Asia Pacific’s financial institutions are lagging the West on responsible investing, but this region’s asset managers and owners believe more strongly than anywhere that their funds will be sustainabilty-focused in the near future, driven by increased regulation and a desire for better quality investments.

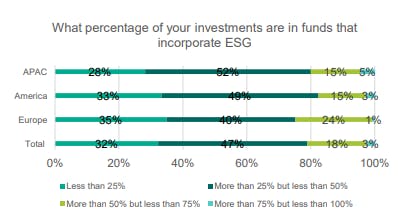

% of investments in ESG funds (click to enlarge). Source: BNP Paribas

These are the key findings from a global study, The ESG Global Survey 2019 released on Thursday, of 347 asset managers and owners in 16 countries in Asia Pacific, Europe and North America by French banking giant BNP Paribas.

Some 20 per cent of Asia Pacific investors say they invest more than half of funds that align with environment, social and governance (ESG) principles. This figure is 25 per cent in Europe and 21 per cent globally.

Asian asset managers are also the most likely to think that the role of ESG is not yet central to their investment strategy, while American and European investors see environmental and social considerations as already pivotal to their decision making.

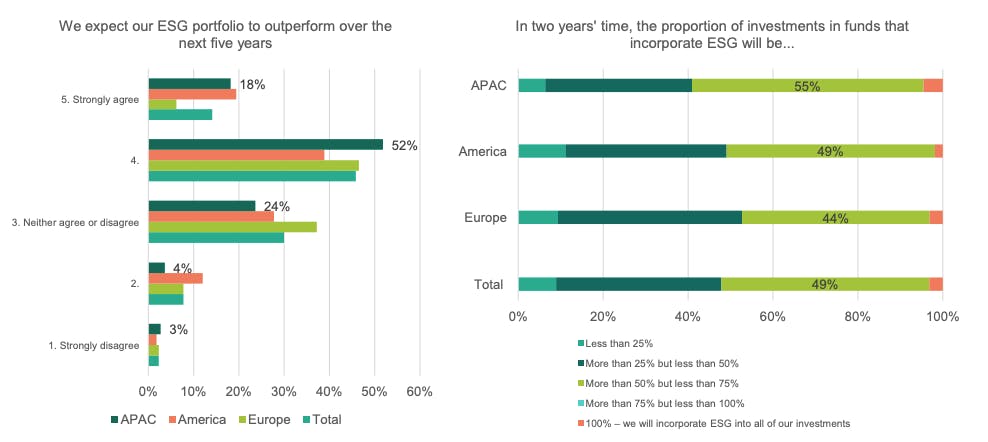

However, more Asian investors than their European or American counterparts think that all investments will be guided by ESG principles over the next two years.

Asian investors are also the most likely to think that their ESG portfolios will outperform non-green assets in five years’ time, and are the most likely to use the United Nations’ Sustainable Development Goals (SDGs) to guide their investments.

“

ESG used to be about managing risk. Now it’s about better quality investments.

Madhu Gayer, investment analytics and sustainability manager, BNP Paribas Securities Services

More Asian investors believe that green investments are the future. Source: BNP Paribas

Madhu Gayer, investment analytics and sustainability manager, BNP Paribas Securities Services, said that the optimism of Asian investors may not come as a surprise as many Asian markets, particularly China, expect to see the introduction of more regulations that will force financiers to disclose the sustainability of their investments.

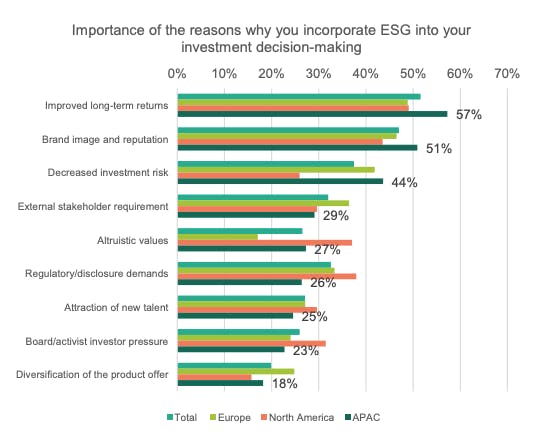

Other key drivers of Asia’s growing belief in the value of ESG investing is that sustainability will lead to better quality investments over the long term and will safeguard the reputation of investors, the study found.

