The coronavirus pandemic has seen entire countries locked down, with businesses, industry and travel all curtailed in an effort to limit the spread of Covid-19.

My analysis for Carbon Brief shows that electricity demand in Europe has fallen by 14 per cent as a result of the crisis, with most major economies imposing widespread restrictions.

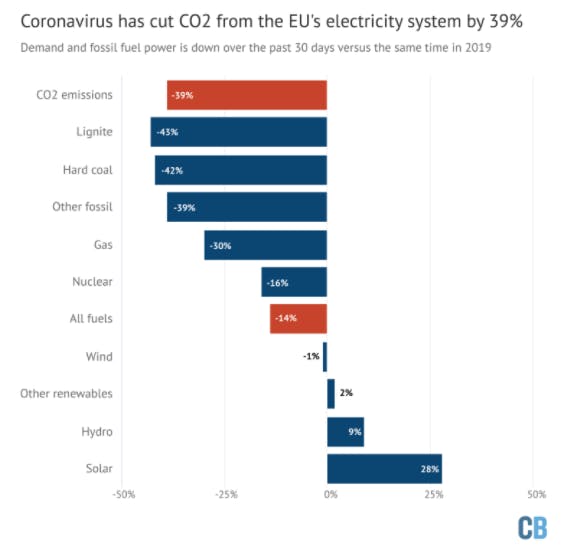

This has resulted in lower levels of coal and gas being burned to generate electricity, meaning CO2 emissions from the sector were 39 per cent lower over the past 30 days than this time last year.

Analysis of detailed electricity data for the 27 EU member states plus the UK, over the past 30 days, also shows that solar generation rose by 28 per cent compared with the same period last year, due to new installations and a sunny April across Europe.

Combined with the fall in overall demand, this means many countries set new record-high shares for renewables in April, as well as record lows for fossil-fired electricity generation. Across the EU27 and UK combined, wind and solar reached a record-high 23 per cent share over the past 30 days, offering valuable insights on the road to zero-carbon electricity systems.

The data from this unprecedented crisis shows that electricity systems can operate smoothly and reliably, even when variable renewables such as wind and solar meet higher shares of demand, which had not been expected until at least 2025.

But this “postcard from the future” of the electricity system also highlights a lack of flexibility, with many power plants unable to switch off in response to low or negative market prices. Electricity systems must become much more flexible to absorb higher levels of wind and solar in the future, including through “responsive demand” that can shift to when power is cheap.

“

The data from this unprecedented crisis shows that electricity systems can operate smoothly and reliably, even when variable renewables such as wind and solar meet higher shares of demand, which had not been expected until at least 2025.

Falling demand

In the face of rapidly spreading coronavirus epidemics, most European countries began to lock down their economies around a month ago, introducing strict controls on movement. This crisis has had major impacts on the electricity sector across Europe, shown in my analysis of data for the 30 days from 28 March to 26 April, compared with the same period last year.

The data shows electricity demand is down 15 per cent in the UK and 13 per cent in the EU-27 over the past 30 days, against the same period last year. This is shown in the chart, below, with Italy seeing the EU’s biggest reduction in demand, at 23 per cent, followed by Spain and France.

Note that the analysis has not been temperature-adjusted, as the last 30 days were comparable in temperature to the same period last year.

Coal-fired electricity has taken the brunt of the reduction in demand – with output falling by more than 40 per cent – because it is currently the most expensive fuel. Brown coal (“lignite”) generation fell by 43 per cent and hard coal fell by 42 per cent, as shown in the chart, below.

Change in electricity output and CO2 emissions for the EU27 and UK from 28th March to 26th April compared with the same period in 2019. Changes for each fuel are shown in blue, with the overall reduction in demand and CO2 emissions is in red. Source: Analysis of data from the European Network of Transmission System Operators for Electricity (ENTSO-E). Chart by Carbon Brief using Highcharts.

Even generation from lignite – often thought of as a cheap fuel – is now more expensive than gas, with a cost of €20-€26 per megawatt hour (MWh) just to cover CO2 emissions permits. In contrast, it costs €20/MWh for the gas and CO2 permits to run a gas plant with mid-range efficiency. Consultancy Aurora Energy Research has forecasted that this means profits could fall by 40-80 per cent at Polish coal plants.

The most dramatic reductions in coal output over the past 30 days have been in Germany, where lignite generation fell 55 per cent and hard coal by 65 per cent. Moreover, Germany’s usual electricity exports to its neighbours dried up, so while national electricity demand was down 9 per cent, production fell nearly twice as fast, by 17 per cent.

Similar trends are cutting coal-fired electricity generation in the US. But coal is not the only fossil fuel being affected by low demand. Gas-fired generation also fell substantially in Europe, down by 30 per cent.

