This story is part of our Decoding Sustainable Finance series, where we attempt to break down complex terminology surrounding the latest regulations and trends in sustainable finance.

The Philippines started exploring real estate investment trust (REIT) structures at the height of the pandemic in 2021.

The first of its REITs, or companies that own and operate income-producing real estate or related assets, was first listed on the Philippine Stock Exchange under mammoth property developer Ayala Land in 2020. The following year, DoubleDragon, another real estate company known for its leases to offshore-gaming operators, also debuted its REIT. The country currently has eight listed REITs.

This form of investment gives individuals or organisations the opportunity to sink in capital in the real estate market, without the need to directly and individually purchase, own, or manage property themselves.

Singapore leads the Southeast Asian region, in the trading of this new asset class, establishing itself as a hub for these companies when it marketed its first REIT, CapitaMall Trust, more than two decades ago. Malaysia saw its first REIT with the listing of Axis REIT Managers Bhd in 2004.

Today, the Singapore stock exchange has 44 REITs with a total market capitalisation of US$84 billion, while the Malaysian bourse has 18 on its main market with a total market capitalisation of US$8.3 billion in the same period.

“The region had a fast-developing real estate and property industry brimming with opportunities despite strict legal constraints and health restrictions due to the pandemic,” wrote Eleanor L. Roque, principal attorney for tax and compliance at United Kingdom-based accounting and consulting firm Grant Thornton International, in a blog post published in 2021.

“These REIT listings give business experts hope, as REITs are seen as one of the catalysts for recovery and growth of the Philippine economy.”

