Investors in the Philippines are more willing to put a higher value on firms that concentrate purely on renewables than those that still have fossil fuels in their line of business, according to a study by the Institute for Energy Economics and Financial Analysis (IEEFA), an energy think tank.

IEEFA analysts made the observation, citing how the value of firms with 100 per cent renewables in their business like Solar Philippines and ACEN Corporation, the energy platform of the Ayala conglomerate, have soared in the past five years, compared to utilities that have varying levels of renewables in their energy mix.

“In terms of how investors view asset values, pure play renewables companies command a valuation premium over utilities having lower levels of renewables in their mix, suggesting that their focus on renewables as a concentrated strategy has paid off,” said Ramnath N Iyer, lead author of the analysis released on Tuesday.

Solar Philippines, whose business strategy focuses on renewables, has grown rapidly. Within 18 months of its listing in 2021, the firm attracted a hefty investment from an established group.

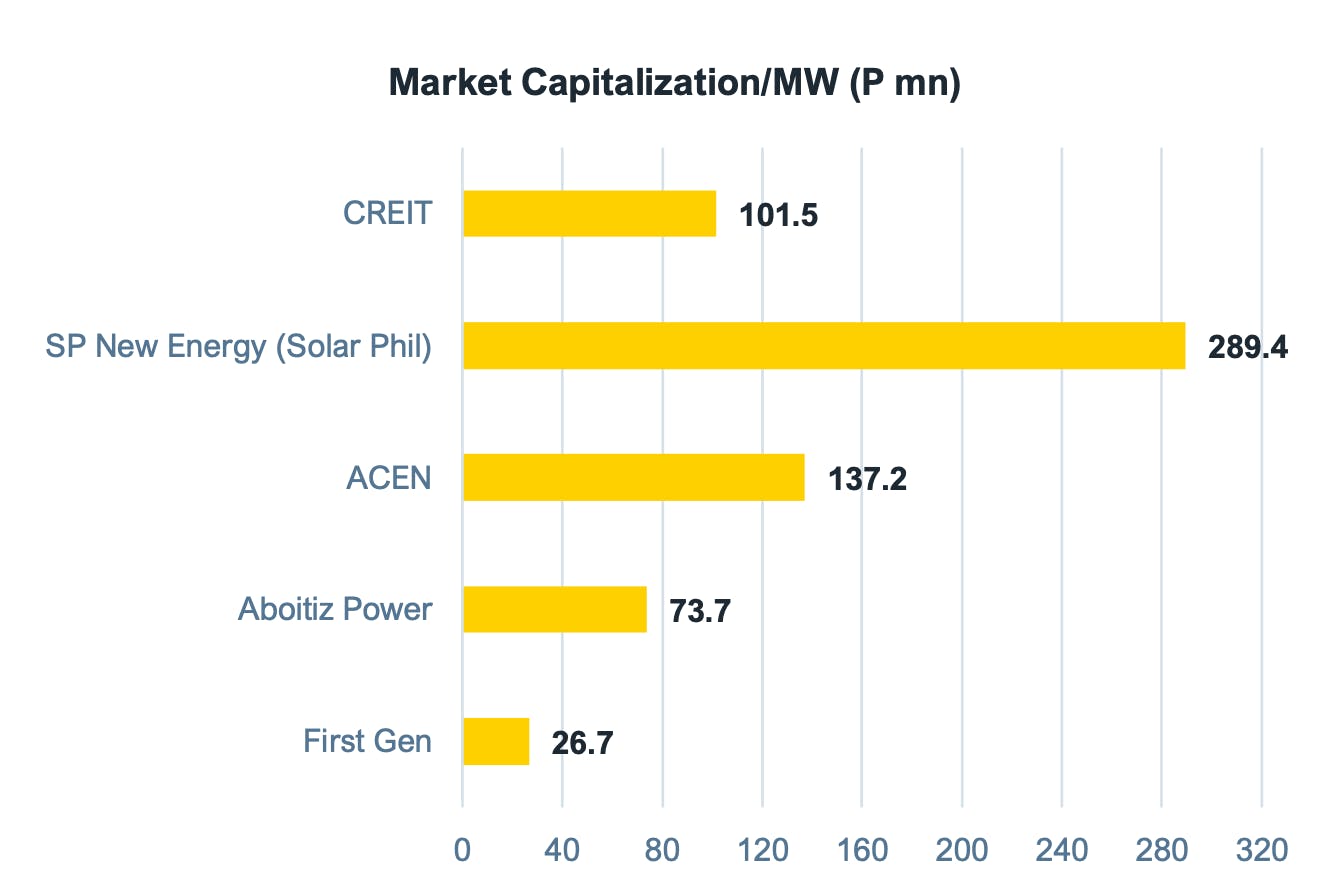

Investors value each megawatt (MW) from Solar Philippines at US$ 5 million (P289.4 million) based on its market capitalisation and megawatts in operation as of August 4.

Investors have put higher value on companies whose business strategy focuses on renewables like Solar Philippines, ACEN, and CREIT. Image: IEEFA

Similarly, ACEN’s valuations of US$2.46 million (P137 million) per MW are likely boosted by the fact that its main strategy is renewables-focused and it targets to grow in both size and geography in the renewable energy space.

“The proactive approach matters because investors typically look for a strong growth profile in the preferred field, in addition to a good strategy and execution capabilities,” said IEEFA in the study.

First Gen, the Philippines’ third-largest independent power producer, on the other hand, has a portfolio that remains dominated by gas, even though it is a leader in the domestic geothermal energy industry. Geothermal power is dominant in the Philippine renewables sector, owing to the archipelago’s location long the Ring of Fire zone of Pacific volcanoes.

The company, as well as Aboitiz Power, a firm that has a long history of hydropower projects and plans to add more solar to its mix by the end of the decade, were found to have been valued the lowest among those surveyed at US$479,000/MW (P26.7 million) and US$1.32 million/MW (P73.7 million) respectively. Aboitiz is one of the big energy firms in the Philippines that is still driving coal expansion.

In Southeast Asia, there are not many listed energy firms that specialise in owning and running purely renewable power assets,” said Iyer, also IEEFA’s climate and renewable energy finance lead.

“It appears that in many countries in the region, the presence of domestic fossil fuel resources like gas in Thailand and Malaysia, coal in Indonesia may also be preventing more active support for renewables,” he said.

Monetising renewable assets through REITs

Philippine renewables companies are introducing innovations that can further unlock finance for investments into clean energy, such as the use of real estate investment trust (REIT) structures, noted the report.

REITs, or companies that own and operate income-producing real estate or related assets, are prevalent in Singapore and Thailand, but none of them have monetised clean energy assets like what Citicore Renewable Energy Corporation (CREC) has done in the Philippines, Iyer told Eco-Business.

CREC spun off one solar plant with a capacity of 22MW and the land on which a set of its solar plants were located, into Citicore Energy REIT Corp (CREIT), the Philippines’ first renewable energy REIT.

CREIT has allowed investors to directly own a portion of the cash flow generated by the solar power assets, while also in the process, allowing the company to raise funds that enable it to invest more in new renewable projects.

Because of this innovation, investors have found it viable to invest in the green energy space. CREIT was valued by investors at US$1.83 million/ MW (P102 million/MW) as of 4 August.

“This innovation opens up a wider base of investors, and as a result opens up the pool of funds available for companies. This is significant for the Philippines because if it is successfully implemented, it shows other companies in the sector a new way of generating income,” Iyer said.

Join the conversation on how the Philippines can unlock sustainable finance for a just and equitable energy transition. Register here for Unlocking capital for sustainability Philippines on September 14, 2023.