Gas also fell because coal-fired generation had already fallen to zero in many instances, making gas the next to be switched off as the second-most expensive fuel. The falls in coal and gas generation were exacerbated by a 28 per cent increase in solar generation, due to new installations and a very sunny April,

The reductions in coal and gas generation mean CO2 emissions from Europe’s electricity sector were 39 per cent lower than in the same 30 days last year, falling from around 78m tonnes (MtCO2) to 48MtCO2. Last year, CO2 emissions from the electricity sector in the EU27+UK were 844MtCO2, a figure that is already down 29 per cent from just six years before.

Breaking records

Falling output from the continent’s coal plants mean the fuel hit new record low shares of the electricity mix in Europe. Across the EU27 and the UK, coal averaged just 11 per cent of the electricity mix, compared to 16 per cent in the same period last year.

During the past 30 days of this analysis, several countries have run for extended periods without burning any coal to generate electricity at all. Great Britain set a new coal-free record of 18 days and counting, while Portugal has gone coal-free for more than a month.

The rapid fall of coal power in Spain continues, with only 3 per cent of its electricity coming from the fuel over the past 30 days, as the chart below shows. In the same period, Romania and Greece each saw their coal share more than halve year-on-year to little over 10 per cent of the electricity mix.

In Germany, coal’s share also nearly halved to just 16 per cent of electricity, down from 30 per cent a year ago. Meanwhile, both Austria and Sweden closed their last coal power plants and became permanently coal-free this month. This takes the total number of EU members to have phased out coal power to six, with another 11 set to follow.

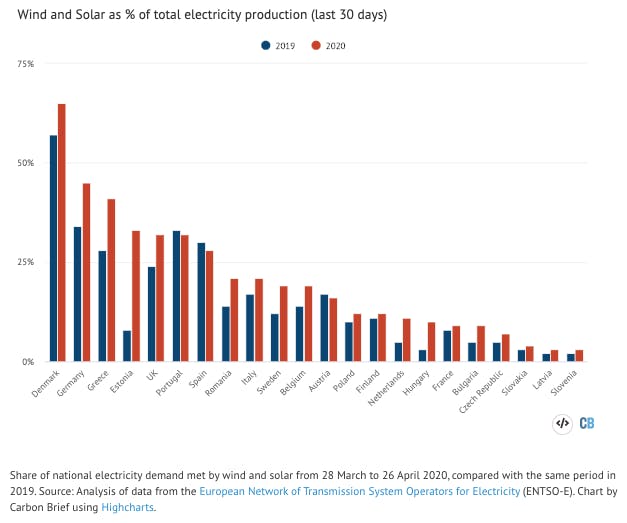

There have also been records for wind and solar, which accounted for 23 per cent of EU27+UK electricity production over the past 30 days. This is the highest ever share for a 30-day period and up five percentage points on the 18 per cent share in the same period last year.

The chart below shows that the highest national shares were 65 per cent in Denmark, up from 57 per cent last year, followed by Germany at 45 per cent, up from 34 per cent, and Greece at 41 per cent up from 28 per cent. In the UK over the past 30 days, wind and solar supplied 32 per cent of electricity, up from 24 per cent last year.

Solar power set new records in the UK, Germany, the Netherlands, France, as more solar panels are constantly being installed across Europe. On 20 April in the Netherlands, renewables made a record 50 per cent of the country’s electricity and fossil generation fell to a record-low 24 per cent.

Negative prices

The unprecedented conditions caused by the coronavirus crisis have sparked conditions in Europe’s electricity system that were not expected for several years. Nevertheless, electricity supplies on the continent – and across the world – have remained resilient.

This is despite the virus threat causing staffing issues and necessitating new operating practices to cope with social distancing rules. European electricity system operators are meeting regularly together because of the crisis.

Recent weeks, have, however, highlighted a number ways in which Europe’s electricity systems will need to evolve in order to cope with ever-greater shares of wind and solar.

For example, electricity markets have seen low demand combine with high wind and solar output, unsettling the balance between supply and demand. As for recent oil market turmoil, this lack of balance has led to an increase in the number of hours with negative electricity prices.

