2020 will be remembered as the year when the world’s two biggest crises—climate change and Covid-19—wreaked havoc.

As Europe and the US debate and dispense multi-billion-dollar Covid-19 rescue packages, and the United Nations and the International Monetary Fund call for global investments in a ‘green recovery’, the most accessible and high-impact focus for health and climate would be to accelerate the replacement of coal-fired electricity.

Creating a mechanism to acquire and retire coal-fired assets and recycle those funds to accelerate renewable energy would produce a triple win: creating jobs post-Covid-19, improving public health, and massively changing the trajectory of carbon emissions.

Health costs and climate maths

Coal-fired power generation is one of the largest sources of greenhouse gases and a major contributor to air pollution. Annually, 200,000-550,000 deaths are attributable to coal-fired electricity in China, India, the US and Europe.

Despite these grim statistics, coal-fired electricity accounts for 38 per cent of global electricity generation and about 10 billion tonnes of CO2 emissions. This exceeds the maximum allowable emissions the Intergovernmental Panel on Climate Change (IPCC) says all sources must stay within by 2050 to keep warming within 1.5 degrees Celsius. The IPCC’s targets call for coal-fired electricity to fall rapidly, from 38 per cent to 9 per cent of global generation by 2030 and to 0.6 per cent by 2050.

Yet despite these targets, more than 1,000 coal-fired power plants are planned or under construction around the world. Furthermore, existing coal-fired facilities in Asia—which have lifespans of 30-40 years—are only 11-years-old on average.

This means that global emission reduction targets cannot be reached unless there is large-scale action to accelerate the retirement of existing coal-fired power plants and to halt the construction of new plants. Current ESG investment initiatives that encourage global financial institutions to divest from coal assets does not solve the problem as, in many cases, those assets are acquired by less sustainability-minded owners.

A coal retirement mechanism

Over 90 per cent of planned and over 70 per cent of existing coal-fired capacity is in China, India and about 20 other developing countries. China, the largest user and biggest builder of coal-fired electricity, is planning to reduce its total coal-fired power generation and has both the technical and financial capability to accelerate its shift towards renewable energy.

Many lower-income countries, however, lack the financial and/or technical capacity to rapidly scale up renewable energy despite dramatic improvements in the cost of renewables, as well as in the storage and distribution of electricity.

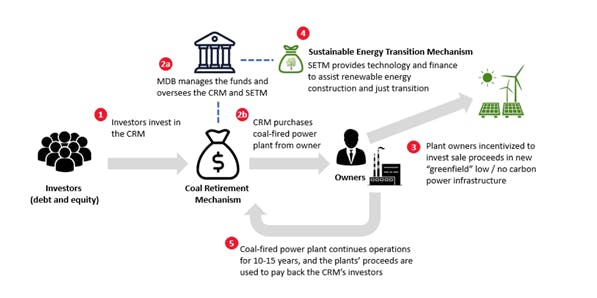

Achieving both retirement of existing coal-fired assets and a sustainable energy transition in those countries would require a large-scale initiative in two parts: a coal retirement mechanism (CRM) to acquire and retire existing coal-fired electrical plants within 10-15 years instead of the currently expected lifetime of 30-40 years, and a sustainable energy transition mechanism (SETM) to provide technical expertise and financial assistance to replace the retired and planned coal plants with a combination of energy efficiency, renewable energy and storage, and possibly gas as a bridge.

Furthermore, rather than being sunk capital, the amounts paid by a CRM to existing coal power plant owners would create a large and immediate source of finance for greenfield renewable energy projects, creating new ‘green’ jobs for the post-Covid-19 recovery. In fact, requirements and incentives to use CRM funds for green energy could be built into the SETM.

The CRM and SETM explained. Image: Donald Kanak

Rather than creating a new and expensive global bureaucracy to oversee the CRM and SETM, an existing global or regional multilateral development bank (MDB) could act as the lead shareholder and administrator of both mechanisms in each country. This allows existing MDBs to divide duties and to expedite establishing and operating CRMs in different countries whilst adapting to national circumstances.

A critical prerequisite for establishing a CRM and SETM would be access to low-cost funds from developed nations and MDBs, which today can borrow at near-zero rates. There may be a role for philanthropic or impact capital as well.

Furthermore, there must be firm agreements between host governments and the lead MDBs on an energy transition road map linked to the country’s emissions reductions commitments and just transition plans, which would include retraining, job assistance and the development of new industries in affected communities. The agreements would need strong provisions to ensure follow-through and to prevent the building of new coal-fired power plants.

Is it affordable? Who will pay?

Using established valuation principles, a CRM should be able to purchase and retire half of the coal-fired capacity in smaller low-income countries for $1-2 billion, and $10-30 billion in larger countries such as Vietnam or Indonesia.

Those are large sums, but to contextualise those amounts, $30 billion is only 0.1 per cent of the $26 trillion investment required for infrastructure in Asia in 2016-2030, or about 7 per cent of the $412 billion that Indonesia plans to invest in national infrastructure in 2020-2024.

Preliminary modeling based on input from experts in energy finance and development suggests that a CRM should be able to purchase existing coal-fired plants and use the revenue of those plants to repay the CRM’s donors and investors in 15 years with a 5 per cent return on investment. In some scenarios, supplementary revenue possibly from reallocating fossil fuel subsidies or from carbon credits could be used to meet the 15-year retirement schedule and the return objective.

Political feasibility and just transition

Developing countries, like their developed counterparts, face political resistance and legal constraints in transitioning away from coal. Not only would a CRM or SETM reduce political opposition, but it should bolster the host country’s confidence to manage energy security and mitigate economic impact to affected communities and workers. As the CRM targets to retire only 50 per cent of existing coal facilities with a 10-15 year transition period, the country can sign on to further reductions as confidence grows.

There are positive signs that with appropriate assistance, developing countries are ready to change their energy blueprints, improve health, and reduce their carbon emissions. Indonesia’s Energy and Mineral Resources Minister has suggested an openness to replacing old coal-fired power plants with renewable energy and several ministries are joining forces to pilot carbon trading in 2020. Vietnam is considering reducing its total coal-fired capacity and building new wind and solar power plants.

China’s role in its own transition and its assistance to other countries will be pivotal. China has reduced coal’s share of electricity generation and plans to further reduce it to 44 per cent by 2035. That level of generation will still, however, be greater than the IPCC’s global target for coal-fired electricity emissions for all countries.

Upon seeing greater commitment to retire coal in other G20 economies, China could contribute greatly to achieving the IPCC’s 2030 and 2050 targets if it could further accelerate its own transition. Hopefully, with multinational support for more rapid energy transition, China, Japan and other countries that support the construction and financing of new coal-fired plants would see greater opportunities for their citizens and corporations in exporting renewable energy solutions.

Left unaddressed, coal-fired electricity alone will overwhelm the IPCC’s 2030 and 2050 emission targets. In the lead up to COP26, leaders of developed countries and the MDBs have a golden opportunity to support a ‘green recovery’ from COVID-19, tackle climate change, and contribute to improving public health.

If MDBs lead by mobilising funds and by overseeing the establishment of CRMs and SETMs, progressive leaders of developing countries can step forward to pilot concepts, accelerate the retirement and replacement of existing coal-fired facilities, and provide their citizens with a just transition toward a more sustainable energy future.

Donald Kanak is chairman of Eastspring Investments, the Asia investment organisation of Prudential plc.