Lockdowns and Covid-19 prevention measures may have done permanent damage to the recycling sector in South and Southeast Asia, a study by circular economy consultancy GA Circular has found.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

The recycling trade in these regions was struggling from poor infrastructure, labour shortages and uncompetitively priced recycled plastic before the pandemic hit, and the virus has exacerbated these issues, in some countries almost wiping out the sector.

Urgent financial and capacity support is needed within the next three to six months to prevent longer term setbacks for the circular economy for plastics and an increase in marine pollution, said authors of the report, which was based on interviews with recyclers, informal collectors, waste management firms and civic society groups in five countries.

Since the outbreak of Covid-19, the volume of waste collected and sorted by the informal sector has fallen by almost two thirds (65 per cent) and demand for recycled plastic has dropped by a half, the study of the recycling sector in India, Indonesia, Vietnam, Thailand and the Philippines found.

Informal waste-pickers account for about 82 per cent of the recycling trade in South Asia and 65 per cent of trade in Southeast Asia, but in many countries waste management has not been considered an essential service, and pandemic mitigation measures have cost millions of waste workers their livelihoods.

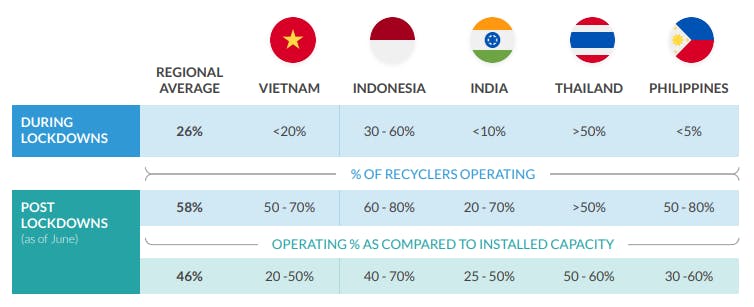

During lockdown periods, more than 80 per cent of the recycling value chain ground to a halt in Vietnam, the Philippines and India, which led to an increase in plastic dumped in landfills and likely more plastics entering the open environment and waterways, according to the study titled Safeguarding the Plastic Recycling Value Chain.

Operational capacity of recyclers in South and Southeast Asia during and post lockdown (click to enlarge). Image: Safeguarding the plastic value chain Insights from COVID-19 impact in South and Southeast Asia

In the most extreme case, the recycling sector in the Philippines was reduced to less then 5 per cent of its normal capacity during lockdown.

In Indonesia, thousands of recycling workers have lost their jobs and face financial ruin. But the study found that Indonesian recyclers have broadly fared better than in other countries in the region, because of lower levels of enforcement of safety restrictions and no nationwide lockdown.

In the weeks after movement restrictions were lifted, recyclers that have reopened have been running at a loss, due to low demand for recycled plastic, low prices and a lack of feedstock. Now, more than 40 per cent of recyclers in South and Southeast Asia face permanent closure or bankruptcy, the study said.

“We are currently operating for the sole purpose of retaining our employees and supporting the infrastructure and value chain which we’ve set up over all these years,” said a recycler in India quoted in the study, which noted that many recycling stakeholders are in ‘survival mode’, hoping that demand will pick up.

One of the main problems underlying the plight of the region’s recycling trade has been the falling price of virgin plastic, which is linked to the price of oil. Recycled plastic has increased in price dramatically relative to virgin plastic, forcing recyclers to slash prices by 21 per cent on average, the report noted.

Demand for recycled plastic has slumped, and buyers have switch to cheaper virgin plastic. In some markets, plastic suppliers have been mixing recycled plastic with virgin plastic, because of the high price of post-consumer content.

Other knocks to the recycling trade include a fall in quality of recycled content. The closure of hotels, restaurants and other commercial venues, which tend to be better at separating waste for recycling, has meant recyclers have had to rely more on poorly segregated recyclables from households for feedstock.

A shortage of workers has also blighted the sector, particularly in India, where 60-80 per cent of waste workers left the cities to move back their homes in the countryside between April and June, and the Philippines, where the government placed heavy restrictions on recycling worker numbers.

Fear of the virus has been another factor. In India, recyclers interviewed for the study reported that employees have not wanted to handle recyclables, even after the material has been set aside for up to 10 days. This has affected the volume of material collected.

Saving recycling from the scrap heap

The report, which was commissioned by investment firm Circulate Capital, noted that if brand owners, investors, governments, and civic society groups do not do more to prop up the recycling sector before the end of 2020, many more Asian recycling businesses will go under over the next three months.

Immediate interventions should include recognition of recyclers and waste-pickers as essential services by the region’s governments, as the United Nations has suggested, and financial support given to recycling operators in the form of low-interest loans by investors.

Brands owners, which drive much of recycled plastic demand globally, should reaffirm their sustainability commitments to use more recycled content in their products and provide guarantees to recyclers, the report proposed.

Longer term, governments should set targets for products to contain a minimum amount of recycled content, and for recycled plastic exports to be allowed. Currently, the Basel Convention, a treaty introduced in 1992 to curb the trade in hazardous waste, limits some cross-border plastic waste trade.

The study emerges the week after a report from Interpol found a link between the global plastic trade and organised crime.

The international law agency’s report highlighted a growing number of Illegal plastic shipments, waste fires and landfills since China banned plastic waste imports in 2018.

The illegal shipments have mainly been rerouted to Southeast Asia via transit countries to camouflage the origin of the shipment, and counterfeit documents and fraudulent waste registrations aiding the expansion of the illicit sector, Interpol’s report found.