Financial regulators in Hong Kong have been working through the months of the pandemic on measures that prepare the finance sector for events which many believe represent much greater economic risk: climate change.

It is reassuring to know that it did not take the recent fires in Siberia and the United States or the sudden and severe floods in Europe, India, Africa and China to spur them to action.

Before these most recent manifestations of climate change, consultations and drafting of climate risk management frameworks have continued within the Hong Kong Monetary Authority (HKMA) and the Securities and Futures Commission.

The HKMA released the Climate Risk Management section of its Supervisory Policy Manual in July.

One important headline indicates that all the Authorised Institutions (AIs) under HKMA supervision (banks and money lenders) are expected to prepare climate-related disclosures as soon as possible, and no later than mid-2023.

The HKMA knows this represents a tough call, so fully aligning disclosures with the Task Force on Climate Related Financial Disclosures (TCFD) framework will be expected no later than 2025.

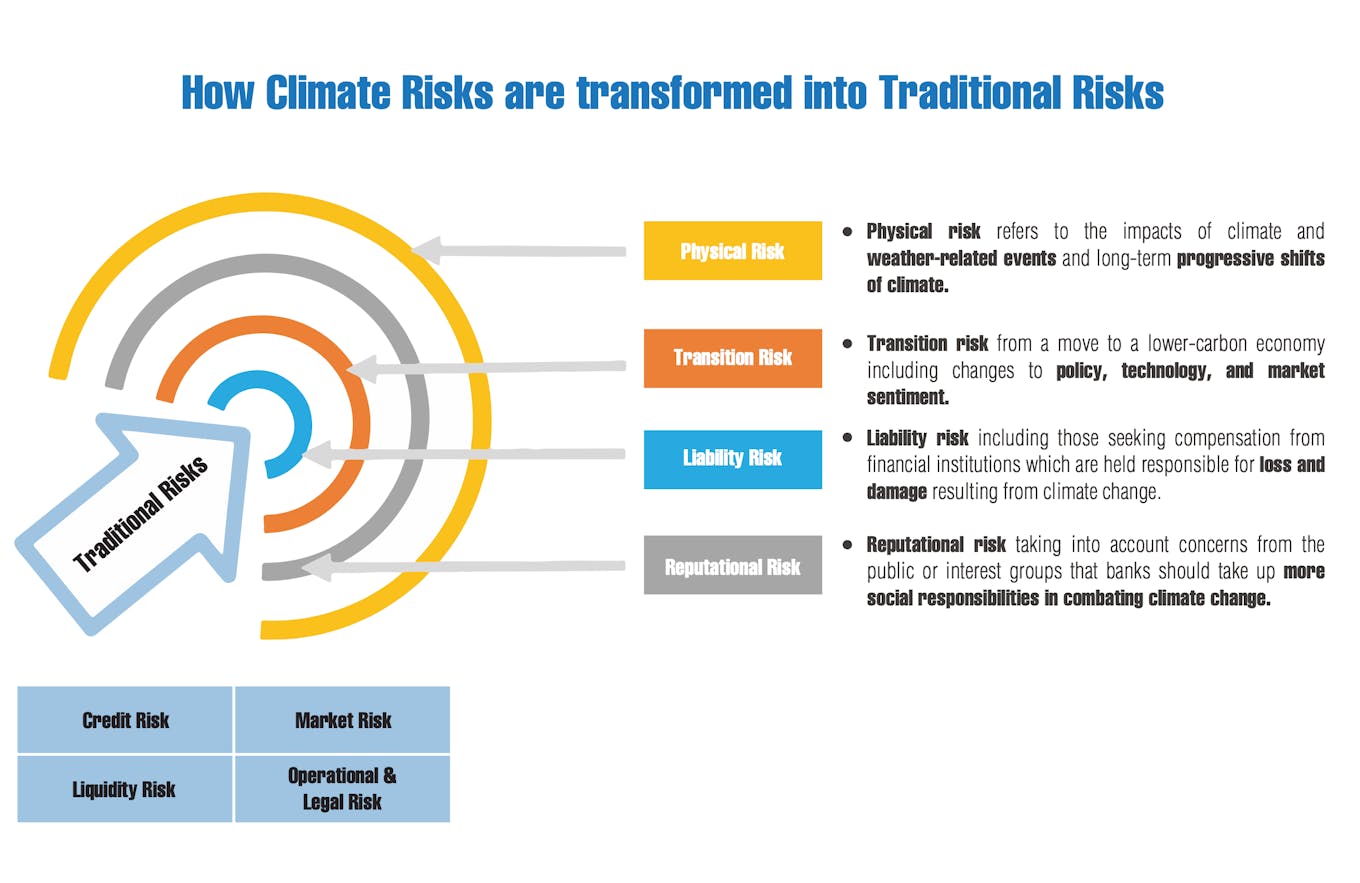

The guidance makes it clear HKMA is not expecting a superficial compliance exercise. They are calling for a comprehensive examination of how climate risk may affect banks’ operations and may impact more traditional measures related to credit, liquidity, market, operational, reputational, strategic and legal risks.