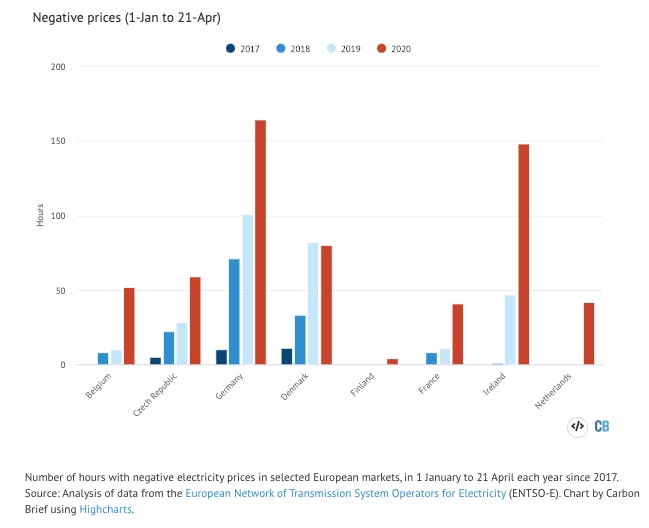

Negative prices occur when electricity supply is expected to outstrip demand, effectively meaning that prices must go below zero to force some power stations to switch off. Although such periods have happened before over the past decade, there has been a marked increase in their frequency across several European markets this year, as the chart below shows.

Analysis of ENTSO-E data for Carbon Brief shows a record number of hours with negative prices in every country at this point in the year. France, Netherlands and Belgium, which have previously had little experience of negative prices, have each seen a sharp uptick.

Ireland is seeing many periods of negative prices during windy days, reaching more than 140 hours so far this year. This almost matches Germany, where around 6% of hours in 2020 to date have seen prices below zero. Even Sweden and Finland saw negative prices for the first time.

Inflexible fossils

While negative pricing may be new for oil, it has been a feature of European electricity markets for a decade. In both cases, negative pricing reflects a lack of flexibility from market participants, with producers unable to reduce their output or consumers unable to take advantage of low prices by raising their demand.

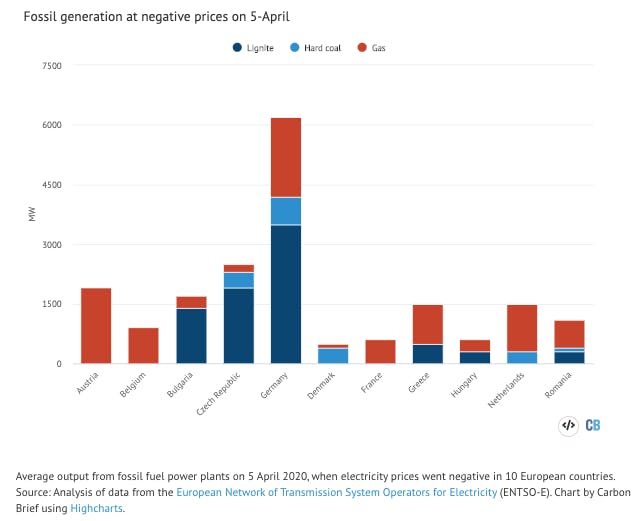

My analysis of recent ENTSO-E data for this piece shows that there were negative prices simultaneously in 10 EU countries at lunchtime on Sunday 5 April. Despite this, some fossil-fuelled power plants continued to generate electricity, indicating a lack of flexibility.

The most inflexible fossil plants are lignite-fired coal generators, which continued to produce electricity during negative pricing on 5 April in Germany, Bulgaria and the Czech Republic, as shown in dark blue in the chart, below.

Lignite plants operating despite negative prices is likely to reflect a lack of investment in flexibility. Although it would be possible to make these plants more flexible, they are already likely to be loss-making, meaning that closing them may be a cheaper option.

Gas generation was also running despite negative prices in many countries, although this may reflect a need to support grid stability rather than an inability to switch off.

Increasing flexibility takes time, meaning planning for the future is required. Europe’s fossil generation fleet has been getting much more flexible over the last 10-20 years. Key changes include those at the power plant, which may need investment, staff training, or renegotiation of fuel supply and heat contracts, as well as with power market design.

Inflexible nuclear

Nuclear plants also tend to be relatively inflexible and this is confirmed by my analysis of recent European data. Over the Easter weekend, when prices also turned negative, most nuclear plants continued to operate outside France and Germany, as the chart below shows.

There has been much debate over the potential to run nuclear plants flexibly as grids are increasingly decarbonised. It is technically possible to do so with some reactor designs and in France, state-owned utility firm EDF reduced the output from its nuclear fleet by one third, from 37 gigawatts (GW) to 25GW, when negative prices hit.

On 8 April, French grid operator RTE cited the exceptional circumstances as nuclear plants used all their flexibility during a windy weekend on the second week of lockdown, noting that this situation is likely to occur increasingly often.

Still, EDF has announced that it will take nuclear plants offline from now until 2022, equivalent to some 170 terawatt hours of generation, or roughly half the UK’s annual total. EDF cited lower electricity demand from Covid-19 as one factor in its decision.

