An action plan for energy cooperation sets out that Asean seeks to raise the proportion of renewable energy in its energy mix to 23 per cent by 2025. However, as of 2020, renewable energy only takes up 14.2 per cent of its total primary energy supply. Asean needs to seize any available funding opportunity, including climate financing, to close the regional target gap.

According to the 7th Asean Energy Outlook (AEO7), the required clean energy transition investment in the Asean power sector under business-as-usual (BaU) from 2021-2050 is US$970 billion.

This amount is far less than the investment required to fund the impact of BaU externalities such as droughts, storms, and pollution-caused health problems, which could reach US$4,569 billion by 2050.

To continue reading, subscribe to Eco-Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

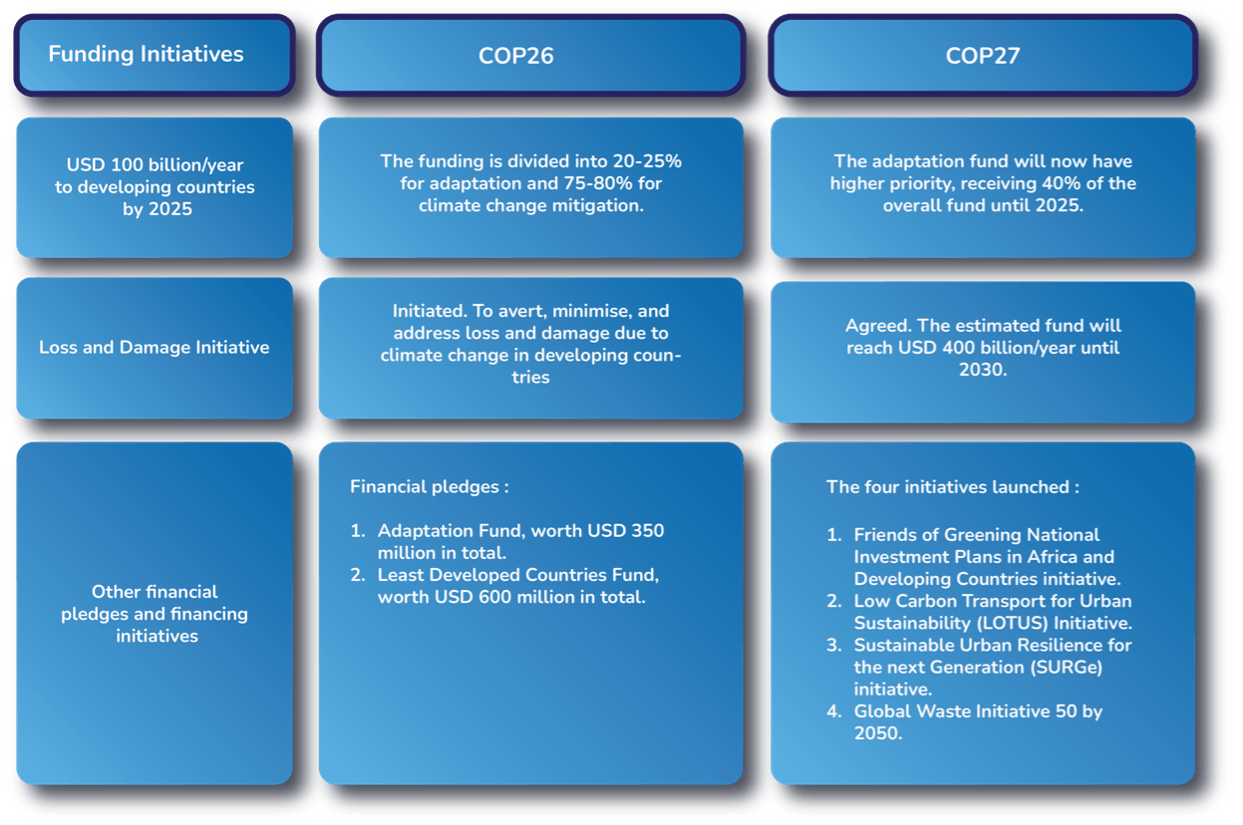

Some new funding opportunities that can be utilised to finance clean energy transition and climate adaptation programmes were initiated at the last COP meeting. At COP27, held in Sharm El-Sheik, Egypt, an important step towards achieving climate justice was made by the establishment of a loss and damage fund in which countries most responsible for the climate crisis agreed in principle to compensate the countries experiencing the worst impacts. The world’s developed countries had pledged earlier to pay US$100 billion a year in climate finance to developing countries by 2020.

Though it appears to be a large investment, US$100 billion per year is, in fact, a modest amount, compared to the total required clean energy investment in Asean.

The table below provides detailed updates on the existing and newly launched climate funding initiatives in COP26 and COP27. Although the latest COP was concluded three months ago in November 2022, most initiatives are still at the stage where donor funding is pending. It is not too late for Asean countries to tap into the agreed climate financing opportunities by preparing an investment-ready environment for clean energy development.

Funding comparison between COP26 and COP27

COP27 also captures more ambitious targets in the updated Nationally Determined Contributions (NDCs) of different countries. It implies that effective and strategic financing mechanisms are essential.