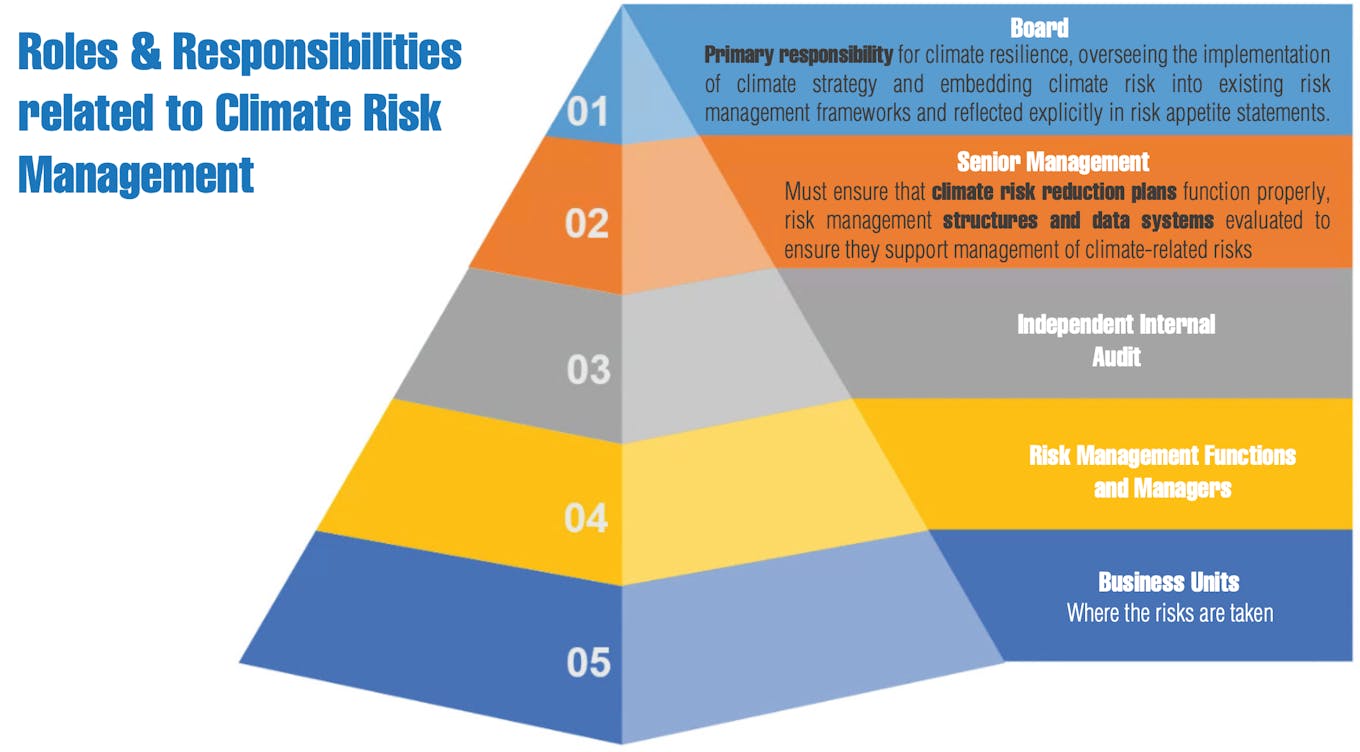

The HKMA goes into some detail about how climate risk should be governed and managed, how client risk should be assessed, internal operations prepared, scenarios analysed, stress tests adapted to cover climate risk, and how monitoring should include keeping abreast of the big issues related to climate change.

The HKMA warns banks that climate change impact could be much larger, more widespread and diverse than other structural changes, and the complex interaction between climate and social, economic, technological and regulatory systems presents significant challenges to risk identification, measurement and strategies.

Banks have legal obligations to monitor risks and conduct business with integrity, prudence and professional competence in a manner which is not detrimental to the interests of depositors. HKMA makes clear this obligation applies to climate change risk as much as the more familiar financial aspects of their operations.

Daunting tasks awaiting bank management

The infographic below highlights the daunting tasks bank management faces in transforming climate risks into traditional risks that their operational staff can take on board.

Image: Carbon Care Asia, 2021.

Banks are urged to ensure sufficient resources are allocated to climate strategy implementation. A comprehensive strategic assessment could benefit from stakeholder engagement to reflect increasing awareness of climate related issues in the community and national and international climate goals.

The following infographic makes it clear that climate risk management cannot be compartmentalized in one corner of a bank, but rather it is a cross-cutting issue affecting all levels.

Image: Carbon Care Asia, 2021.

Dodging is not an option

While setting climate goals is not mandatory, HKMA is clear that AIs should be aware of the potential adverse impact of inaction on greenhouse gas reduction targets if the organisation cannot demonstrate it is aligned with the climate goals of local and national authorities and international agreements.

To create this set of requirements, HKMA has drawn on the work of the heavyweight international regulatory alliances: the Financial Stability Board, the Central Banks and Supervisors Network for Greening the Financial System and the Basel Committee on Banking Supervision.

Climate risk management by banks will play an important part in ensuring the finance sector contributes to accomplishing climate change targets. There will be no dodging these new measures just as there will be no dodging the implications of a changing climate.

John Sayer is director of Carbon Care Asia, a consultancy in carbon strategy, sustainability innovation and green finance.