It has been a tumultuous year for the energy sector, with both wins and losses in for sustainability in the sector. While in many countries funding and political support for renewable energy reached unprecedented levels such as India, China, and Indonesia, the sector regressed in Australia, where the Abbott government slashed the country’s renewable energy target and powered ahead on coal projects, earning Australia the title of ‘Worst Performing Industrial Country on Climate Change’.

Meanwhile, the global movement to divest fossil fuels seemed to be gaining ground, and the drastic drop in crude oil prices at year-end had a ripple effect on many economies and financial markets, changing the dynamics of energy landscape dramatically.

Here’s our pick of the top 5 developments this year:

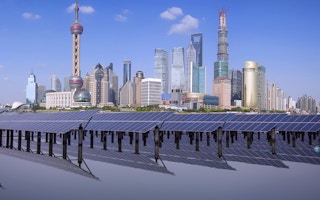

1. China overtakes North America and Europe on clean energy, solar

China has cemented its position as the top investor in renewable energy investment. The Global Status Report, released in June by the Renewable Energy Policy Network for the 21st Century showed China spent a total of US$56.3 billion on wind, solar and other renewable projects. The report stated that China accounted for 61 percent of the total investment in renewables by developing countries, and that China invested more in renewable energy than all of Europe last year.

In February, Bloomberg figures also showed China’s investment in energy efficiency reached US$4.3 billion, overtaking the United States’ spending - at US$3.6 billion - for the first time ever. A separate report launched in August also found that China had surpassed Europe’s solar leaders, Germany and Italy as the world’s biggest solar market. With an installed capacity of 12GW and US$23.56 billion of financing for the country’s solar industry, China’s top spot as a solar market reflects its commitment to curb emissions and shift to cleaner energy after widespread criticism for its polluting, carbon-intensive economic growth.

2. Solar’s year in the sun

A Bloomberg report in August reported that for the first time since 2006, global demand for solar panels was set to outstrip supply, resulting in a looming shortage of photovoltaic panels across the industry. This shortage was caused by a global glut of panels in the past two years, which made solar a more affordable energy source for many countries and consumers.

The industry is set to install 61 gigawatts of solar panels in 2015, up from 40 gigawatts in 2013, according to Bloomberg New Energy Finance. Some solar manufacturers expect a shortfall in supply, while others have begun to expand to meet this growing demand, said the report.

3. Fossil fuel divestment enters mainstream

At the UN climate summit in New York in September, the Rockefellers, who made their vast fortune on oil, along with other philanthropies and high-wealth individuals, announced pledges to divest a total of $50 billion from fossil fuel investments - signalling how the global movement has grown.

Since it launched three years ago, the worldwide campaign calling on universities, religious institutions, cities, and states to stop investing in the fossil fuel industry is growing faster than any other in history, now spanning 697 campaigns worldwide. Norway is also considering divesting the country’s $840 billion sovereign wealth fund. This has understanably made the energy lobby sit up, and helped spark investment into cleaner, renewable forms of energy.

4. Asia scales up renewable energy targets

Governments across Asia announced plans this year to increase the share of renewable energy sources in their energy mix - an important step for reducing developing Asia’s dependence of fossil fuels.

China, the world’s top emitter of greenhouse gases, in November pledged to increase the non-fossil fuel share of all energy to around 20 per cent by 2030 as part of its landmark climate agreement with the United States. This is more than double of the current share of renewable and nuclear energy in China’s energy mix, which stood at 9.8 per cent in 2013.

India, which is under renewed scrutiny to act on climate change following the US-China deal, announced plans in November to grow the contribution of renewables such as solar and wind from 6 per cent currently to 15 per cent over the next five years. The government also announced plans to increase its target to generate 20,000 megawatts (MW) of solar energy by 2022 to 100,000MW. Indonesia too announced plans to double the energy generated by renewable sources from 10.7 gigawatts (GW) currently to 21.5 GW by 2019 – a target that would require $36 billion in investment.

At a regional level, the Asia-Pacific Economic Cooperation in November also announced a plan to double the share of the region’s energy mix within fifteen years. To achieve this, APEC shared plans to reduce tariffs on environmental goods such as renewable energy components, cooperation among member countries on technology adoption, and renewable energy grid integration. As a means to speed up the adoption of renewable energy in Asia, the Asian Development Bank launched the world’s first online marketplace in Singapore that will link global cleantech companies with prospective clients in the region.

5. Global price of oil drops sharply

The price of oil dipped below US$60 a barrel in December after members of the Organization of Petroleum Exporting Countries (OPEC) decided against reducing oil output despite a forecasted drop in demand. This prompted the biggest one-day decline in oil prices in three years.

The drop in oil prices is expected to have far-reaching ramifications for the global energy landscape – low prices undercut the economic growth of oil producing countries such as Nigeria, Russia, and Venezuela. Oil importing countries, on the other hand, welcomed the oil price drop as a means to boost economic growth. The United States, the world’s largest oil consumer, rejoiced at drops in fuel prices even as the European Union experienced a “welcome, if small boost to growth”, along with China and other Southeast Asian countries.

Governments in Southeast Asia also capitalised on the decline of oil prices to scale back on wasteful fossil fuel subsidies – Malaysia abolished petrol and diesel subsidies at the beginning of December, while Indonesian President Joko Widodo also reduced fuel subsidies in November. The drop in oil prices was also linked to falling demand from importing countries, a trend that signalled increased energy efficiency and a transition from fossil fuels.

While there were some concerns that the tumbling oil price would adversely affect the renewable energy sector, analysts said it will have limited impact on the $250 million global clean power industry. Commitments from countries such as the United States, China, and Japan to cut greenhouse gas emissions and promote alternatives to fossil fuel would continue to support the uptake of renewables, and a temporary drop in oil prices would not derail investment in the clean energy sector, said analysts.

This story is part of our Year in review series, which looks at the top stories that shaped the business and sustainability scene in each of our 11 categories.