Why investors value sustainability (click to enlarge). Source: BNP Paribas

Asian investors are the least likely to believe that a push for sustainable investing will be driven by activist or board pressure or by a desire to attract new talent.

Gayer said: “In Asia, ESG used to be about managing risk. Now it’s about better quality investments.”

The study emerges the week after a report from the Global Sustainable Investment Alliance (GSIA) found that the global value of sustainable investments had jumped by more than a third in two years, to $30.7 trillion, with Asia—led by Japanese pension funds—driving the bulk of growth, amid rising concern about climate change.

The GSIA report found that negative screening of funds—which weeds out funds linked to controversial sectors such as tobacco and fossil fuels—was the main driver of growth in sustainable investing over the last two years.

But in BNP Paribas’ study, benchmarking the performance of ESG funds versus regular funds was found to have a bigger impact on investors’ decisions.

Barriers to sustainable investing

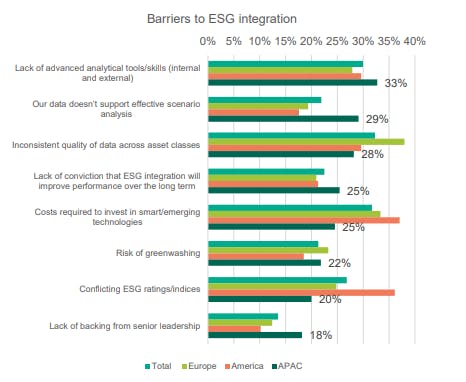

Despite the hopeful outlook for ESG investing, major barriers to adoption remain. The biggest one is data. “Transforming disparate data sets into actionable insights and technology costs are hindering progress,” commented Gayer.

Barriers to ESG integration (click to enlarge). Source: BNP Paribas

A lack of the right tools to analyse ESG data and an inconsistent quality of data were identified as among the major concerns, while analysing social data was found to be the most difficult type of data for investors to manage.

“It used to be that investors would complain that they didn’t have enough [ESG-related] data. Now, there’s too much, and analysing it is becoming more difficult,” said Gayer.

Another major barrier is cost. Nowhere believes more strongly than Asia that regulations around ESG investing will drive up cost.

The ESG talent crunch

The rising tide for ESG investing will mean more asset managers and owners are needed with sustainability skills and experience—and APAC is where this demand is being most keenly felt.

The study revealed that Asian banks have the greatest need to hire ESG specialists, train existing teams on ESG issues, and strengthen sustainability practices, such as reducing the company’s carbon emissions and boosting diversity and inclusion targets.

“Hiring for ESG skills from non-traditional [finance] backgrounds—that’s a gamechanger for our industry,” said Gayer.

“We’ve got people who understand the risks and investments, but they now have to be more cognisant of ESG issues,” he said. “New people will be coming into financial services who don’t speak our jargon. They will come with a [sustainability] jargon of their own.”

“

There is a great deal of lip service being paid to ESG and what financial institutions say they are doing to manage climate risk. But my fear is that it remains largely a marketing exercise.

Jessica Robinson, founder and managing director, Moxie Future

Is change happening fast enough?

What the study does not ask investors is whether they feel that the market is moving fast enough to decarbonise investments as the effects of climate change get more severe.

The survey emerges six months after a report from the Intergovernmental Panel on Climate Change revealed that the world has just over a decade to dramatically reduce carbon emissions or face the most severe effects of a warming world.

Jessica Robinson, founder and managing director of sustainable investment firm Moxie Future, told Eco-Business that financial institutions are “simply not doing enough” to green their investments.

“There is a great deal of lip service being paid to ESG and what financial institutions say they are doing to manage climate risk. But my fear is that it remains largely a marketing exercise,” she said.

“Calls for an urgent overhaul of our financial system are becoming stronger by the day - starting with a rapid decarbonisation of investments by large institutional investors, many of which are public asset owners who are not acting in the best long-term interests of their beneficiaries.”

“This is relevant across the world, but particularly in Asia where the effects of climate change are now undeniable and taking action needs to be happening today, not tomorrow,” she said.