The financial backers of the world’s biggest advertising agency groups should rethink their investment strategies to encourage the likes of WPP, Dentsu and Omnicom to stop working for highly polluting brands, a new report by United Kingdom-based non-profit Planet Tracker recommends.

Through their ads, agencies generate pollution and waste by driving the consumption of goods and services produced by some of the world’s largest corporate greenhouse gas emitters, including fossil fuel clients, the report said.

The latest study by Planet Tracker has for the first time gone beyond carbon emissions to track advertisers that have a high waste and water footprint, such as meat producer Tyson Foods and fizzy drinks brand Coca-Cola. Activist pressure on the ad industry to reduce its environmental impact has historically focused on agencies that work for fossil fuels clients.

The report, titled From ADversity to ADvantage, called on the largest investors in the big six ad holding groups to pressure their investees to change their stance on how they work for environmentally harmful clients.

Planet Tracker estimates that these firms wield the combined emissions footprint of 530 million tonnes of carbon dioxide equivalent per year from just 39 clients – larger than the carbon footprint of the United Kingdom, which accounts for 1.1 per cent of global emissions.

The six advertising holding companies – WPP, Interpublic Group, Omnicom, Dentsu, Havas and Publicis Groupe – account for about 10 per cent of the global advertising market combined.

Currently, the holding groups mostly claim that they can nudge polluting clients to pivot to cleaner ways of doing business through their strategic counsel. But Planet Tracker argues that agencies should more actively work to transition their clients to sustainable business models or refuse to work for polluting brands.

“By not pressing the holding companies to refuse to work for clients with high environmental footprints, investors are complicit in allowing business-as-usual to continue,” the report said.

The big ad groups should also recognise the material financial implications of client and employee dissatisfaction that results from working for polluting clients – which is a risk to their bottom line, the report asserted.

A brand that has invested heavily in building its sustainability credentials, such as Unilever, one of the world’s biggest advertisers, might move their account if their agency worked for a major polluter.

And if young agency staff become disillusioned by working for major polluters, an agency risks losing its core asset; some 60 per cent of an agency’s cost base is its employees, suggested the report.

“We caution against investors and lenders viewing environmental footprints as a non-financial issue,” said Planet Tracker in the report.

The non-governmental organisation said it is possible that investors that want to avoid industries with links to environmental deterioration could be attracted to ad companies because of a reliance on environmental, social and governance (ESG) scores, which will value only the environmental metrics of the agency itself – not its client exposure.

The world’s biggest ad firms have strongly made their case for environmental consciousness in recent years, as sustainability has shot up the corporate agenda among their clients.

Many agencies rely on the industry’s own initiatives, such as Ad Net Zero, which commits to decarbonise the production, distribution and publication of advertising, but this pledge only applies to the relatively small environmental footprint of the agencies themselves – not the polluting products they promote.

In its annual report, WPP, the world’s biggest ad firm, said that its policy is to not “undertake work which is intended or designed to mislead in any respect, including social, environmental and human rights issues”.

The British advertising giant works for companies including oil majors Shell, BP, Chevron, ExxonMobil and Saudi Aramco – all companies that have, at some point, been called out for greenwashing.

New York-headquarterted Interpublic Group, the world’s fourth largest ad holding company, has acknowledged that: “If large shareholders were to reduce their ownership stakes in our company as a result of dissatisfaction with our policies or efforts in this area, there could be negative impact on our stock price, and we could also suffer reputational harm”.

Meanwhile, according to Planet Tracker’s report, only two of the five publicly listed holding companies have a clear link between sustainability and executive pay. “In neither case is the amount material. None link to the environmental performance of their clients,” the report said.

Planet Tracker director of research John Willis told Eco-Business that agency holding groups have mostly ignored externalities such as their climate impact, because of the nature of how senior advertising executives are remunerated.

“If the aim [of advertising holding companies] is simply to increase profits – which is how ad executives are essentially paid – then they will ignore externalities such as climate change, until they are materially impacted. However, if/when these externalities become financially relevant, then they will pay attention as their earnings and are impacted, and in turn, the valuation of these companies,” he said.