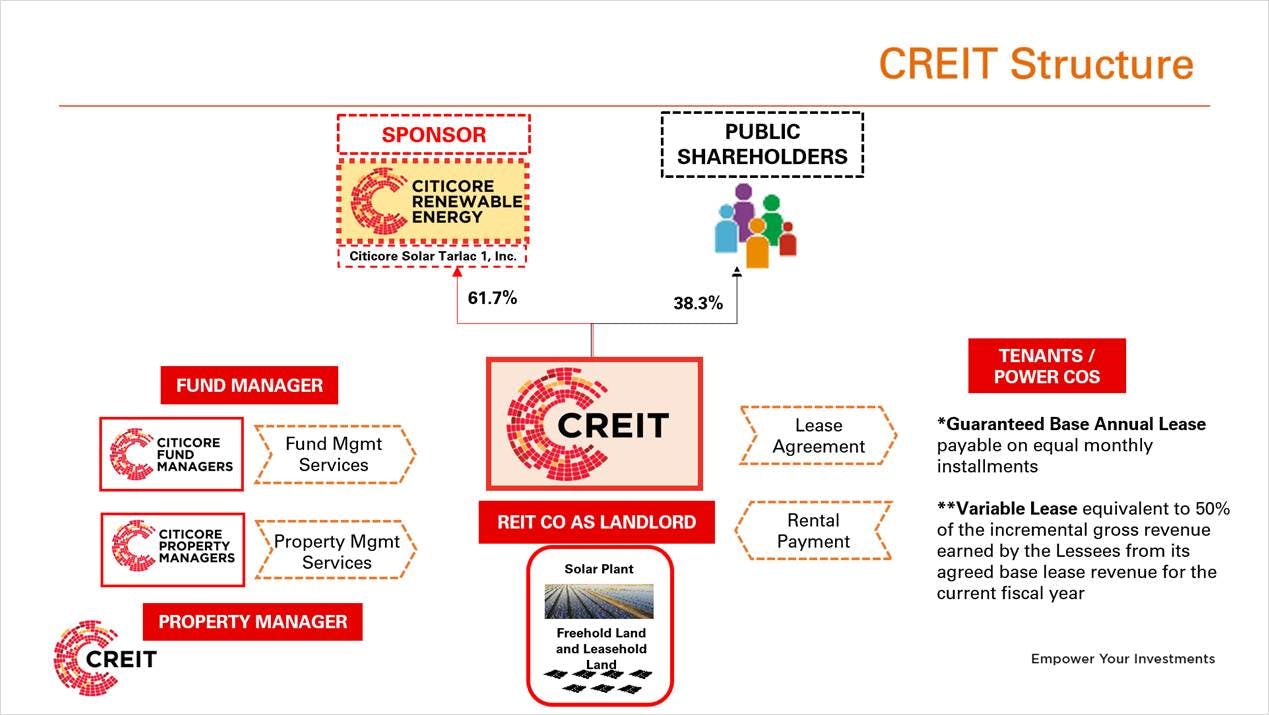

Citicore Renewable Energy Corporation (CREC) turned its land and solar plant into Citicore Energy REIT Corp (CREIT), a renewable energy REIT. As such, CREIT became the tenant-operator of the solar plant and acts as a “landlord”, leasing the land to investors who own a portion of the cash flow generated by the solar power assets. Image: CREIT

Given this emerging business environment for REITs, Filipino clean energy firm Citicore Renewable Energy Corporation (CREC) started mulling over a new way to monetise green assets through the use of such structures.

It owned a land area of 1.65 million square meters which housed a 22 megawatt (MW) solar power plant, and decided to spin off the property into Citicore Energy REIT Corp (CREIT).

Unlike regular REITs elsewhere in the region, CREIT allows investors to directly own a portion of the cash flow generated by renewable energy assets: its solar farm.

In the process, it also enables the company to raise funds to acquire more new clean power projects.

The concept of energy REITs also took off in China in March this year. State Power Investment Corporation (SPIC), one of China’s five major electricity generation firms, plans to raise about US$1 billion from the REIT underlain by its 500MW offshore wind power project in Yancheng, Jiangsu Province. Another government-backed renewable energy investor, Beijing Energy International, aims to raise around US$284 million from its REIT. The REIT’s bottom assets are composed of a 300MW solar power station in Yulin, Shaanxi province, and a 100MW station in Suizhou, Hubei province.

It is significant that the Philippines and China are introducing such innovations to monetise renewable energy investments, but they also come with drawbacks, said Tien Foo Sing, chair professor at the department of real estate at the National University of Singapore.

“Infrastructure REITs like renewable energy assets have higher upfront investments costs. This is due to the capital-intensive nature of these investments, relative to regular land with no such structures,” said Sing.

Eco-Business looks into what REITs are, as well as benefits and drawbacks of the new financing channel. What does such a mechanism mean for clean power in the region?

What is a real estate investment trust (REIT)?

A REIT is a securitised vehicle that converts a non-liquid asset to one that can be used more easily to raise capital.

Securitising an asset means that certain types of assets are pooled so that they can be repackaged into interest-bearing securities.

The asset to be converted is liquidated by moving it “off the balance sheet of the owner” to a special purpose vehicle or a shell company that holds the asset, said Prof Sing.

In the case of the Philippines, CREC was the sponsoring company that turned its solar plant and land into CREIT, a “special purpose vehicle” to facilitate the cash flows from the solar plant to the investors.

The SPV is structured as a trustee, which will appoint a third-party asset manager and property manager to supervise and operate the underlying real estate and infrastructure assets in their portfolio, which is held in trust for REIT investors.

Since CREIT assets are investment fund objects, they are traded far more easily than a property. Investors may directly own a portion of the cash flow generated by the solar farms without having to buy, manage, or finance the property themselves.

How did CREC come across its idea of a renewable energy REIT?

As REITs were gaining ground in the Philippine Stock Exchange in 2021, CREC wanted to find a way to maximise this form of investment.

CREC owned Enfinity Philippines Renewable Resources, Inc. (EPRRI) which operated a 22MW solar plant in Clark, Pampanga.

It reorganised EPRRI and renamed it CREIT, which became a full-fledged REIT entity upon its listing in February 2022.

From being merely a solar-operating company which derived its revenues from electricity sales, CREIT became a “landlord” owning real estate property and a solar plant.

With the REIT structure, CREC pays a lease payment to CREIT as the tenant-operator of the Clark Solar Plant.

CREIT has other parcels of land in Cebu, Negros Occidental, Arayat among others. They are rented out to solar power operators.

In March this year, CREIT reported that its profits skyrocketed last year. Company officials said this shows that its shift to the energy REIT business model had worked. It is set to issue Asean green bonds to expand its real estate portfolio.

How are renewable energy REITs embedded into real estate assets?

The main use of real estate assets in a renewable energy REIT portfolio is for renewable energy generation.

