The business world has shown steady progress at measuring and disclosing its carbon footprint since the beginning of the decade, but corporate climate impact transparency has started to stagnate, according to a report from asset management firm Arabesque.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

A study of corporate climate disclosure, released on Friday (20 November), found that the proportion of companies disclosing scope 1 and scope 2 emissions — that is, the direct emissions of a company and the indirect emissions from bought electricity, heat or steam — increased from 44 per cent to 68 per cent globally from 2014 to 2019, but the level of reporting plateaued between 2018 and 2019.

“This stagnation in disclosures is a concern both for investors, who are wanting to make better-informed decisions, and for our ability to effectively take action on climate change, as it means that we do not know how much

some companies are really emitting,” the report said.

Arabesque’s report is based on data from 2,034 companies from a range of industries based in Asia, Europe and the United States.

Weaker reporting has been most clearly seen in arguably the most important country for corporate climate action: the United States. American companies have not stopped reporting altogether. Rather, the quality of data they are providing has fallen, making it less useful for investors and other stakeholders to assess their performance.

Poorer American reporting and improved reporting among Asian corporates have meant that Asia has overtaken the US in Arabesque’s assessment of how emissions disclosure compares globally, known as the Arabesque S-Ray Temperature Score. Europe leads the world for emissions reporting, although European companies have shown weaker reporting diligence between 2018 and 2019.

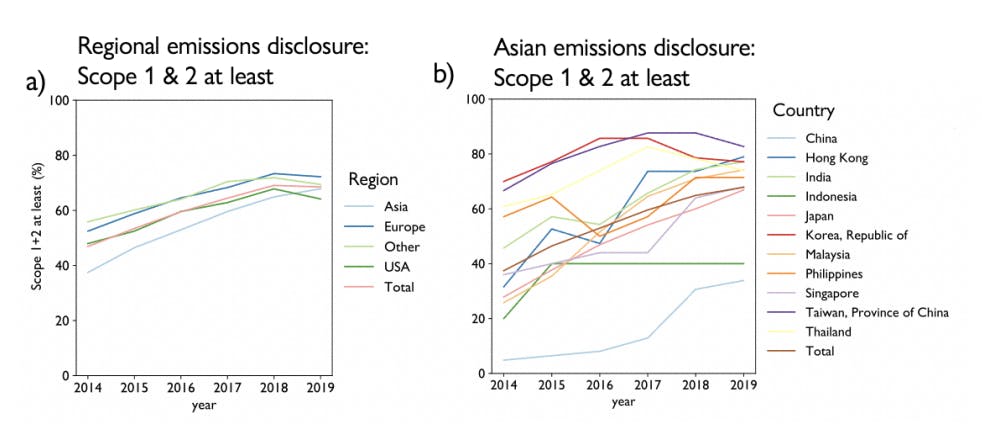

Percentage of companies reporting on at least scope 1 and scope 2 emissions for a) Asia, Europe, US, other regions and globally, b) How Asian countries compare on emissions reporting. Source: Arabesque S-Ray Temperature Score

Asia’s progress on reporting scope 1 and 2 emissions is varied. It is led by companies in Japan, Singapore, Malaysia and India, while it has dipped in Taiwan and Thailand in the last few years, and shown no progress in Indonesia since 2015.

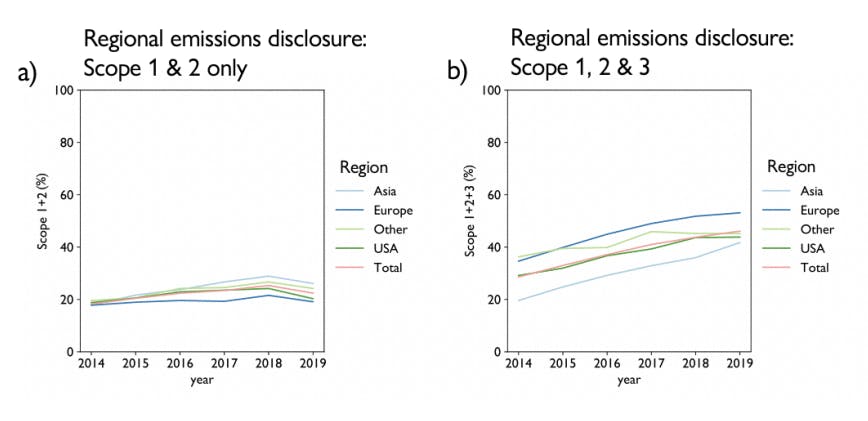

While scope 1 and 2 emissions disclosure may have flattened in the last year, the level of sophistication in reporting is increasing as more companies report their scope 3 emissions — that is, the emissions of the end user, which are the hardest for companies to control. Asia is showing the greatest rate of increase in scope 3 reporting.

Percentage of companies in each region disclosing a) scope 1 and scope 2 emissions only, b) scope 1, 2 and 3 emissions. Source: Arabesque S-Ray Temperature Score

The general increase in emissions reporting indicates that companies are “responding to the increasingly clear and consistent requests for more granular data from investors and other stakeholders”, the study said. However, the report also shows that companies will tend not to report unless they are required to.

An obstacle is the overwhelming choice of reporting frameworks, which could “lead to more data gaps than it fills,” the report said. World Economic Forum released a universal set of metrics to bring “clarity” to sustainability reporting in September that industry watchers complained was yet another framework for companies to contend with.

“They [companies] know that in many cases, their emissions will be estimated based on their peers, and so why use resources and take on any potential risks associated with reporting this data when there is currently little incentive to do so?” the report said.

“Until the risks of not-disclosing outweigh the risks of disclosing, which they are starting to, it will be challenging to push these companies over the transparency line,” it noted.

Beyond 2020, the trends are pointing towards increased disclosure. In Japan, China, Singapore, Malaysia and the Philippines, regulators have moved towards mandatory sustainability reporting, while the European Union is working on a disclosure framework that is aligned with the Paris Agreement goals.

In the US, investors are leading the way towards improved disclosure. In July, 40 investors with nearly $1 trillion in assets wrote to regulators to ask them to integrate climate change into their mandates, including a provision for banks to disclose the emissions of their loans and investments.

Arabesque’s report emerged a fortnight after the US pulled out of the Paris Agreement. Newly elected President Joe Biden has pledged to rejoin the accord. Earlier this month, Biden pledged to ensure publicly traded companies disclose their climate risks and emissions levels.