A Singapore-led consortium has announced that the artificial intelligence (AI) utility it developed to combat greenwashing concerns will now be able to access nationwide data on green buildings, and support banks issuing sustainability-linked loans (SLLs) in the real estate sector in identifying prospective projects while monitoring whether these projects achieve specific performance targets.

The utility, known as Project NovA!, was incepted in 2021 by Singapore’s central bank alongside other industry players to help financial institutions better identify green financing opportunities and climate risks through AI.

“When we started, we didn’t have a very specific use case,” said Danielle Jiang, deputy director of the Monetary Authority of Singapore (MAS)’s AI development office at a Singapore Fintech Festival panel discussion on Tuesday. A decision was made last year to focus on real estate SLLs, considering the built environment’s significant contribution to global carbon emissions and the surge in popularity of the financing instrument, Jiang said.

The growth of SLLs – loans that incentivise sustainable business activities by tying a borrower’s interest rates to its achievement of ambitious pre-determined sustainability performance targets (SPTs) – has been exponential in the city-state, quadrupling in volume since 2019.

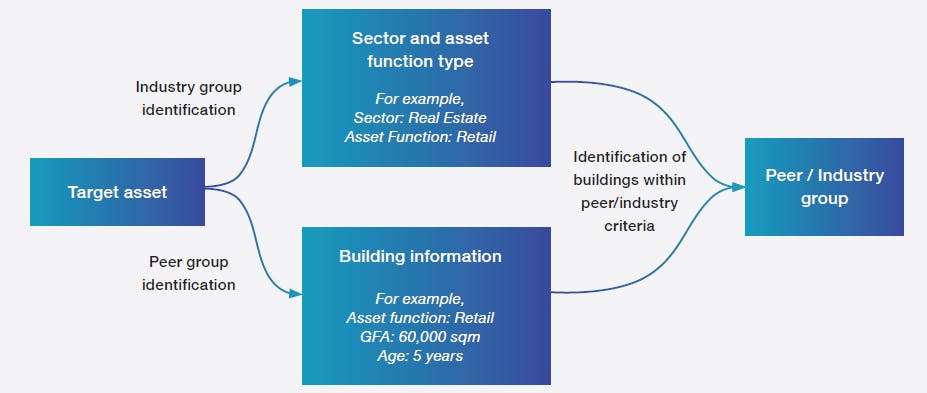

By collaborating with the country’s Building and Construction Authority to integrate its Super Low Energy Building (SLEB) database into the AI utility, property-specific peer and industry benchmarks can be generated for more accurate comparisons, said MAS in a press release. These benchmarks can then help financial institutions set ambitious key performance indicators (KPIs) targets for borrowers, which has proven to be challenging to date due to scarce and inconsistent data.

A flow chart showing the steps taken to generate benchmarks for the real estate sector by property characteristics such as type, usage and age. Image: Monetary Authority of Singapore

“Financial institutions need more precise targets because we need to have air cover to make sure that the targets we set will stand against the test of being good and reliable, versus greenwashing,” said Kelvin Tan, head of sustainable finance and investments, Asean from HSBC, which is one of the consortium members.

The access to at-source data – or data that is collected directly from the original sources using devices with sensors connected to the internet – allows banks to monitor the progress borrowers make against the selected SPTs in a timely manner, which can potentially prevent overstating of sustainability claims.

“At the moment, how we monitor these performances is quite static. We don’t look at it from a predictive point of view. If we can make use of AI to look at it in a more predictive manner, that will make it a very powerful tool,” added Tan, speaking on the same panel as Jiang.

The ability to forecast future performance against SPTs using AI also enables proactive interventions when borrowers are likely to breach pre-agreed targets, shared Tan Kiat How, senior minister of state of Singapore’s national development ministry at the event.