Some Southeast Asian countries have expressed support for the loss and damage fund, but cautioned that climate finance promises from developed countries have not been forthcoming.

A 2022 technical report published by the United Nations Framework Convention on Climate Change confirms that the goal of developed country parties to jointly mobilise US$100 billion per year has not yet been realised. Climate finance provided and mobilised by developed countries for developing countries was US$83.3 billion in 2020; the goal is likely to become achievable from 2023 onwards.

At COP27, only 34 nations submitted their NDC updates. Among these countries, four Asean member states, Indonesia, Thailand, Singapore, and Vietnam, submitted their enhanced NDC with different implementation priorities.

Among them, Indonesia, Thailand and Singapore said plans to reach their emission reduction target will be achieved by scaling up their renewable energy share, while Vietnam is focusing on improving energy efficiency and savings.

Indonesia announced the development of innovative green finance instruments such as its green sukuk and green bonds, a public-private partnership through the SDGs-One Indonesia Platform. It also said that it will implement a carbon tax by 2024 or sooner.

Singapore plans to raise its carbon tax from SG$5 (US$3.5) to SG$25 (US$17.5) per tonne by 2025, to SG$45 (US$31.5)/tonne by 2027 and to a maximum of US$59/tonne by 2030. Singapore also revealed its Climate Action Data Trust database, which will be launched in 2023 to avoid double-counting carbon credit data.

The implementation of the carbon market is also being pursued in Thailand and Vietnam. Thailand and Switzerland have just signed an agreement on carbon credit trade, technology transfer, and fund support.

Meanwhile, Mr. Tran Hong Ha, Vietnam’s Minister of Natural Resources and Environment, stated that Vietnam is establishing carbon markets and is seeking Singapore’s assistance to complete the legal framework for the market formation and the institution for governance.

Besides bilateral collaboration on carbon market creation, the two countries are also expanding their cooperation to reduce emissions in other strategic sectors. Thailand has agreed to collaborate with the United States to reduce methane emissions from agricultural and animal husbandry sectors.

Meanwhile, Vietnam signed a new Memorandum of Understanding with France to strengthen bilateral cooperation on emission reduction and energy transition, which will be funded by Agence Française de Développement (AFD) Group such as Facility 2050 and the Euopean Union-funded WARM (Water and Natural Resources Management) Facility.

Even though Asean is relatively new in clean energy financing, member states received US$2.1 billion in 2015 to US$3.4 billion in 2020 from Multilateral Development Bank. This clearly states that renewable energy-related policies are becoming more stable and clearer, which has succeeded in attracting many investors.

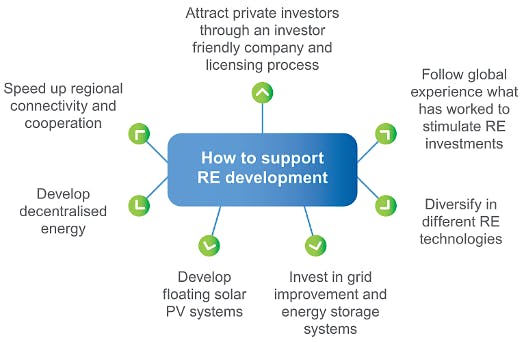

Figure 1. Seven key actions in supporting renewable energy financing and investment in Asean. Source: Asean Centre for Energy, 2022

Despite the improvement in renewable energy financing commitments, there are seven key actions to improve renewable energy investment in the region, as depicted in the figure above.

The most crucial component is establishing good governance on enabling registration and legislative processes to attract more renewable energy investment.

This can be achieved by consolidating all renewable energy processes into a single institution as what European Union and India have done. In Asean, only Malaysia adopts this one-stop-shop concept with its Sustainable Energy Development Authority (SEDA).

Moreover, since many Asean member states have small and remote islands, developing decentralised energy becomes crucial in realising the SDG and renewable energy goals more cost-effectively. Previously, many efforts in off-grid development have been implemented in the Mekong region (Cambodia, Lao PDR, Myanmar, Thailand and Vietnam).

The same initiative is also being implemented in Malaysia with its renewable energy Islands project, which focuses on building solar and low-speed wind smart grid plants in Redang, Perhentian and Tioman Islands. Meanwhile, the other five actions are also being executed at different levels in each country.

Clearly, from these findings, the awareness of climate change’s mitigation and adaptation in Asean is progressing positively, as can be seen in countries’ climate goals that are constantly being updated. However, despite this positive endeavour, renewable energy share in the 2020 energy mix is still 8.8 per cent lower than the 2025 regional target.

Thus, more international support and investment are needed to ramp this development up. Also, Asean member states are encouraged to actively implement the above seven key actions to cultivate the perfect environment for renewable energy development whilst ensuring the region meets the goals outlined in its submitted NDC.

Faricha Hidayati is a research assistant at Sustainable Energy, Renewable Energy and Energy Efficiency (REE) Department, Asean Centre for Energy (ACE). Monika Merdekawati is a technical officer while Septia Buntara Supendi is a manager at ACE.