Investors need to prepare for an “increasing likelihood of disorderly transitions and elevated physical risks” amid rising emissions and the current socioeconomic and geopolitical backdrop, warned Singapore’s sovereign wealth fund GIC in its recent annual report.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

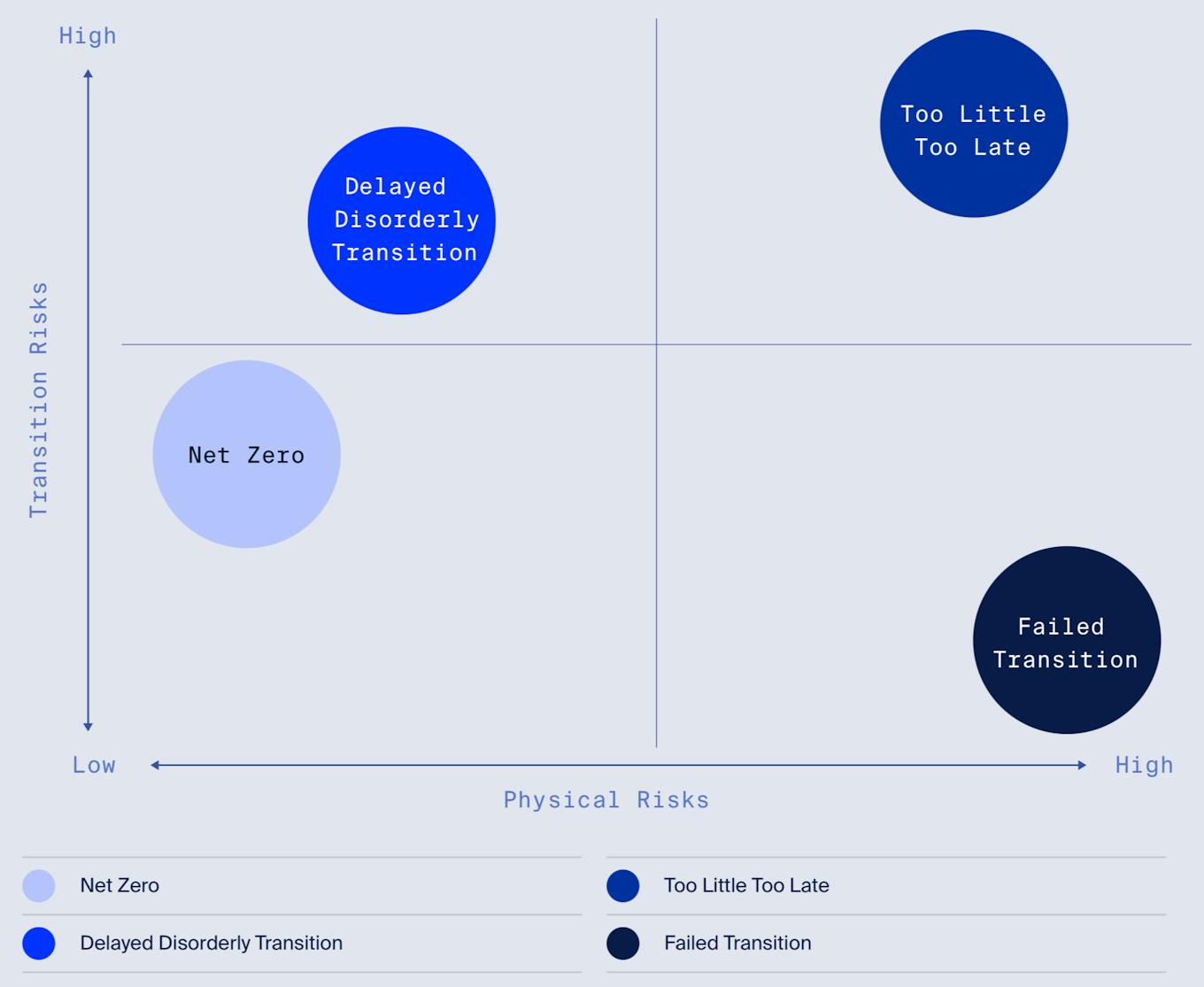

Among the four proprietary climate scenarios GIC currently uses to stress test its portfolio, its two high transition risk scenarios are becoming more probable, said the state-owned investor. These are the “delayed disorderly transition” and “too little too late” scenarios, which sit between the two other extremes – the most optimistic being one where the world achieves “net zero” emissions by 2050 and the other being a “failed transition”.

