Battery recycling is all the rage in China, but for wider Asia where electric cars have been slower to hit the roads, it will likely be years before the demand for recovering and reusing end-of-life power cells pick up.

Still, industry insiders say more can be done in the meantime to develop the supply chains and talent needed to facilitate the growth of this nascent sector, while tightening regulatory standards to improve the integrity of the market.

Globally, demand for metals such as cobalt, lithium and nickel is expected to outstrip supply within the decade as clean energy hardware like electric cars and energy storage cells become more popular.

The trend is both putting pressure on opening more mines, and drawing attention to the environmental and social harms of metals extraction. This dilemma was thrust into the spotlight recently as talks on deep-sea mining stalled: regulators could not reconcile the prospects for additional nickel and cobalt supply with the biodiversity risks trawling the ocean floor carries.

Against this conundrum, the metals reuse industry has been growing, including in frontier markets such as Southeast Asia. Initial deals on recycling facilities have been signed in countries like Malaysia and Vietnam, while the first few plants have started operating in Singapore.

The agreements appear hedged on future electric vehicle growth. Several nations have said they want to be manufacturing hubs, while foreign carmakers are setting up more shops in the region. Germany’s Mercedes has said it will have an all-electric lineup in Malaysia by 2030.

But these early agreements do not portend guaranteed success, recyclers say.

“It is not that easy. Currently, for lithium-ion battery recycling, there is strong investment in China. For Southeast Asia, I’m looking forward [to more funding], but the scale of investment is still far too small,” said Vince Goh, managing director of Se-cure Waste Management, an electric car battery recycler in Singapore. The firm crushes and separates the materials in thousands of tonnes of lithium-ion car batteries a year, selling the intermediary products that can be further refined downstream.

Goh said investors want to see a promised supply of raw materials – old electric vehicles – and buyers of recycled battery metals before committing funds.

Rules and rewards

In the meantime, governments need to prepare the recycling industry for a scale-up, he said. For instance, there needs to be proper standards and regulations on pollution and safety hazards – important safeguards for the flammable and chemically-complex materials. Certain methods also involve heating and melting metals, which requires fuels and creates greenhouse emissions.

“Non-genuine” recyclers with lax controls have been popping up “everywhere”, and errant firms could gain a major cost advantage if they are allowed to continue operating, Goh cautioned.

He added that Singapore also needs to train up its metallurgy talent pool again, after losing much of it when transforming into a financial hub decades ago.

The difficulties of navigating a nascent market means financial support is needed, said Bryan Oh, co-founder and chief executive of Singapore-based NEU Battery Materials, which recycles lithium from batteries.

Oh pointed to the United State’s landmark “Inflation Reduction Act” climate bill, which dictated that recycled electric car batteries, regardless of origin, is to be considered made-in-America and be available for subsidy. News agency Reuters reported that the clause is “kicking off a U.S. factory building boom”.

NEU Battery Materials itself also received a grant in 2021, of undisclosed amount, from the philanthropic arm of Singapore’s sovereign fund Temasek. The recycler currently has a pilot facility in Singapore that can process 150 tonnes of batteries a year.

The challenge in Asia, outside of China, is for recyclers to find the “right scale and right partnerships” to make sound business models, Oh said.

He added that rules such as getting carmakers to set up battery recycling channels, adopted by China in 2021, would help, as would Europe’s requirement for manufacturers to disclose the amount of recycled materials they use in batteries.

Oh said he is eyeing expansion into Europe, citing business opportunities with partners. Goh of Se-cure Waste Management is looking to build a plant in North America in the coming years, while also expanding into Southeast Asian countries.

Globally, the battery recycling capacity in 2025, at about 250 gigawatt-hours (GWh), is expected to meet only about 30 per cent of the total car battery capacity needed that year, according to a end-2021 report by analyst Fitch Solutions. Studies put the recycling rate today at about 5 per cent.

Asia leads the race with over 55 GWh of recycling capacity planned till 2030, but with most of it – 43.5 GWh – in China, according to Hong Kong newspaper South China Morning Post.

The figures differ by types of metal recycled too. A recent note by natural resources analyst Wood Mackenzie said that recycled lithium substances by 2030 will only meet 7 per cent of demand. The flammable metal is also by chemistry harder to recycle than cobalt and nickel.

The likes of such figures continue to be used to support the scale-up of mining, and opening up of deep-sea extraction. The nickel supply chain is particularly entrenched in Asia, with Indonesia and the Philippines being top suppliers. Meanwhile, talks are expected to pave the way for commercial seabed mining by 2025.

‘Matter of policy priority’

But it is a matter of policy priority in choosing what to focus on, according to Sian Owen, director of the Deep Sea Conservation Coalition, a network of organisations advocating for better protection of seabed ecosystems.