Ad majors’ footprint scrutinised

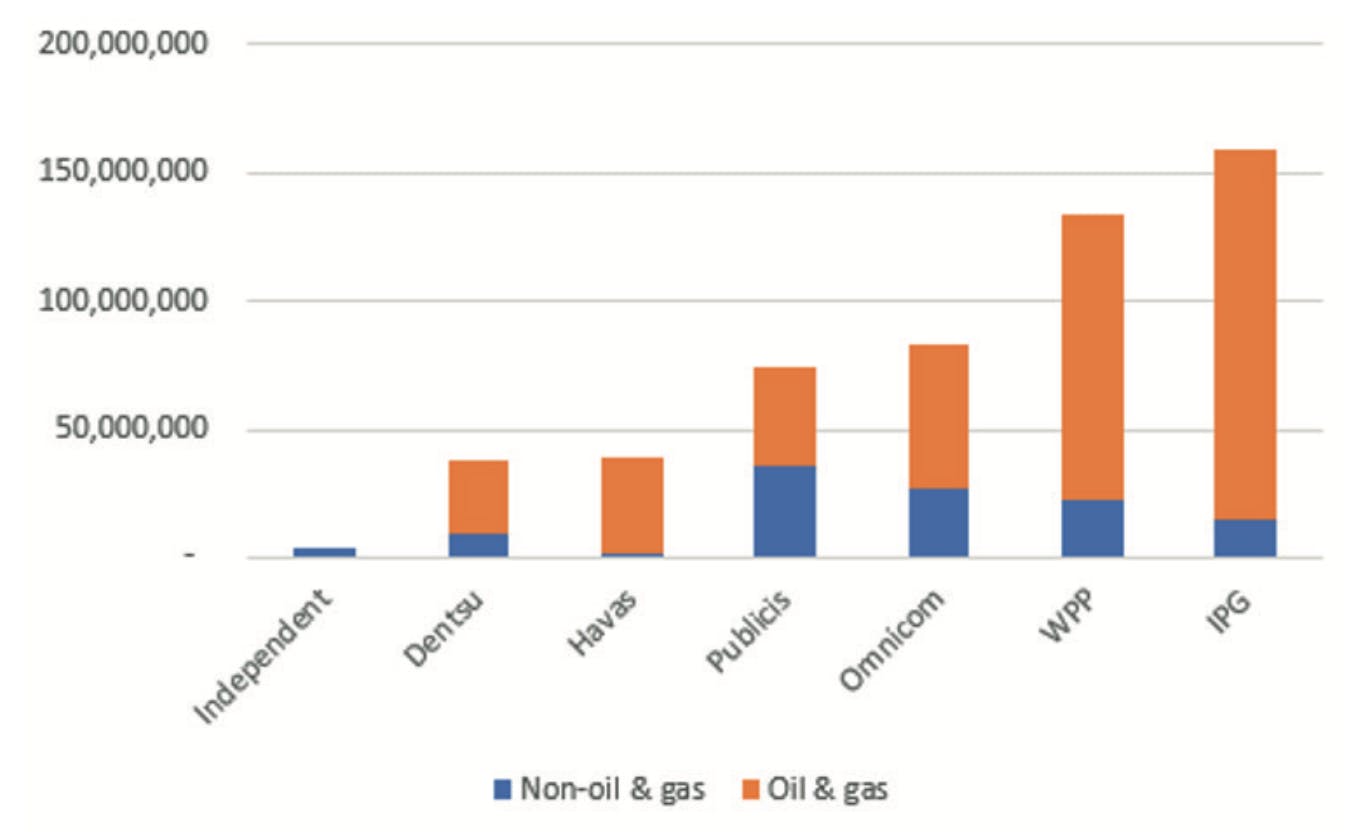

The report found that Interpublic Group, the advertising holding company that owns agency brands McCann, Weber Shandwick and UM, and works for the likes of Saudi Aramco, General Motors, Unilever and ExxonMobil, is the industry’s biggest carbon-emitting ad group.