Although CO2 emissions from Europe’s electricity system are currently below normal – as my analysis shows – EDF’s decision could increase emissions over the next year, if the plants it is taking offline would not otherwise have closed temporarily for maintenance.

Inflexible renewables

My analysis shows that during recent periods of negative pricing, some wind, solar and biomass plants have also been relatively inflexible, despite the technical capability to switch off.

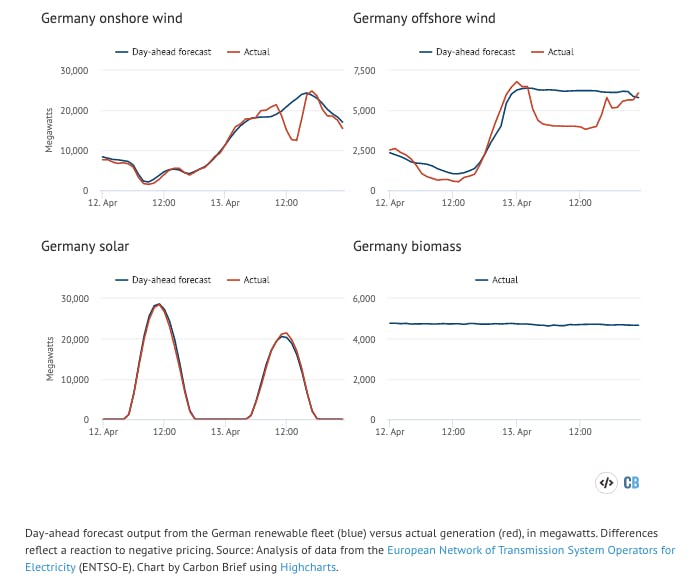

When prices went negative on Easter Monday lunchtime, German onshore windfarms nearly halved their output in line with negative prices, as the chart below left shows. Yet over half the fleet did not switch off. Similarly, only a minority of offshore windfarms reacted (top right) and neither solar (below left) nor biomass plants (below right) noticeably adjusted their output.

A combination of technical investment and market reform will be needed to increase the flexibility of renewable plants. For example, new government contracts or subsidies can be designed to encourage renewable assets to respond appropriately at times of system stress.

The UK government is currently consulting (pdf) on a change to its primary renewable support scheme (“contracts for difference”) that would see no subsidies paid in any hour which was negatively priced in “day ahead” electricity markets.

Responsive demand

There is a general consensus that electricity markets will need to become increasingly flexible in order to reach zero carbon at lowest cost.

Another way to improve flexibility is to encourage electricity consumers to respond to market prices and tariffs designed to do this are now starting to become available. Such tariffs offer lower prices when electricity demand is low, with prices going up when supply is tight.

One recent example is in the UK in April, where utility firm Octopus Energy paid customers to use electricity when wholesale prices went negative. Another example is that search giant Google is shifting non-essential processing tasks to the hours of cleanest generation, based on day-ahead hourly forecasts of grid “carbon intensity”.

Car charging will also play a role in moving electricity demand, but although the UK has nine retail tariffs dedicated to electricity vehicle charging, not one seems to include a pricing structure that encourages consumers to choose the cheapest point overnight to charge their car.

Grid stability

The current crisis also highlights another challenge for electricity grid operators. With demand far below normal levels, grids can become less stable.

On Easter Monday at 5am, Great Britain had its lowest ever demand on the national grid. For system operator National Grid, maintaining enough “inertia” when demand is low is a challenge that has historically been met by fossil-fired power plants. The firm says:

“[C]oal and gas generators are currently the only forms of controllable inertia generators on the [GB] system. So even when there is low demand we might have to bring on some gas and coal generators to ensure that we have enough inertia”.

On Easter Monday, the firm did just that, bringing on 2GW of gas power plants, whilst instructing windfarm and interconnector operators to reduce their output.

The firm is already working towards being able to operate the GB electricity grid without any coal or gas plants by 2025, however, having signed specific “inertia” contracts with new suppliers which – for the first time – will be able to provide inertia without needing power plants running. The contracts will provide the same inertia as five coal power plants, the firm says.

In response to the current crisis, National Grid has also set up a new service called “super sel” where power plants offer to reduce their minimum output (“stable export limit”) to a new super-low level.

These sorts of innovations will be increasingly required on the road to zero-carbon electricity grids, as wind and solar generate even higher shares of demand.

As BloombergNEF founder Michael Liebreich noted in a recent blog: “[W]ith electricity demand suppressed by Covid-19, variable renewables are suddenly a far higher proportion of power supply than expected in many markets – it’s like a postcard from the future. Let’s learn from the experience and invest accordingly.”

This story was published with permission from Carbon Brief.