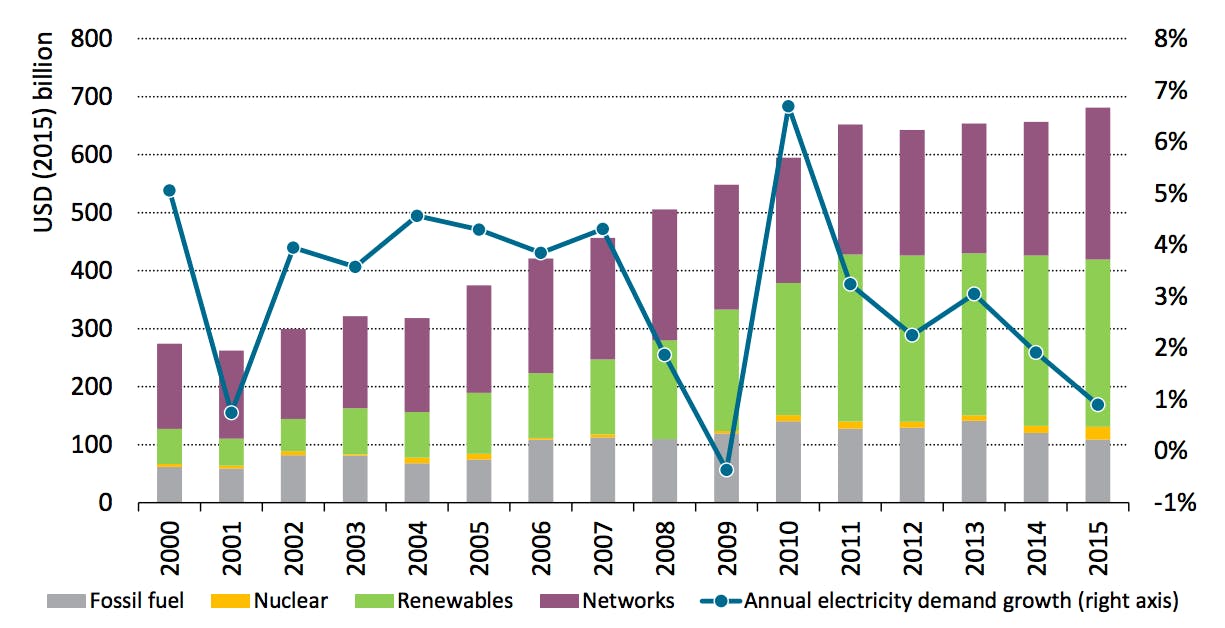

The large clean energy cost reductions are behind a continuing shift in the power sector, where 70 per cent of investment in generating assets goes to renewables and fossil fuel investment is in decline.

Renewable power investment held steady at around $290bn in 2015, the IEA says, yet cost reductions mean more capacity could be bought for the money. Solar investment was lower than 2011 in dollar terms, but 60 per cent more capacity was added.

Last year, rising renewable additions combined with weakening power demand growth in a landmark way. The IEA says: “For the first time, investment in renewables-based capacity generates enough power to cover global electricity demand growth in 2015.”

New renewables commissioned in 2015 have the capacity to generate 350 terawatt hours (TWh), against an increase in demand of less than 250TWh. This means all other capacity brought online in 2015 was effectively surplus to requirements.

(It’s worth adding a couple of qualifiers: first, 40 per cent of investment was to replace ageing assets; second, renewables often generate power intermittently rather than on demand).

Net of retirements, nuclear also expanded last year, adding the capacity to generate an extra 50TWh. In total, new plant added in 2015 has the capacity to generate 1,000TWh of electricity a year, more than four times the increase in demand.

Global investment in power generation and electricity networks (coloured bars, left axis) and electricity demand growth (line, right axis). Source: World Energy Investment 2016, IEA.

Investment in electricity networks is increasing, reaching $260bn last year. This is partly down to the need to incorporate renewables. However, the IEA says around 90 per cent is being driven by the need to expand electricity access and replace old kit.

The network investment figures includes grid-scale batteries. Spending here has risen ten-fold since 2010, the IEA says, though it still amounts to less than 1 per cent of the network total.