The greenhouse gas emissions footprints (in tonnes of carbon dioxide equivalent) of advertising holding companies based on attribution analysis of 39 carbon-intensive clients. Source: Planet Tracker, Trucost

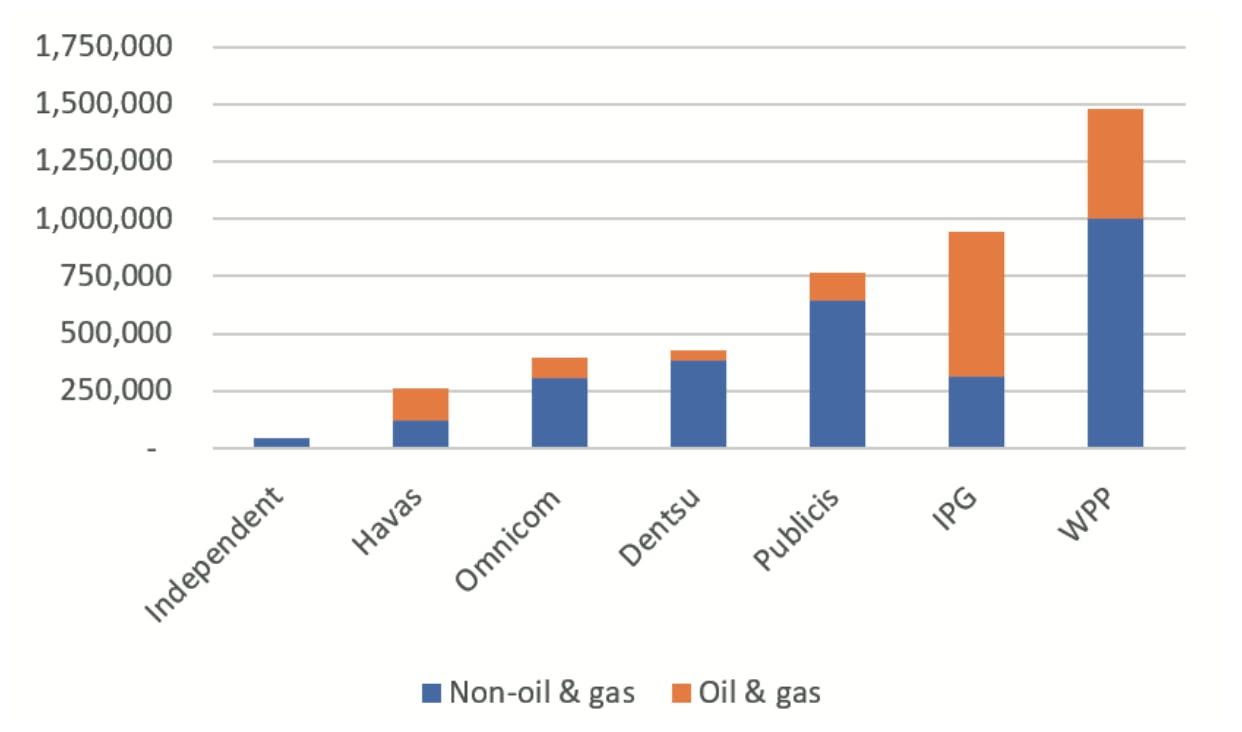

British firm WPP, which owns agencies including creative network Ogilvy and public relations firm Hill+Knowlton and works for companies including packaged goods firms Colgate Palmolive, Kraft Heinz and Unilever, has the biggest waste footprint, according to Planet Tracker’s calculations.

The waste footprint (in tonnes) of the world’s biggest advertising holding companies based on attribution analysis of 39 advertising clients. Source: Planet Tracker, Trucost