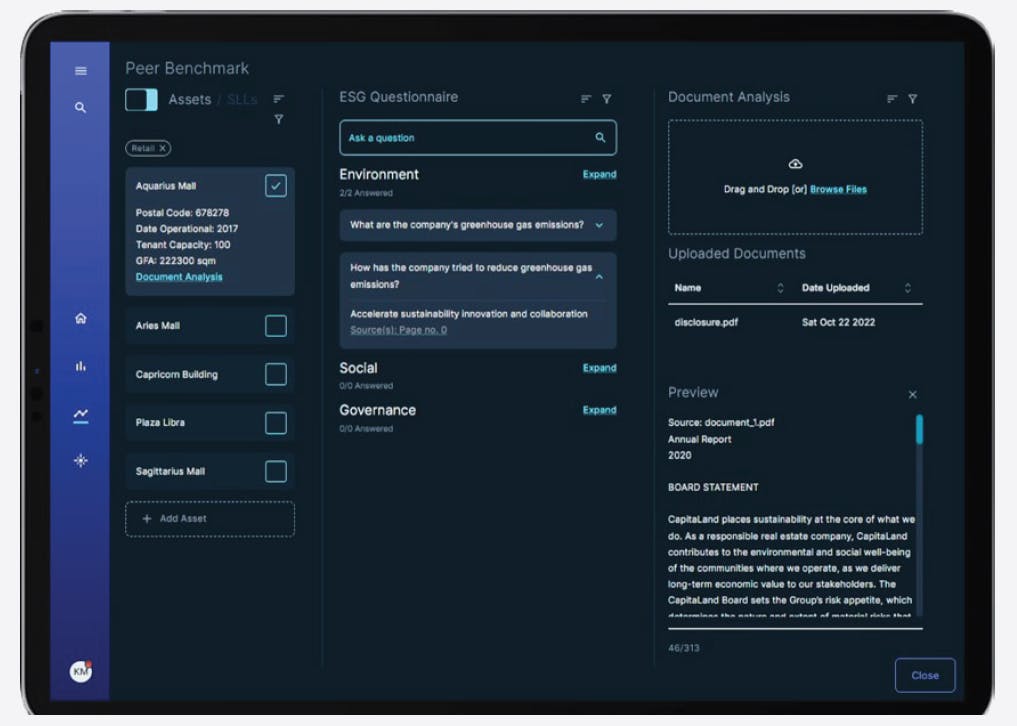

Additionally, the natural language processing capabilities of the AI utility can automate the extraction and categorisation of sustainability information from a borrower’s disclosure documents. This can cut down the time spent and errors from manually reviewing these documents.

A screenshot of how NovA!’s proprietary natural language processing engine can extract information from disclosure documents to answer a pre-defined set of questions that banks typically ask when onboarding borrowers. Image: Monetary Authority of Singapore

Based on pilot tests of the tool by consortium members, including the Singapore-based subsidiary of British lender Standard Chartered and Japan’s Sumitomo Mitsui Banking Corporation (SMBC), NovA! can potentially identify and facilitate SLL issuances amounting to SG$300 million (US$222.5 million) compared to existing systems.

The increased transparency around sustainability targets from the sharing of data between participating banks has also been estimated to save one to two man days per SLL for the setting of each KPI.

The 23 consortium members include all three Singapore-based banks DBS, OCBC and UOB, state investor Temasek, Japan’s largest bank Mitsubishi UJF Financial Group (MUFG), British real estate company Savills and carbon credit certifier Verra. Eco-Business understands that discussions are currently underway with Verra about their contribution to the project and details will be announced in due time.

On Tuesday, NovA! launched a whitepaper which called on prospective tenderers for a second business district that the city state is planning for to consider using the AI platform to obtain green financing. The Jurong Lake District – located outside Singapore’s city centre and in the western part of the island – has been envisioned as a model sustainable district which will provide over 100,000 new jobs and 20,000 homes by 2050.

Singapore’s buildings account for over 20 per cent of the nation’s carbon emissions. Embodied carbon, which refers to emissions resulting from the extraction, manufacturing and transportation of construction materials, can account for up to 40 per cent of emissions over a building’s lifetime in countries like Singapore, where the lifespan of buildings are shorter with urban renewal.

Singapore is currently exploring the application of the new AI utility to similar use cases in the power, manufacturing and transportation industries, before expanding it globally.

Moving forward, NovA! will focus on creating incentives for industries to decarbonise, Jiang said.

“A lot of effort goes into validation and monitoring, which costs up to 75 per cent of the whole value chain. So can AI and data make it faster and cheaper? ESG should not be a very painful compliance process,” she said. “It needs to drive value for society, which means if you do good, you should be rewarded.”