Investment map

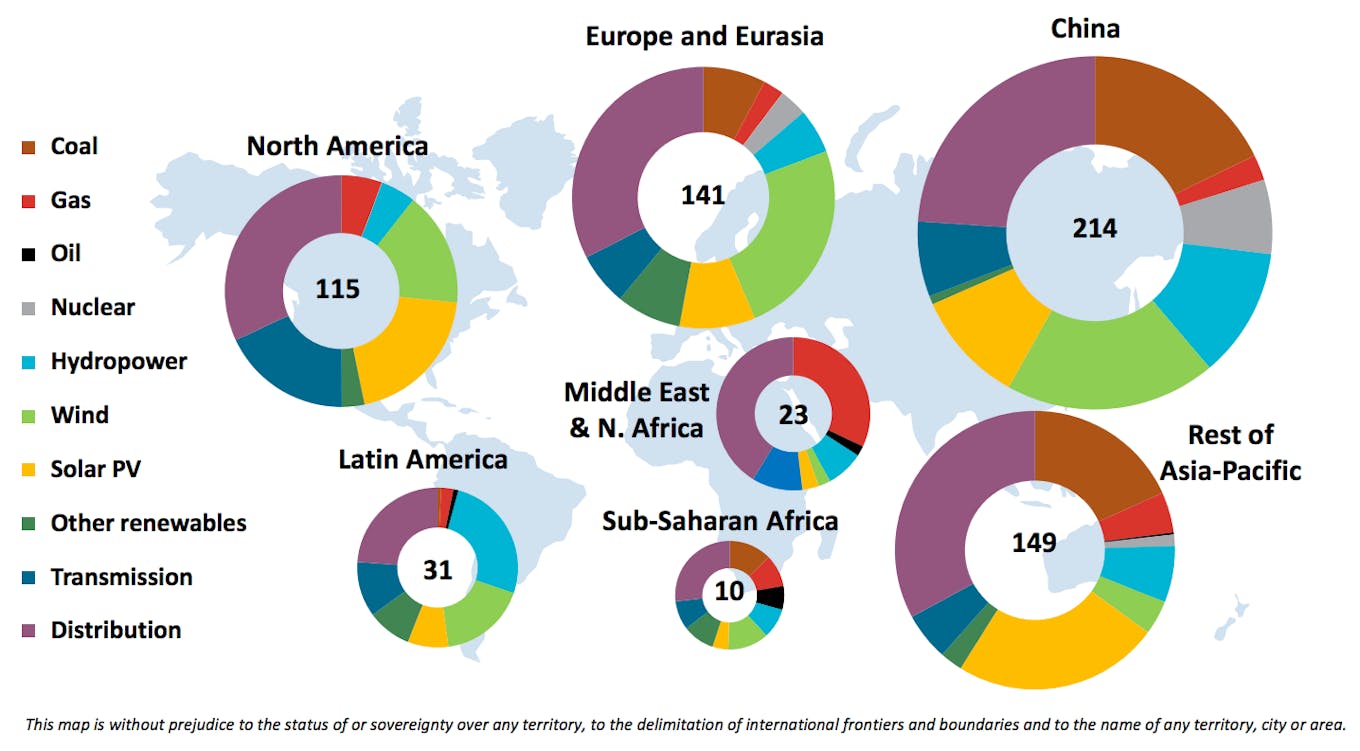

Power sector investments were disproportionately concentrated in China and other Asian countries. The split was particularly stark for new coal-fired generation, where more than 80 per cent of investment was in Asia.

This trend is likely to continue. The IEA says around half of under-construction coal capacity is in China, which added more than 50 gigawatts (GW) of coal plant in 2015.

Investment in electricity generation and networks by region and type, 2015. Source: World Energy Investment 2016, IEA.

