China’s central government has ranked its provinces according to the financial risks posed by investments in coal-fired power, an effort to curb chronic overcapacity in the sector.

The traffic light warning system comes a year after the central government devolved powers on environmental impact assessments related to coal projects.

In the past year, coal mining companies and coal-power generators have been amassing debt, increasing the extent to which stranded coal assets creating financial instability.

But rather than curbing coal-fired power expansion, many provinces appear to be encouraging it, with potentially chaotic consequences for China’s targets on renewable energy.

In response, the National Energy Administration (NEA), a government body presiding over energy policy, and the National Development and Reform Commission (NRDC), an administrative body with control of economic regulations, have published a joint index aimed at highlighting the distribution of risk across the country. This follows a government announcement made in April calling a halt to excessive investment in coal-fired power.

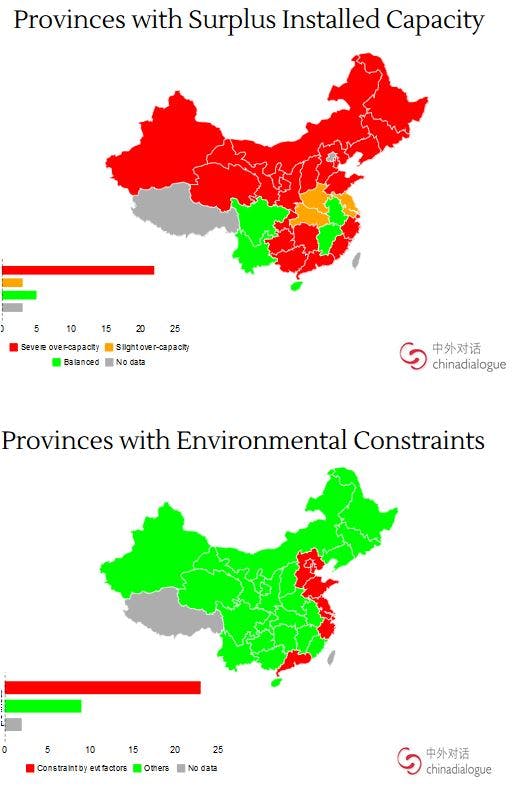

The index is composed of three categories, red, amber and green, based on the following criteria: abundance of installed capacity, constraints on local resources (such as water) and economic returns.

Fourteen provinces have been given red alerts that highlight the poorest economic returns; and 17 classed as green, where the risk is least severe (see map below).

Provinces given red warnings must slow down approvals of new coal-fired power projects immediately, while utilities are obliged to exercise caution when approving new projects, and ensure that new projects come online over a longer period of time.

An amber warning signals that provincial governments and businesses should approach new projects with caution. China also has a target to peak carbon emissions by 2030 or before, a goal that would become more complicated if the country’s regions allow lots of new coal-fired power stations to be built despite overcapacity.

The index is based on the predicted “reserve rate” three years from now. The reserve rate is the generating capacity available in the event of a generation plant going down or other supply disruptions. Under the new alert system, a glut of reserve is classed as red; while a balanced supply and demand, or undersupply and low reserve capacity, is classed as green.

Economic viability is used as one of the index criteria, and is based on the predicted return on investment of new coal-fired power capacity three years in the future. This calculation is compared with the rate of return from interest rates in medium to long-term government bonds.

Where returns are expected to be lower than government bonds, the risk is classed as red; a similar level of return to government bonds is classed as amber; while a higher return than bonds guarantees a rating as green in the traffic light rating system.

This article was originally published by Chinadialogue under a Creative Commons license.