For instance, as CREC already had a solar plant and land during its listing, it was able to raise more capital by sponsoring CREIT as a “landlord” which leases the land to investors who own a portion of the cash flow generated by the solar power assets. This applies to CREC’s decision to come up with the REIT structure in 2021.

At the same time, CREC is able to raise more funds that will enable it to invest in new renewable projects. It is targeting to recycle capital for additional solar projects worth five gigawatts (GW) in the next five years.

CREIT expanded its land portfolio to 4.96 milllion square meters, but the equivalent installed capacity of its operational solar plants is still at 145MW. This is because CREIT’s land acquisitions this year are leased out to solar developers who are still constructing the solar farms. The 284MW is the gross installed operating capacity of the Citicore Power Group.

How do renewable energy REITs recycle capital?

The sponsoring company earns income when it lists a REIT in an initial public offering (IPO), which refers to offering shares of a private corporation to the public in a new stock issuance for the first time.

In the case of CREC, it was able to raise a capital of US$124 million when it listed CREIT, which it can recycle as funds for project development of new renewable energy assets. Instead of CREC paying for the land, its REIT arm will shoulder the expense.

What are the advantages of renewable energy REITs?

Renewable energy infrastructure REITs are more attractive to investors because they fit into their impact investing scheme, which focuses on a portfolio of green assets, said Prof Sing.

“Not many infrastructure assets fit into impact investing schemes. Institutional investors are prepared to accept lower investment returns in driving their impact investing objectives,” he said.

As compared to direct investments in physical real estate and infrastructure assets, investing in REITs is also more liquid for investors. For owners of assets, REIT vehicle allows them to unlock the asset values, and recycle the capital into other new infrastructure and real estate assets.

Renewable energy and renewable REITs are public securities, which if listed and traded on stock exchanges, have to regularly distribute revenue from the assets back to investors as dividends, either quarterly or every six months.

Under Philippines law, REITs are required to allocate at least 90 per cent of its distributable income as dividends. In the case of CREIT, guaranteed lease payments from operating solar tenants are 95 per cent of earnings before tax, which is distributed as dividends to investors.

What are the disadvantages of renewable energy REITs?

Infrastructure REITs like renewable energy assets have higher upfront investment costs due to the capital-intensive nature of the investments, said Prof Sing.

Real estate also has longer leases that can stretch for a period of 99 years, while renewable energy assets leases last only half of this lifespan, depending on the solar or wind power plant.

“Infrastructure assets will depreciate over time, while property prices can rise, translating to higher share prices,” he said.

In China, renewable energy assets are not easy to invest in because they are usually state-owned assets. The private sector is less willing to build and invest in infrastructure projects, because the project may be subject to some form of price control imposed by the government to reduce costs for users. For example, generating electricity for a residence is given at a cheaper and subsidised rate in the country.

The country’s top economic planner, however, has signalled that mechanisms will be built up and reformed to spur the development of private investment, while keeping the proportion of such investments in fixed assets “at a reasonable level”. In July, the National Development and Reform Commission (NDRC) said in a notice that it encourages private investment projects to issue REITs to expand financing channels.

Why are renewable energy REITs significant for Asia?

Renewable energy REITs are an alternative way to finance clean energy growth, said Ephyro Luis Amatong, consultant to the Sustainable Banking and Finance Network, a global non-profit composed of financial sector regulators, central banks, ministries of finance, and ministries of environment.

“Instead of having to keep borrowing from banks or issuing bonds, companies can recycle their capital from the REIT IPO to fund other investments,” Amatong told Eco-Business. The REIT is required by law to IPO so the public gets an opportunity to invest indirectly in renewable energy projects, he said.

Such options are timely now more than ever as interest rates soar, not only in Asia, but across the world, he added.

Inflation brought about by pandemic recovery, as well as the impact on energy and food prices borne out of the Russian-led war in Ukraine have been the main sources of soaring prices that have led to high interest rates.

A recent report from the Institute for Energy Economics and Financial Analysis (IEEFA), an energy think tank, specifially noted the value of renewable energy REITS in opening up a pool of funds for regional companies.

Keen to learn more about the latest trends and developments in green finance? Find out more at Unlocking Capital For Sustainability, our annual flagship event.