China stranding

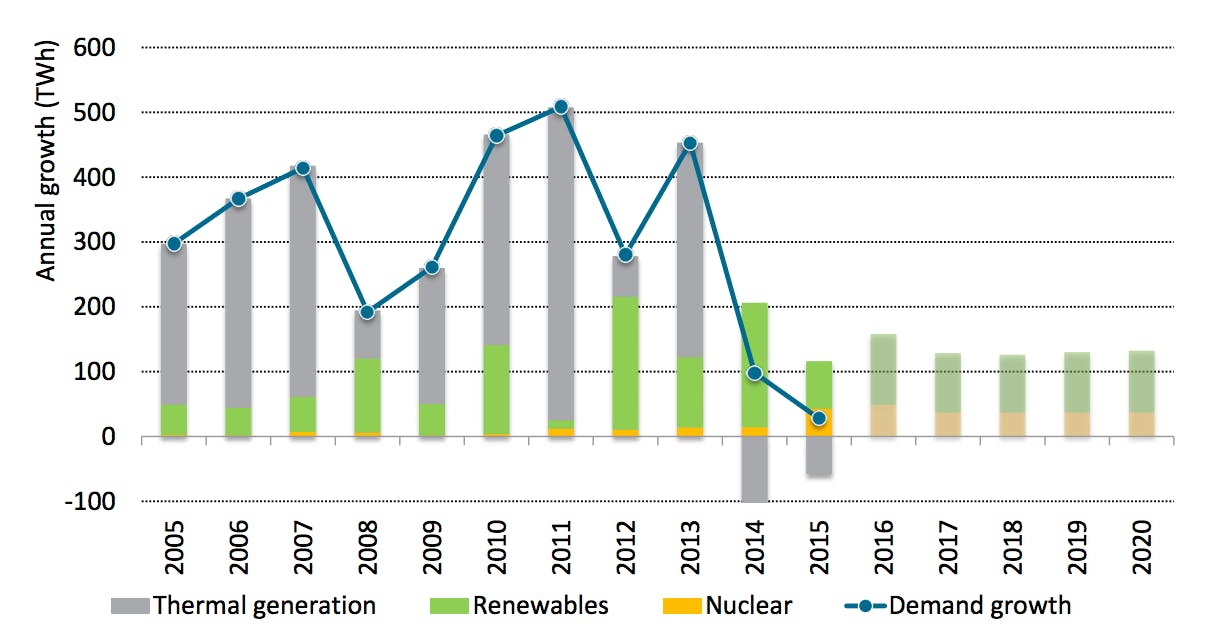

The IEA, in comments that echo recent Greenpeace analysis, says that much of this surge in Chinese coal capacity is unnecessary. It says: “China has overinvested in new fossil fuel capacity…low-carbon sources are expected to be able to cover annual demand growth…through 2020, leaving little scope for an expansion in fossil fuel generation.”

It illustrates the problem with the chart below, which shows falling demand growth being more than covered by consistent expansion of nuclear and renewables.

China’s power generation growth (bars) and demand growth (line). Source: World Energy Investment 2016, IEA.

Fossil overinvestment in China, and elsewhere, will lead to stranded assets that become redundant before they have repaid the money spent to build them, the IEA says. It calls Chinese investments “inconsistent with market fundamentals”.

Climate inconsistent

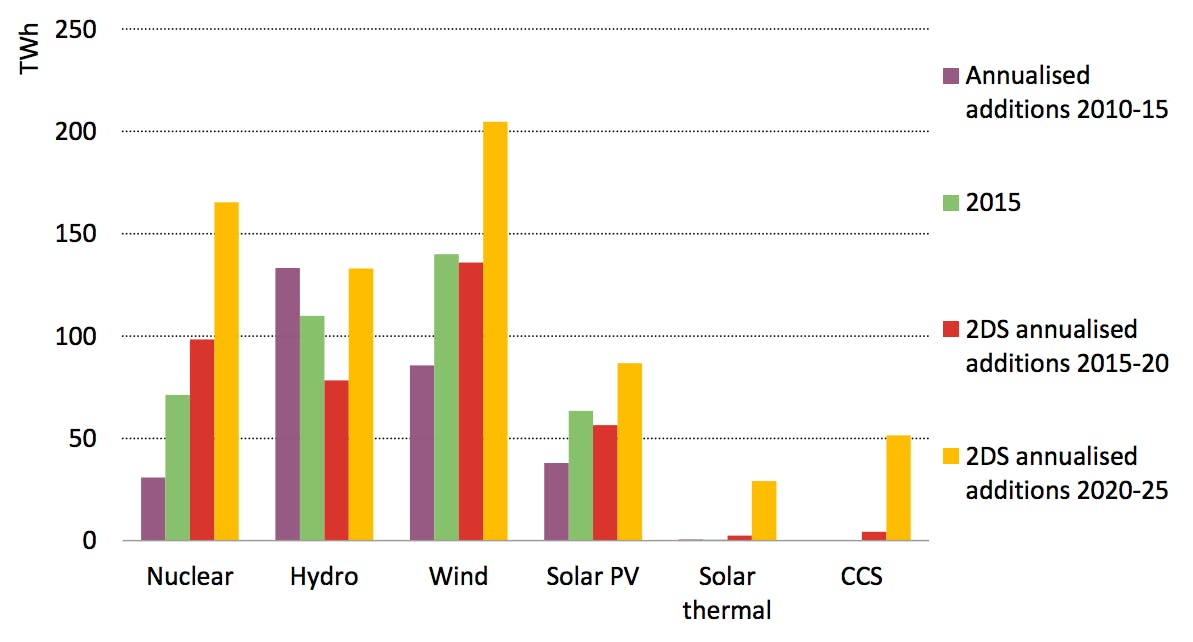

Low-carbon sources of power are on the rise and fossil fuel’s share of the global energy mix is falling. Yet despite identifying a change in direction for energy investment, the IEA says spending on low-carbon will need to increase rapidly over the years ahead if countries of the world are to meet their agreed climate goals.

It concludes: “Globally, energy investment is not yet consistent with the transition to a low-carbon energy system envisaged in the Paris Climate Agreement reached at the end of 2015.”

New low-carbon electricity generation and growth rates in the IEA 2C scenario (2DS). Source: World Energy Investment 2016, IEA.

This story was originally published by Carbon Brief under a Creative Commons’ License and was republished with permission.