Transition risks are brought about by policy changes and disruptive technologies, while physical risks refer to the acute and chronic impacts of rising temperatures, which include extreme weather events or sea-level rise.

While the “too little too late” outcome – where slow and insufficient policies result in global warming between 2⁰C to 3⁰C above industrial levels – remains GIC’s predominant scenario, the “delayed disorderly transition” scenario has overtaken the “failed transition” scenario in probability in the latest assessment conducted last December.

The “delayed disorderly transition” scenario describes one where the world is initially slow to address climate change, but a sudden surge in policy action manages to limit warming to below 2⁰C by 2100, in line with the Paris Agreement’s goals.

The assessment is part of the fund manager’s ongoing monitoring of climate scenarios to better prepare its investment portfolio for climate risks and opportunities, said a GIC spokesperson, who declined to share the baseline warming scenario it currently uses.

“Rather than predict the precise climate scenario that will unfold, GIC adopts the approach of preparing for the range of plausible outcomes that could impact the investment portfolio,” the spokesperson told Eco-Business.

The climate scenarios in descending order of probability based on GIC’s latest assessment are: Too Little Too Late, Delayed Disorderly Transition, Failed Transition and Net Zero. Image: GIC Report 2024/25

Last month, Temasek, another Singapore state investor, revealed that it is reviewing its baseline 1.8°C climate scenario to assess how changes in policies and adoption rates of decarbonisation technologies might affect prior warming projections.

Experts that Eco-Business previously spoke to anticipate that more large financial institutions will begin to reassess the core climate scenarios they rely on to measure their risk exposure across industries, from insurance to banking.

Eyeing investments in adaptation and energy infrastructure

In response to Eco-Business’ queries, the GIC spokesperson cited rising business and living costs and increasing geopolitical risks as some new challenges that investors have faced over the past year, causing near-term priorities to diverge across regions.

“These factors have led some countries to reassess their near-term sustainability policies, and in certain instances, reduce support for decarbonisation,” the spokesperson said.

“Meanwhile, other countries have increasingly linked decarbonisation objectives with energy security and industrial competitiveness, driving further progress and creating new investment opportunities.”

In anticipation of the United States president Donald Trump withdrawing the country from the Paris climate accords earlier this year, major banks pulled out of the United Nations-backed net zero banking alliance (NZBA).

But China and the European Union have since vowed to strengthen their climate targets, despite missing the official deadline to submit their updated nationally determined contributions this year. Asean banks have also doubled down on their net zero targets and signalled that they are still on the lookout for transition-related deals.

Policy signals, the economic viability of technologies and pace of change in global warming will be the key drivers that will inform GIC’s approach to sustainable investing, the spokesperson told Eco-Business.

In particular, it expects demand for climate adaptation solutions to accelerate, which investors will play a crucial role in providing capital for. Earlier this year, both GIC and Temasek released reports sizing up the climate adaptation market, with the former estimating that investment opportunities across the public and private debt and equity will rise from US$2 trillion today to US$9 trillion by 2050, with US$3 trillion of this increase driven by further global warming.

While GIC works to identify more investment opportunities in the climate adaptation space, it stated that it has already invested in a leading data analytics provider using predictive modelling to help the insurance industry, corporates and governments properly price climate-related risks, as well as a water management firm working to reduce water consumption, manage wastewater and improve energy efficiency across a wide range of industries.

Annual investments in clean energy in major economies in 2019 and 2024. While Southeast Asia’s investments into fossil fuels shrunk, it was the only economic bloc that saw a decline in renewables investments in the same period, from US$19 billion to US$15 billion. Image: GIC Report 2024/25

The world’s ongoing push for electrification and clean technologies – which GIC attributes not to government subsidies and regulation, but the “improving economics” of renewables – is also leading the investor to make bets on power equipment supply chains and grid infrastructure.

In particular, GIC said it is upbeat on regulated electric networks and utilities, as investing in their asset base presents additional earnings growth opportunities. The fund, which holds investments in over 40 countries outside of Singapore, stated that it “especially [favours] assets benefitting from stable and transparent jurisdictions” that have regulatory frameworks supporting high cashflow predictability. It is also eyeing solutions addressing grid congestion, such as dispatchable baseload generation and battery storage.