More natural gas facilities than ever will be firing in Southeast Asia almost two decades from now, according to a report by Singapore-based research firm Asia Research & Engagement (ARE).

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

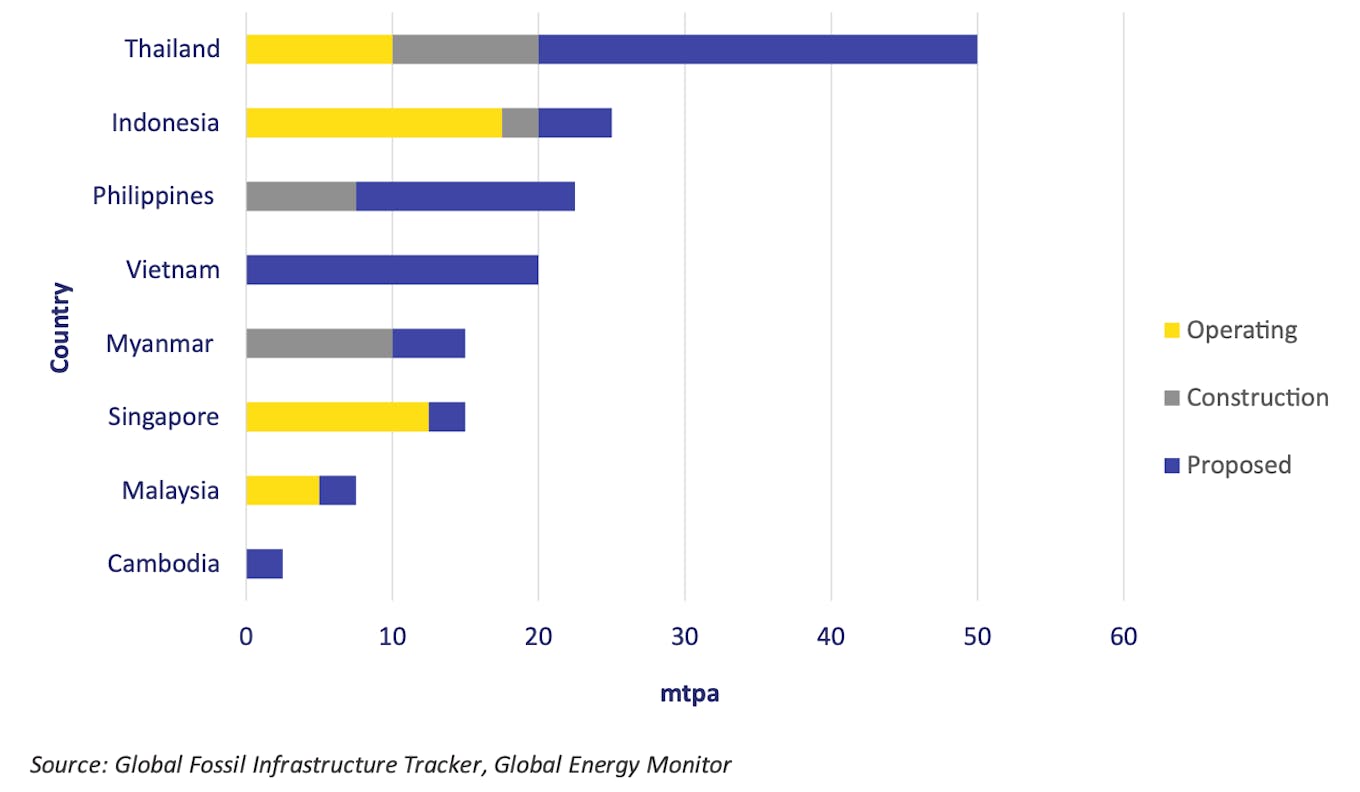

Led by Thailand, Indonesia and Singapore, the region currently has liquified natural gas (LNG) facilities operating at a capacity of 45 million tonnes per annum (Mtpa), which release the equivalent greenhouse gas emissions of more than 10 coal plants in one year.

This is expected to almost double to a capacity of 80 Mtpa by 2040, as proposed projects, mostly in Thailand, the Philippines and Vietnam will be completed by then.

“If allowed to continue, expanded LNG use stands to thwart efforts to keep global warming below 1.5 C,” ARE’s report read. “Growing investment in LNG by the Philippines, Vietnam, and other Southeast Asian nations will only help push the world further beyond this critical target.”

Last year’s biggest addition to global LNG consumption was Thailand’s new US$900 million regasification facility, with a capacity of 7.5 Mtpa, added the analysis.

Image: HAF, Source: ARE, Greenhouse Gas Equivalencies

The Philippines and Vietnam made their first forays into LNG this year.

The Philippines received a shipment in April to fuel its 1,200 megawatt (MW) Ilijan power plant, amid declining reserves from its Malampaya natural gas field off the province of Batangas and after Asian spot LNG prices slid from all-time highs in 2022. The purchase was handled by AGP International Holdings, backed by Osaka Gas and the Japan Bank for International Cooperation.

A month later, Vietnam’s first imports of LNG arrived with a shipment of 70,000 tonnes of Indonesian LNG purchased by state-run PetroVietnam Gas. The new terminals in both Southeast Asian nations are slated to expand the region’s LNG import capacity by 7.8 Mtpa.

The Philippine government has been promoting renewable energy, but as part of its energy development plan, it continues to approve projects to import LNG as a transitional fuel. Although Vietnam is trying to reduce its reliance on coal while tackling worsening power shortages that imperil its fast-growing economy, its development plan likewise calls for more than doubling its reliance on natural gas.

Elsewhere in Southeast Asia, Thailand, Malaysia and Singapore began importing LNG in the 2010s, and Myanmar did so in 2020. Cambodia is preparing to start taking shipments, with a three-phase plan to promote the fuel’s adoption at home.

“Southeast Asia’s limited legacy LNG infrastructure makes the pivot to low-carbon power sources a viable option compared to investing in new LNG infrastructure,” Kurt Metzger, energy transition director of ARE, told Eco-Business.

“The new research underscores that LNG’s carbon intensity is on par with coal, emphasising the necessity of investing in solar, wind, and low-carbon sources to limit global warming below 1.5 degrees.”

Indonesia has the most LNG operating in Southeast Asia, as of 2021, but is expected to be overtaken by Thailand, once its facilities that are both under construction and proposed will be operational by 2040.

In the rest of the world, the report’s authors find it worrisome that the expected production of LNG “far exceeds” what global energy authority International Energy Agency (IEA) calculates is necessary to meet the goals of the Paris Agreement.

The report noted how IEA predicts that LNG used globally must peak in 2025 and decline to 150 Mtpa by 2040 to achieve its 2050 net zero target. But oil firm Shell forecasts in its outlook this year that demand will reach almost 700 Mtpa by 2040, with projected LNG production and supply rising by 20 per cent to 480 Mtpa based on LNG infrastructure currently under construction.

Natural gas is considered a cleaner-burning fuel because it releases up to 60 per cent less carbon dioxide than coal. But experts have flagged the climate impacts of methane—a powerful greenhouse gas—that is emitted during its production, transportation and combustion.