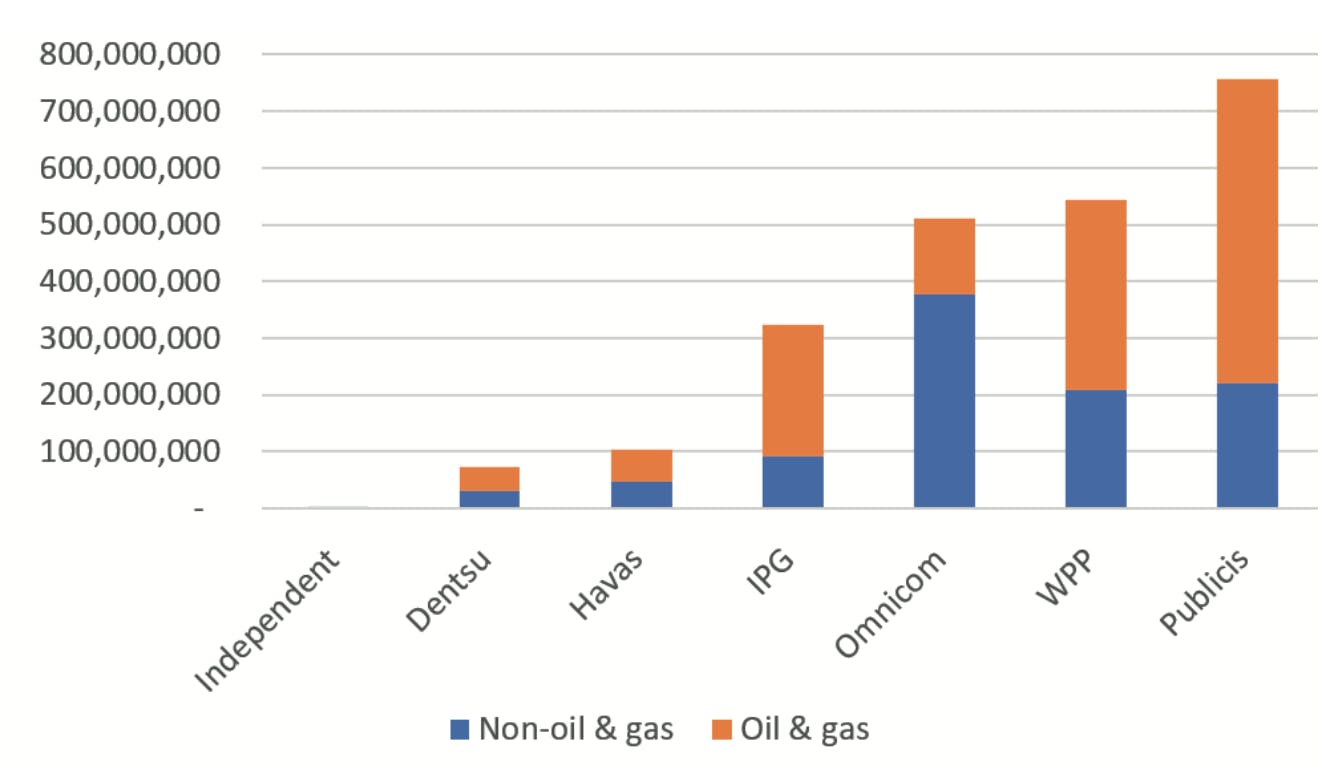

French firm Publicis Groupe, which own agency brands Saatchi & Saatchi and Leo Burnett and works for the likes of French oil and gas giant TotalEnergies, packaged goods firm Procter & Gamble and luxury brand LVMH, has the biggest water footprint.

Advertising holding groups with the biggest water footprint. Source: Planet Tracker, Trucost

BlackRock and Vanguard have the largest investments in ad holding companies but also the highest attributable environmental footprint for emissions, waste and water in terms of the agencies’ clients, the study found.

Clearer measurement and reporting by the agencies of their clients’ environmental footprint scores would help investors to make better decisions, the report read.

It added that the biggest six holding companies have a “growth problem” that will could be helped by avoiding working for environmentally damaging clients.

Between 2015 to 2022, the six biggest ad agencies grew more slowly than global advertising revenues, as competition from independent agencies – more than 900 of which have committed to stop working for fossil fuels clients – and market share gobbled up by digital advertising giants Meta and Google has eaten into their balance sheets.

Richard Bleasdale, who has worked for clients including ExxonMobil, Shell and McDonald’s during his time running Omnicom ad firm DDB and other agencies in Singapore, told Eco-Business that Planet Tracker’s report makes for “depressing reading”, potentially more so in Asia, where commitments to sustainable beliefs and practices are “still in the early stages.”

He summed up the problem by quoting DDB founder Bill Bernbach: “A principle isn’t a principle until it costs you money”.

Bleasdale said: “The primary principle of agency holding companies, and specifically their senior management, is money. In Asia, which offers the opportunity for higher relative growth, the principle is even more acute.”

Any rejection of environmentally-damaging clients will “more likely be driven by the bravery of the younger employees of the holding companies, voting with their dissatisfaction and their feet, than by the top brass,” he said.