Asian countries like Japan have the technology to generate battery-grade metals from old cells, Owen said. Collection and processing is currently still expensive, but money put into recycling innovation – that could lower costs – is still outweighed by funding for mining exploration, she noted.

Asian countries – China, India, Japan, Singapore and South Korea – currently have governments or firms holding 13 of 31 exploration permits issued for deep-sea mining globally.

Mining is still popular now because not all the costs are borne by buyers, but local communities that lose livelihoods, clean water and cultures for land-based extraction, and ocean biodiversity for deep-sea mining, Owen said.

“As long as others are forced to foot the bill, extraction will remain seemingly good business,” she said, adding that there should also be efforts to reduce demand in areas such as vehicle ownership levels to lower the need for raw materials.

Technology, to a certain extent, is also helping. A variant of the lithium-ion battery that uses iron and phosphate – both more common substances – instead of nickel and cobalt, is fast gaining traction on the back of performance gains, and support by Chinese makers and American giant Tesla.

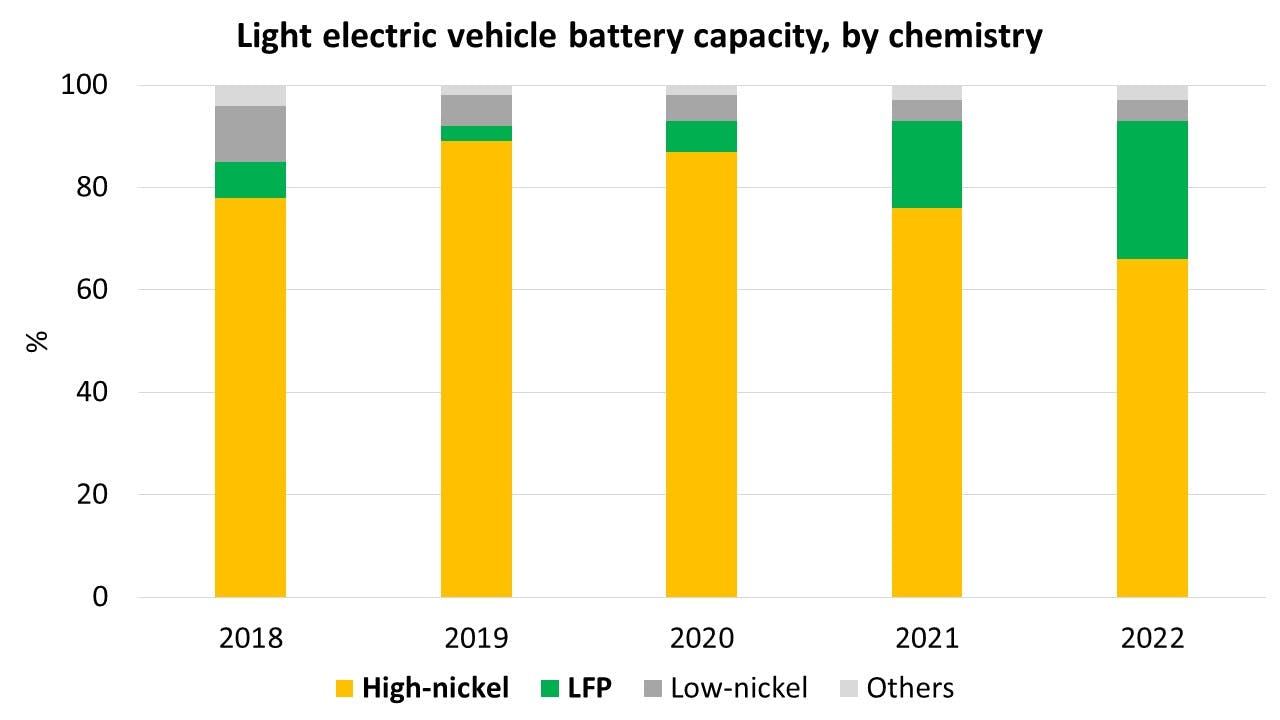

The “LFP” battery, as it is termed, made up 27 per cent of total cell capacity last year, up from 6 per cent in 2020, according to the International Energy Agency.

While nickel-rich batteries, such as the Nickel-Manganese-Cobalt (NMC) variant, is still dominating markets today for superior performance, Lithium-Iron-Phosphate (LFP) batteries are fast catching up. LFP cells are also cheaper, making them ideal for budget car models. Data: International Energy Agency.

But its growing popularity could also create challenges for lithium recyclers. LFP batteries are generally cheaper, which reduces cell makers’ business impetus to recycle their raw materials, Oh from NEU Battery Materials explained.

Nonetheless, both Oh and Se-cure Waste Management’s Goh believes recycled metals can reach cost-parity with virgin ingredients for battery production.

“No country will reject lithium-ion battery recycling, because it is a source of green energy,” Goh said. Countries without ore reserves, like Singapore, would especially want in on metals reuse, he added.